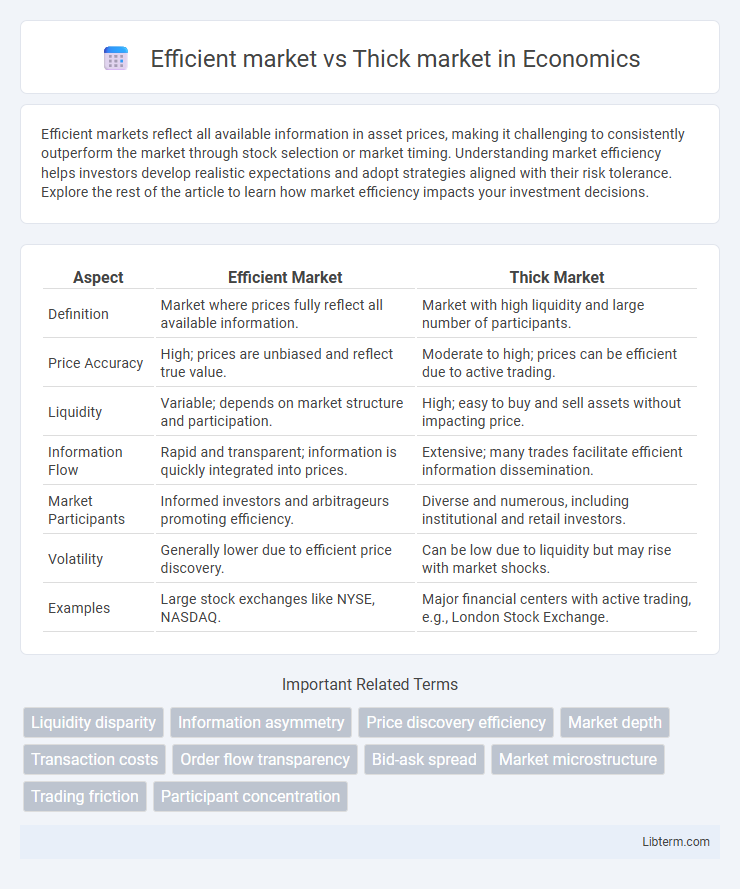

Efficient markets reflect all available information in asset prices, making it challenging to consistently outperform the market through stock selection or market timing. Understanding market efficiency helps investors develop realistic expectations and adopt strategies aligned with their risk tolerance. Explore the rest of the article to learn how market efficiency impacts your investment decisions.

Table of Comparison

| Aspect | Efficient Market | Thick Market |

|---|---|---|

| Definition | Market where prices fully reflect all available information. | Market with high liquidity and large number of participants. |

| Price Accuracy | High; prices are unbiased and reflect true value. | Moderate to high; prices can be efficient due to active trading. |

| Liquidity | Variable; depends on market structure and participation. | High; easy to buy and sell assets without impacting price. |

| Information Flow | Rapid and transparent; information is quickly integrated into prices. | Extensive; many trades facilitate efficient information dissemination. |

| Market Participants | Informed investors and arbitrageurs promoting efficiency. | Diverse and numerous, including institutional and retail investors. |

| Volatility | Generally lower due to efficient price discovery. | Can be low due to liquidity but may rise with market shocks. |

| Examples | Large stock exchanges like NYSE, NASDAQ. | Major financial centers with active trading, e.g., London Stock Exchange. |

Understanding Efficient Markets

Efficient markets are characterized by rapid incorporation of all available information into asset prices, ensuring that securities always trade at their fair value and making it impossible to consistently achieve abnormal returns. This concept is underpinned by the Efficient Market Hypothesis (EMH), which asserts that market prices reflect the collective knowledge of investors, analysts, and institutions without bias or delay. In contrast, thick markets emphasize liquidity and transaction volume, where numerous buyers and sellers facilitate continuous trading but do not guarantee the immediate reflection of all relevant information in prices.

Defining Thick Markets

Thick markets are characterized by a high volume of buyers and sellers, ensuring liquidity and tighter bid-ask spreads, which enhances price discovery and reduces transaction costs. Unlike efficient markets that emphasize the rapid incorporation of information into prices, thick markets prioritize market depth and active participation to maintain stability and facilitate trades. This abundance of market participants in thick markets mitigates the impact of large orders, preventing price volatility and promoting continuous market functioning.

Key Differences Between Efficient and Thick Markets

Efficient markets are characterized by rapid incorporation of information into asset prices, ensuring that securities always trade at their fair value, while thick markets exhibit high trading volumes that enhance liquidity and reduce transaction costs. Key differences include market depth, with thick markets providing ample buyers and sellers for large trades without significant price changes, whereas efficient markets emphasize accuracy in price discovery rather than transaction frequency. Liquidity and information dissemination speed are primary factors distinguishing these market types in financial economics.

Liquidity in Efficient vs Thick Markets

Efficient markets exhibit high liquidity characterized by rapid price adjustments and low transaction costs, ensuring assets are quickly bought and sold at fair values. Thick markets feature a dense concentration of buyers and sellers, enhancing liquidity through increased trading volume and narrower bid-ask spreads. Both market types promote efficient price discovery, but thick markets particularly facilitate continuous trading and depth, reducing market impact for large transactions.

Price Discovery Mechanisms

Efficient markets facilitate rapid price discovery through high liquidity, ensuring asset prices quickly reflect all available information. Thick markets feature a dense concentration of buyers and sellers, enhancing transaction frequency and reducing bid-ask spreads, which sharpens price accuracy. Both market types optimize price discovery by minimizing information asymmetry and enabling timely trade execution.

Information Flow and Market Transparency

Efficient markets are characterized by rapid and accurate information flow, ensuring that all available data is instantly reflected in asset prices, promoting high market transparency. Thick markets feature a large number of participants and high trading volume, which enhances liquidity and facilitates smoother information dissemination, contributing to transparent price discovery. Both market types rely on seamless information flow, but efficient markets emphasize the speed and accuracy of data incorporation, while thick markets prioritize participant density and transaction frequency for transparency.

Impact on Transaction Costs

Efficient markets reduce transaction costs by ensuring high liquidity and tight bid-ask spreads, facilitating faster and cheaper trades. Thick markets, characterized by a large number of buyers and sellers, also lower transaction costs through increased competition and market depth. Both market types enhance price discovery, but efficient markets typically exhibit lower volatility and more predictable transaction costs compared to thick markets.

Market Participation and Diversity

Efficient markets rely on widespread market participation to quickly incorporate diverse information into asset prices, ensuring accurate valuation and reduced arbitrage opportunities. Thick markets are characterized by high liquidity and a large number of active participants, which enhances price stability and allows for diverse trading strategies that reflect a wide range of information and investor preferences. Greater market diversity in thick markets promotes resilience and efficiency, as varying trader behaviors and information sources contribute to more robust price discovery.

Real-World Examples of Each Market Type

Efficient markets, exemplified by the New York Stock Exchange, feature rapid information dissemination and high liquidity, leading to prices that quickly reflect all available data. Thick markets like the cryptocurrency exchanges, including Binance or Coinbase, exhibit dense trading activity with substantial bid-ask spreads but greater volatility and less predictable price discovery. These real-world examples highlight the contrast between the strong informational efficiency of stock markets and the liquidity-driven dynamics of thick markets.

Implications for Investors and Traders

Efficient markets, characterized by rapid incorporation of information into asset prices, reduce opportunities for investors and traders to consistently achieve abnormal returns, emphasizing the importance of passive investment strategies. Thick markets, with high trading volumes and liquidity, facilitate faster execution and narrower bid-ask spreads, benefiting both institutional and retail traders through improved price discovery and reduced transaction costs. Understanding the distinction aids investors in selecting strategies aligned with market conditions, where efficient markets favor index funds and thick markets support active trading and arbitrage opportunities.

Efficient market Infographic

libterm.com

libterm.com