Free capital mobility allows investors to move funds across borders without restrictions, promoting global economic integration and efficient allocation of resources. This unrestricted flow of capital can stimulate growth, enhance liquidity, and increase investment opportunities worldwide. Discover how free capital mobility impacts your financial decisions and international markets by reading the full article.

Table of Comparison

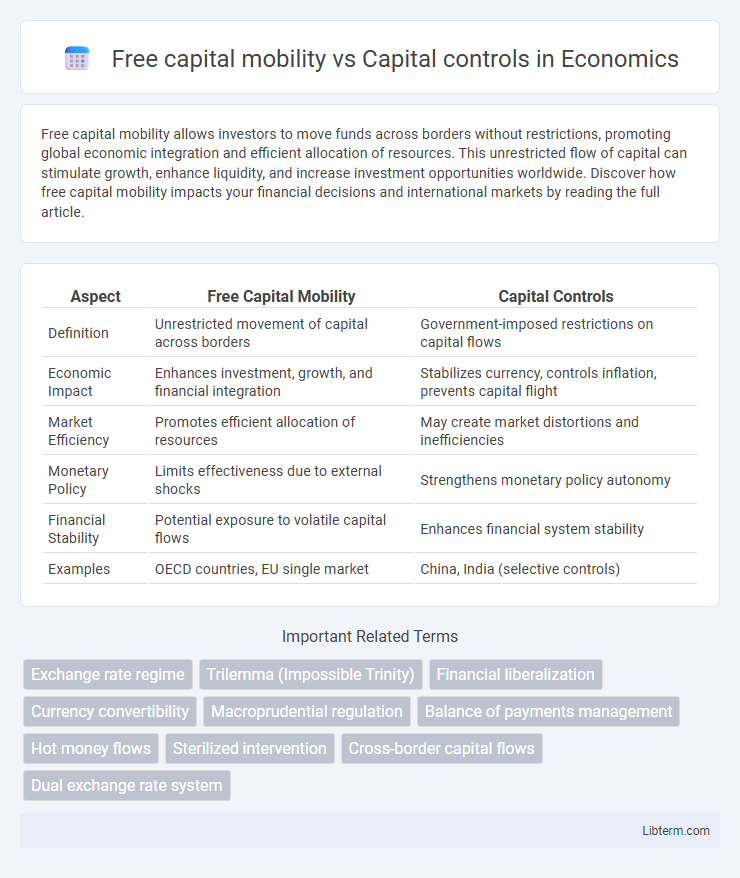

| Aspect | Free Capital Mobility | Capital Controls |

|---|---|---|

| Definition | Unrestricted movement of capital across borders | Government-imposed restrictions on capital flows |

| Economic Impact | Enhances investment, growth, and financial integration | Stabilizes currency, controls inflation, prevents capital flight |

| Market Efficiency | Promotes efficient allocation of resources | May create market distortions and inefficiencies |

| Monetary Policy | Limits effectiveness due to external shocks | Strengthens monetary policy autonomy |

| Financial Stability | Potential exposure to volatile capital flows | Enhances financial system stability |

| Examples | OECD countries, EU single market | China, India (selective controls) |

Introduction to Capital Mobility and Capital Controls

Capital mobility refers to the ability of investors to freely move capital across borders with minimal restrictions, enabling efficient allocation of resources and fostering global investment opportunities. Capital controls are regulatory measures imposed by governments to limit or manage the flow of foreign capital, aimed at stabilizing the economy, preventing rapid capital flight, and protecting domestic financial markets. Understanding the balance between free capital mobility and capital controls is essential for policymakers to maintain economic stability and attract sustainable investment.

Defining Free Capital Mobility

Free capital mobility refers to the unrestricted flow of financial resources across national borders, allowing investors to move capital without regulatory barriers or government intervention. This system enables efficient allocation of global financial assets, promotes foreign direct investment, and enhances liquidity in international markets. Contrarily, capital controls impose restrictions such as taxes, tariffs, or limits on currency exchange to regulate or limit cross-border capital movements.

Understanding Capital Controls

Capital controls refer to regulatory measures implemented by governments to limit or regulate the flow of foreign capital in and out of a country's economy, aiming to stabilize financial markets and protect national economic interests. These controls can include taxes on cross-border transactions, restrictions on currency exchange, and limits on foreign investments. Understanding capital controls is crucial for assessing their impact on economic stability, foreign exchange rates, and investment flows compared to the liberal approach of free capital mobility.

Historical Perspectives on Capital Flows

Historical perspectives on capital flows reveal that free capital mobility, exemplified during the Gold Standard era (1870-1914), facilitated rapid cross-border investment and economic integration, but also exposed countries to financial crises like the 1930s Great Depression. In contrast, the mid-20th century Bretton Woods system enforced capital controls to stabilize post-war economies and prevent speculative attacks, highlighting the trade-offs between economic stability and market efficiency. Empirical data from emerging markets in the 1990s show that sudden deregulation of capital controls often led to volatile capital flows and currency crises, underscoring the necessity of prudent regulatory frameworks.

Economic Benefits of Free Capital Mobility

Free capital mobility fosters efficient allocation of resources by enabling investments to flow effortlessly across borders, enhancing global productivity and economic growth. It encourages foreign direct investment (FDI), which drives technology transfer, infrastructure development, and employment opportunities in emerging markets. Increased access to international capital markets reduces borrowing costs for businesses and governments, promoting economic stability and expansion.

Risks and Challenges of Unrestricted Capital Movement

Unrestricted capital movement exposes economies to volatile financial flows, increasing the risk of sudden capital flight that can destabilize currency values and macroeconomic stability. Capital controls serve as a safeguard to mitigate speculative attacks and protect domestic markets from external shocks, yet they may also reduce foreign investment and limit economic growth. Managing the balance between free capital mobility and regulatory oversight remains critical to preventing systemic risks and ensuring sustainable financial integration.

Advantages of Implementing Capital Controls

Capital controls help stabilize emerging economies by reducing volatile short-term capital flows and minimizing the risk of financial crises. They enable governments to maintain monetary policy autonomy and protect domestic industries from speculative attacks. By controlling capital inflows and outflows, capital controls foster economic resilience and support sustainable growth.

Drawbacks and Criticisms of Capital Controls

Capital controls can distort market efficiency by restricting the free flow of capital, leading to reduced foreign investment and slower economic growth. They may induce capital flight as investors seek to circumvent restrictions, creating black markets and undermining financial stability. Furthermore, capital controls often generate uncertainty and reduce investor confidence, which can deter long-term investment and hinder integration into global financial markets.

Case Studies: Successes and Failures of Both Approaches

Chile's 1970s free capital mobility attracted foreign investment but also led to financial volatility and crises in the 1980s, highlighting risks of unfettered flows. Malaysia's 1998 capital controls effectively stabilized its economy during the Asian Financial Crisis, limiting capital flight and fostering recovery while drawing criticism for interventionist policies. India's gradual liberalization illustrates a balanced approach, reducing controls to boost growth while maintaining safeguards to prevent destabilizing outflows.

Policy Implications and the Future of Capital Flow Management

Free capital mobility enables efficient global allocation of resources, fostering economic growth and financial integration, but poses risks of sudden capital flight and financial instability. Capital controls serve as policy tools to mitigate volatility, protect emerging markets, and maintain monetary autonomy, particularly during crises or speculative attacks. Future capital flow management will likely balance liberalized movements with targeted regulations, utilizing enhanced macroprudential frameworks and digital surveillance technology to safeguard economic stability while promoting open markets.

Free capital mobility Infographic

libterm.com

libterm.com