Reserve requirements mandate the minimum amount of funds that banks must hold in reserve, either as cash in their vaults or deposits with the central bank, to ensure liquidity and stability in the financial system. These requirements influence how much money banks can lend, directly impacting interest rates and economic growth. Discover how understanding reserve requirements can help you navigate the banking system and safeguard your financial interests by reading the rest of this article.

Table of Comparison

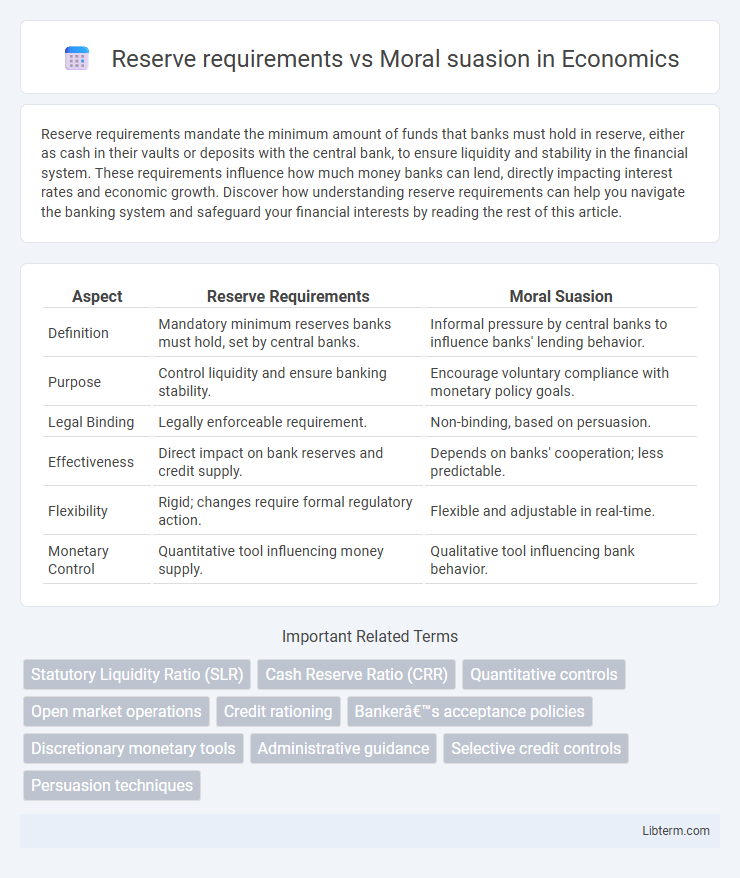

| Aspect | Reserve Requirements | Moral Suasion |

|---|---|---|

| Definition | Mandatory minimum reserves banks must hold, set by central banks. | Informal pressure by central banks to influence banks' lending behavior. |

| Purpose | Control liquidity and ensure banking stability. | Encourage voluntary compliance with monetary policy goals. |

| Legal Binding | Legally enforceable requirement. | Non-binding, based on persuasion. |

| Effectiveness | Direct impact on bank reserves and credit supply. | Depends on banks' cooperation; less predictable. |

| Flexibility | Rigid; changes require formal regulatory action. | Flexible and adjustable in real-time. |

| Monetary Control | Quantitative tool influencing money supply. | Qualitative tool influencing bank behavior. |

Introduction to Monetary Policy Tools

Reserve requirements mandate banks to hold a specific percentage of their deposits as reserves, controlling liquidity and influencing credit availability within the economy. Moral suasion relies on central banks persuading financial institutions to adhere to policy goals without formal regulations, leveraging influence through communication and guidance. Both tools serve critical roles in monetary policy frameworks for managing money supply, interest rates, and overall economic stability.

Defining Reserve Requirements

Reserve requirements are regulatory mandates set by central banks that require commercial banks to hold a minimum percentage of their deposits as reserves, either in cash or in accounts with the central bank, to ensure liquidity and control money supply. Unlike moral suasion, which relies on persuasive communication and informal pressure by authorities to influence bank behavior, reserve requirements legally enforce a quantitative limit on funds available for lending and investment. These requirements directly impact bank lending capacity, financial stability, and overall monetary policy effectiveness.

Understanding Moral Suasion

Moral suasion involves central banks persuading commercial banks to adhere to monetary policies without legal enforcement, relying on influence rather than mandates. Unlike reserve requirements, which mandate a specific percentage of deposits to be held as reserves, moral suasion leverages trust and authority to guide lender behavior. This strategy is crucial during economic fluctuations when flexible, non-binding guidance helps stabilize credit flow without altering regulatory frameworks.

Historical Context of Reserve Requirements

Reserve requirements originated in the early 20th century as a regulatory tool to maintain banks' liquidity and control money supply, especially after the establishment of the Federal Reserve in 1913. Historically, these requirements were pivotal during the Great Depression, when the Federal Reserve used them to prevent bank failures and stabilize the economy. In contrast, moral suasion emerged as a more flexible, informal central bank tactic relying on persuasion rather than statutory mandates to influence bank behavior during periods of financial uncertainty.

Key Features of Moral Suasion

Moral suasion involves central banks persuading commercial banks to adhere to policy goals without legal enforcement, relying on influence and dialogue to guide lending, reserve holdings, and credit allocation. Key features include its informal nature, flexibility in application, and effectiveness in situations where legal reserve requirements may be too rigid or disruptive. Unlike reserve requirements, which legally mandate minimum reserves, moral suasion depends on the credibility and cooperative relationship between regulators and financial institutions.

Comparative Analysis: Mechanisms and Impact

Reserve requirements mandate banks to hold a specific percentage of their deposits as non-lendable reserves, directly controlling liquidity and credit creation, while moral suasion relies on persuasive communication from central banks to influence banking behavior without formal obligations. Reserve requirements provide a clear, quantifiable tool with immediate impact on money supply and lending capacity, whereas moral suasion depends on the credibility and cooperation of financial institutions, making its effects more subtle and variable. The former's rigidity ensures predictable regulatory outcomes, whereas the latter allows flexibility but risks inconsistent implementation and effectiveness.

Advantages and Limitations of Reserve Requirements

Reserve requirements ensure banks maintain a minimum percentage of deposits as reserves, which strengthens liquidity and safeguards financial stability by preventing over-lending. This regulatory tool provides a clear, enforceable standard that helps control money supply, but it may reduce banks' lending flexibility and can be blunt, impacting all banks regardless of individual risk profiles. Limitations include potential inefficiency during economic fluctuations and the possibility of real resource underutilization, as reserve mandates do not directly influence bank behavior beyond the required thresholds.

Pros and Cons of Moral Suasion

Moral suasion leverages the influence of central banks to guide financial institutions' behavior without legal enforcement, offering flexibility and fostering cooperative compliance, but it often lacks the enforceability of reserve requirements, which mandates specific cash reserves and ensures financial stability through strict regulatory measures. The primary advantage of moral suasion lies in its ability to encourage voluntary adherence to monetary policy goals, reducing market disruption and political resistance. However, its effectiveness is limited by the willingness of banks to comply, making it less reliable during periods of financial stress compared to the automatic impact of reserve requirements.

Central Bank Strategies: When to Use Each Tool

Reserve requirements enforce mandatory minimum reserves that banks must hold, effectively controlling liquidity and credit expansion during periods of economic overheating or inflation. Moral suasion relies on persuasive communication and informal pressure by central banks to influence bank behavior, typically employed in less critical situations or when immediate regulatory changes are impractical. Central banks prefer reserve requirements for direct, enforceable impact during financial crises, while moral suasion suits ongoing monetary policy adjustments emphasizing cooperation and flexibility.

Reserve Requirements vs Moral Suasion: Policy Implications

Reserve requirements mandate banks to hold a specific fraction of deposits as reserves, directly controlling liquidity and influencing credit expansion. Moral suasion relies on persuasive communication by central banks to encourage financial institutions to align with policy goals without formal regulations. The policy implications highlight that reserve requirements provide measurable and enforceable tools for monetary stability, whereas moral suasion offers flexibility but may lack reliability in altering banking behavior consistently.

Reserve requirements Infographic

libterm.com

libterm.com