Monetary tightening involves central banks increasing interest rates and reducing money supply to curb inflation and stabilize the economy. This policy impacts borrowing costs, consumer spending, and investment decisions, often slowing economic growth. Discover how monetary tightening affects your financial decisions and the broader market in the full article.

Table of Comparison

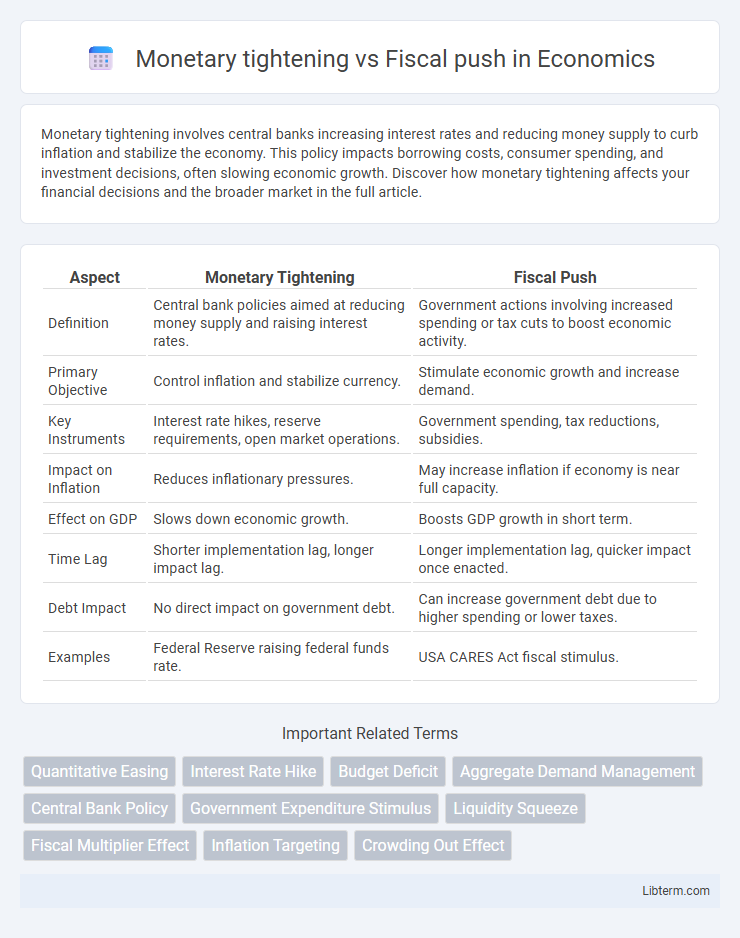

| Aspect | Monetary Tightening | Fiscal Push |

|---|---|---|

| Definition | Central bank policies aimed at reducing money supply and raising interest rates. | Government actions involving increased spending or tax cuts to boost economic activity. |

| Primary Objective | Control inflation and stabilize currency. | Stimulate economic growth and increase demand. |

| Key Instruments | Interest rate hikes, reserve requirements, open market operations. | Government spending, tax reductions, subsidies. |

| Impact on Inflation | Reduces inflationary pressures. | May increase inflation if economy is near full capacity. |

| Effect on GDP | Slows down economic growth. | Boosts GDP growth in short term. |

| Time Lag | Shorter implementation lag, longer impact lag. | Longer implementation lag, quicker impact once enacted. |

| Debt Impact | No direct impact on government debt. | Can increase government debt due to higher spending or lower taxes. |

| Examples | Federal Reserve raising federal funds rate. | USA CARES Act fiscal stimulus. |

Understanding Monetary Tightening

Monetary tightening involves central banks increasing interest rates or reducing money supply to control inflation and stabilize the economy. This policy aims to curb excessive spending and borrowing by making credit more expensive, thereby slowing down economic growth and containing price pressures. Understanding monetary tightening is crucial for assessing its impact on inflation, employment, and overall economic stability.

The Fundamentals of Fiscal Push

Fiscal push involves increased government spending and tax cuts aimed at boosting economic growth, especially during downturns. By injecting capital into infrastructure, healthcare, and social programs, fiscal policy directly stimulates demand and creates jobs, counteracting recessionary pressures. Unlike monetary tightening, which restricts money supply to control inflation, fiscal push focuses on expansionary measures to enhance aggregate demand and support economic recovery.

Key Differences: Monetary vs Fiscal Policies

Monetary tightening involves increasing interest rates and reducing money supply to control inflation, implemented by central banks through tools like open market operations and reserve requirements. Fiscal policy, guided by government decisions, uses taxation and public spending adjustments to influence economic growth and stabilize demand. Key differences include the actors involved--central banks for monetary policy versus the government for fiscal policy--and the direct impact on liquidity and budget deficits respective to each approach.

Historical Context: Policy Responses in Economic Crises

Monetary tightening and fiscal push have historically been key policy responses during economic crises, with central banks raising interest rates to control inflation while governments increase spending to stimulate growth. For example, during the 1980s stagflation, the Federal Reserve's monetary tightening helped curb runaway inflation, whereas the 2008 financial crisis saw aggressive fiscal stimulus packages offset tightening credit conditions. These approaches reflect the balancing act policymakers perform to stabilize economies by managing demand through interest rate adjustments and government expenditure.

Impact on Inflation: Contrasting Approaches

Monetary tightening reduces inflation by raising interest rates, which curtails consumer spending and investment, leading to lower demand pressures. Fiscal push, involving increased government spending or tax cuts, can stimulate economic growth but risks higher inflation if demand outpaces supply. Central banks often use monetary tightening to counteract inflationary effects from fiscal expansion, balancing growth and price stability.

Effects on Employment and Growth

Monetary tightening, typically through higher interest rates and reduced money supply, slows economic growth by increasing borrowing costs, which can lead to lower investment and higher unemployment rates. Fiscal push, involving increased government spending and tax cuts, stimulates demand, promotes job creation, and accelerates GDP growth by directly injecting money into the economy. The balance between these policies crucially affects labor market dynamics and long-term economic expansion, with fiscal measures often offsetting the restrictive impact of monetary tightening.

Policy Coordination: Synergy or Conflict?

Monetary tightening aims to control inflation by raising interest rates and reducing liquidity, while fiscal push involves increased government spending or tax cuts to stimulate economic growth. Effective policy coordination between central banks and fiscal authorities can create synergy, balancing inflation control with growth support. However, misalignment may lead to conflict, where fiscal expansion undermines monetary restraint, causing economic instability or diminished policy effectiveness.

Case Studies: Global Experiences and Lessons

Monetary tightening and fiscal push strategies yield varied outcomes across global case studies, with developed economies like the U.S. showing restrained inflation through interest rate hikes while emerging markets experience growth slowdowns. Japan's prolonged monetary easing contrasted with targeted fiscal stimulus highlights the importance of policy coordination to sustain economic recovery. Lessons emphasize balancing inflation control with growth support, tailoring approaches to specific economic structures and debt capacities.

Risks and Limitations of Each Approach

Monetary tightening reduces inflation by raising interest rates, but it risks slowing economic growth and increasing unemployment, potentially leading to recession. Fiscal push stimulates the economy through government spending or tax cuts, yet it can exacerbate budget deficits and increase public debt, risking long-term financial stability. Both approaches have limitations in timing and effectiveness, with monetary policy often lagging impact and fiscal measures facing political constraints.

Future Outlook: Balancing Monetary and Fiscal Strategies

Monetary tightening aims to control inflation by raising interest rates, which can slow economic growth, while fiscal push involves increased government spending to stimulate demand and support recovery. Future outlook requires balancing these strategies to avoid overheating the economy or triggering recession, emphasizing coordinated policy to maintain stability and sustainable growth. Data from recent economic cycles show that synchronized monetary and fiscal policies enhance resilience against shocks and promote long-term prosperity.

Monetary tightening Infographic

libterm.com

libterm.com