A trilemma presents a situation where you face three choices, but can only successfully achieve two, forcing difficult decisions and trade-offs. This concept is widely applicable in economics, ethics, and philosophy, prompting complex strategic thinking. Explore the rest of the article to understand how trilemmas affect your decision-making processes.

Table of Comparison

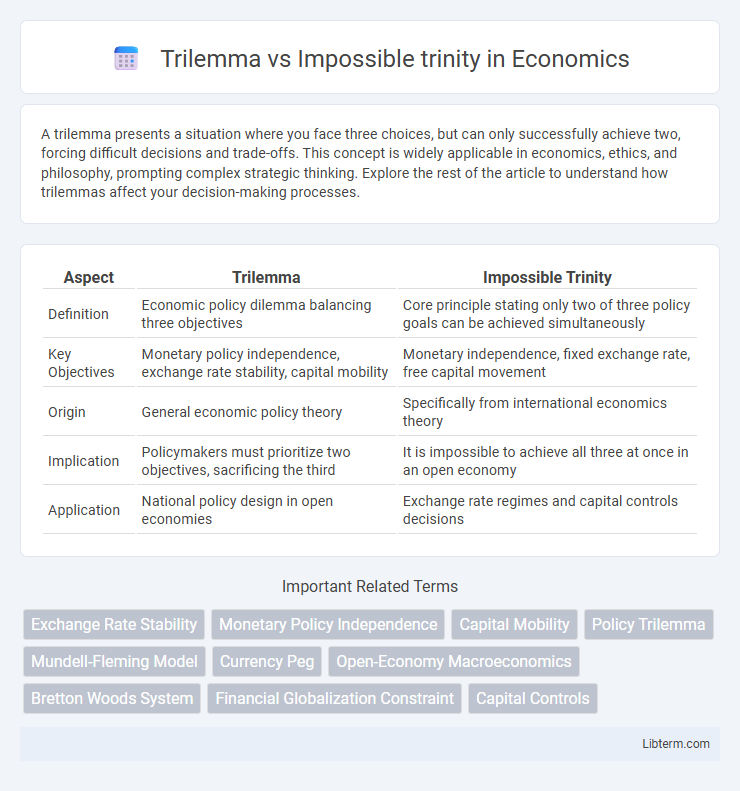

| Aspect | Trilemma | Impossible Trinity |

|---|---|---|

| Definition | Economic policy dilemma balancing three objectives | Core principle stating only two of three policy goals can be achieved simultaneously |

| Key Objectives | Monetary policy independence, exchange rate stability, capital mobility | Monetary independence, fixed exchange rate, free capital movement |

| Origin | General economic policy theory | Specifically from international economics theory |

| Implication | Policymakers must prioritize two objectives, sacrificing the third | It is impossible to achieve all three at once in an open economy |

| Application | National policy design in open economies | Exchange rate regimes and capital controls decisions |

Understanding the Basics: Trilemma and Impossible Trinity

The trilemma and impossible trinity both describe the challenge of achieving three desirable economic policies simultaneously but with key differences in focus. The trilemma, often discussed in international finance, states that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy. The impossible trinity, closely related, emphasizes that choosing any two of these goals forces sacrificing the third, highlighting fundamental trade-offs policymakers face in managing open economies.

Historical Origins of the Trilemma Concept

The concept of the Trilemma, historically rooted in economic theory, emerged from the analysis of international monetary policy constraints faced by countries. Coined during the Bretton Woods era, the Trilemma or Impossible Trinity highlights the trade-offs among exchange rate stability, monetary policy independence, and capital mobility. Early work by economists such as Robert Mundell and Marcus Fleming formalized this concept, shaping the foundation for modern open-economy macroeconomics.

Defining the Impossible Trinity in Economics

The Impossible Trinity in economics refers to the challenge that a country cannot simultaneously achieve free capital movement, a fixed foreign exchange rate, and an independent monetary policy. This trilemma forces policymakers to prioritize two of these three objectives, sacrificing the third to maintain economic stability. Understanding this trade-off is crucial for managing exchange rates and capital flows in an open economy.

Core Principles of Each Framework

The Trilemma centers on three competing priorities in international economics: exchange rate stability, monetary policy independence, and capital mobility, where only two can be achieved simultaneously. The Impossible Trinity emphasizes the impossibility of maintaining a fixed foreign exchange rate, free capital movement, and an independent monetary policy together. Both frameworks highlight fundamental constraints in economic policy, illustrating the trade-offs faced by governments in managing global financial integration.

Key Differences Between Trilemma and Impossible Trinity

The Trilemma and Impossible Trinity both address constraints in economic policy but differ in scope and application. The Trilemma typically refers to a situation--like the "Golden Triad" in finance--where only two out of three goals can be achieved simultaneously, emphasizing trade-offs in decision-making. The Impossible Trinity specifically relates to international economics, stating that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy, highlighting fundamental policy conflicts.

Real-World Applications and Examples

The trilemma, also known as the Impossible Trinity, illustrates the real-world challenge that countries face in simultaneously achieving free capital flow, a fixed foreign exchange rate, and an independent monetary policy. For example, China maintains a fixed exchange rate and controls monetary policy but restricts capital mobility, while the United States allows free capital movement and independent monetary policy but lets exchange rates float. Emerging markets like India often sacrifice exchange rate stability by allowing some volatility to maintain monetary policy autonomy and moderate capital flow controls.

Economic Policy Implications

The Trilemma, or Impossible Trinity, states that a country cannot simultaneously maintain free capital movement, a fixed foreign exchange rate, and an independent monetary policy, necessitating trade-offs in economic policy decisions. Policymakers must prioritize which two objectives align best with their economic goals, affecting exchange rate stability, inflation control, and financial market openness. Choosing capital mobility and exchange rate stability often sacrifices monetary autonomy, while emphasizing monetary policy independence and capital mobility can lead to exchange rate volatility.

Challenges in Achieving All Three Goals

The Trilemma, also known as the Impossible Trinity, highlights the challenge in international economics where a country cannot simultaneously achieve free capital movement, a fixed foreign exchange rate, and an independent monetary policy. Attempting to maintain all three goals leads to conflicts, forcing policymakers to prioritize two at the expense of the third. This fundamental trade-off complicates economic stability, limiting a nation's ability to control inflation while attracting foreign investment and stabilizing currency values.

Case Studies: Successes and Failures

The Impossible Trinity, also called the Trilemma, states that countries cannot simultaneously maintain fixed foreign exchange rates, free capital movement, and an independent monetary policy. A notable success is Hong Kong, which sustains a currency peg while allowing capital flows by sacrificing monetary autonomy. In contrast, the 1997 Asian Financial Crisis exemplifies failure, where countries like Thailand attempted all three goals, leading to speculative attacks and economic turmoil.

Future Perspectives and Ongoing Debates

Future perspectives on the Trilemma, also known as the Impossible Trinity, emphasize the adaptation of monetary policies in an increasingly interconnected global economy where countries aim to balance exchange rate stability, capital mobility, and monetary independence. Ongoing debates concentrate on innovative policy frameworks that could potentially mitigate the trade-offs, such as digital currencies and supranational financial regulations, to enhance economic resilience. Researchers and policymakers continue to explore how technological advancements and evolving international financial architectures may redefine the constraints imposed by the Impossible Trinity.

Trilemma Infographic

libterm.com

libterm.com