Cap-and-trade is an environmental policy tool designed to reduce greenhouse gas emissions by setting a limit on total emissions and allowing companies to buy and sell emission allowances. This market-based approach incentivizes businesses to decrease their carbon footprint while providing flexibility in how they meet regulatory requirements. Discover how cap-and-trade programs impact industries and the environment by reading further.

Table of Comparison

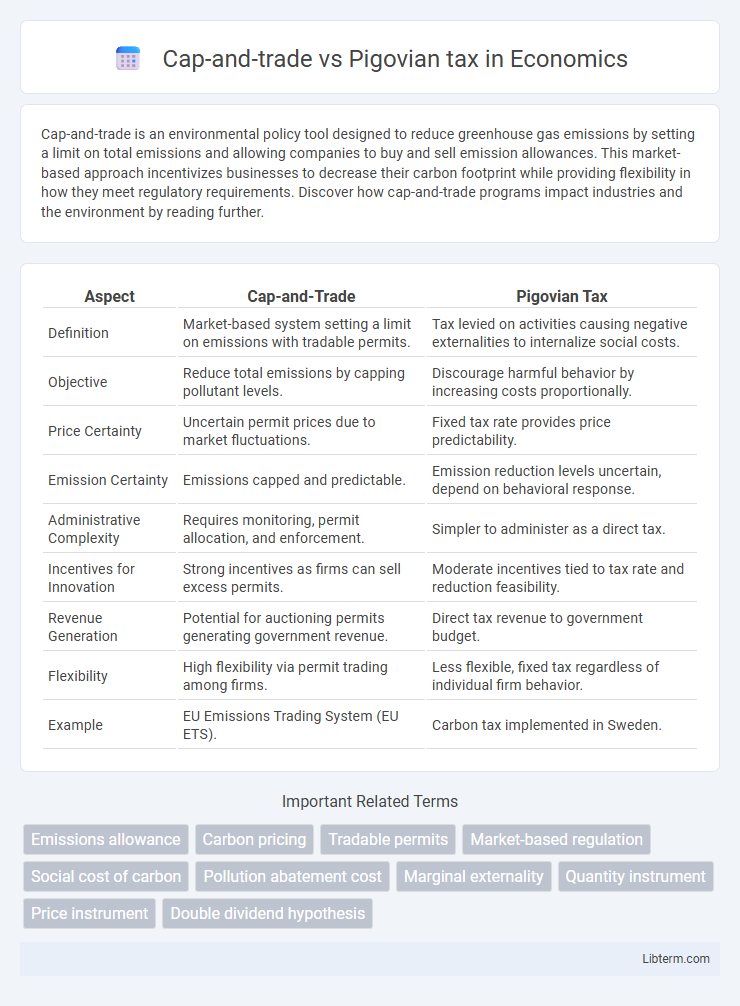

| Aspect | Cap-and-Trade | Pigovian Tax |

|---|---|---|

| Definition | Market-based system setting a limit on emissions with tradable permits. | Tax levied on activities causing negative externalities to internalize social costs. |

| Objective | Reduce total emissions by capping pollutant levels. | Discourage harmful behavior by increasing costs proportionally. |

| Price Certainty | Uncertain permit prices due to market fluctuations. | Fixed tax rate provides price predictability. |

| Emission Certainty | Emissions capped and predictable. | Emission reduction levels uncertain, depend on behavioral response. |

| Administrative Complexity | Requires monitoring, permit allocation, and enforcement. | Simpler to administer as a direct tax. |

| Incentives for Innovation | Strong incentives as firms can sell excess permits. | Moderate incentives tied to tax rate and reduction feasibility. |

| Revenue Generation | Potential for auctioning permits generating government revenue. | Direct tax revenue to government budget. |

| Flexibility | High flexibility via permit trading among firms. | Less flexible, fixed tax regardless of individual firm behavior. |

| Example | EU Emissions Trading System (EU ETS). | Carbon tax implemented in Sweden. |

Introduction to Cap-and-Trade and Pigovian Tax

Cap-and-trade systems establish a market for pollution permits, allowing companies to buy and sell emissions allowances to meet environmental targets efficiently. Pigovian taxes impose a direct fee on the amount of pollution emitted, incentivizing firms to reduce carbon output by internalizing the external costs. Both mechanisms aim to correct negative externalities but differ in approach, with cap-and-trade setting a quantity limit and Pigovian tax setting a price on pollution.

Defining Cap-and-Trade Systems

Cap-and-trade systems set a maximum allowable level of pollution, issuing permits that companies can buy or sell to stay within limits. This market-based approach creates a financial incentive for businesses to reduce emissions efficiently. By capping total emissions and enabling trading, cap-and-trade drives innovation while ensuring environmental goals are met.

Understanding Pigovian Taxes

Pigovian taxes impose a direct cost on activities generating negative externalities, such as pollution, by aligning private costs with social costs to reduce harmful behaviors efficiently. These taxes incentivize firms and individuals to internalize environmental damages by increasing the price of environmentally detrimental goods or emissions. Unlike cap-and-trade systems that set emission quantity limits, Pigovian taxes provide price certainty, encouraging continuous investment in cleaner technologies and sustainable practices.

Economic Theory Behind Market-Based Environmental Policies

Cap-and-trade and Pigovian tax are market-based environmental policies grounded in economic theory aimed at internalizing externalities. Cap-and-trade sets a quantity limit on emissions with tradable permits, creating a market price for pollution and incentivizing firms to reduce emissions cost-effectively. Pigovian tax imposes a direct tax on the negative externality, equal to the marginal social damage, providing continuous price signals for emissions reduction and encouraging innovation.

Efficiency of Cap-and-Trade vs Pigovian Tax

Cap-and-trade systems achieve environmental targets by setting a firm emissions cap and allowing market trading of permits, creating cost-effective pollution reductions through price uncertainty and flexibility. Pigovian taxes impose a fixed price per unit of pollution, providing price certainty but leading to uncertain pollution outcomes, which can be less efficient if regulators inaccurately set the tax level. Economic models suggest cap-and-trade is generally more efficient under strict emissions limits and when emissions targets are prioritized, while Pigovian taxes perform better when marginal damages are well known and price predictability is desired.

Flexibility and Predictability in Policy Outcomes

Cap-and-trade systems offer flexibility by allowing firms to trade emission permits, enabling cost-effective reductions where they are cheapest, while maintaining a fixed total emissions cap for environmental certainty. Pigovian taxes provide predictability in marginal costs by setting a fixed price per unit of pollution, giving firms clear incentives to reduce emissions but with uncertain total environmental outcomes. Policymakers must balance cap-and-trade's environmental certainty with Pigovian tax's cost predictability to achieve optimal emissions control.

Administrative Complexity and Implementation Challenges

Cap-and-trade systems involve setting a maximum pollution level and distributing or auctioning permits, requiring continuous monitoring and enforcement to prevent fraud and ensure compliance. Pigovian taxes impose a fixed fee per unit of pollution, demanding accurate measurement of emissions and political consensus to establish appropriate tax rates. Both approaches face administrative challenges, but cap-and-trade systems typically require more extensive infrastructure for permit trading and market regulation compared to the relatively straightforward tax collection mechanisms of Pigovian taxes.

Impact on Businesses and Consumers

Cap-and-trade systems create a market for emission allowances, allowing businesses to buy and sell permits, which incentivizes cost-effective pollution reduction but can lead to fluctuating compliance costs and price uncertainty for consumers. Pigovian taxes impose a fixed cost per unit of pollution, providing price certainty for businesses and consumers but potentially resulting in less predictable overall emission reductions. Both approaches aim to internalize environmental externalities, yet cap-and-trade offers flexibility in emission targets while Pigovian taxes deliver stable pricing signals influencing investment and consumption decisions.

Case Studies: Global Applications and Lessons Learned

Cap-and-trade systems, as seen in the European Union Emissions Trading System (EU ETS), have demonstrated success in reducing greenhouse gas emissions by setting a firm emissions cap while allowing market trading flexibility. Pigovian taxes, exemplified by Sweden's carbon tax, effectively internalize external costs by directly charging emitters per ton of CO2, leading to substantial emissions declines and economic growth decoupling. Case studies reveal that while cap-and-trade offers price certainty over total emissions, Pigovian taxes provide predictable cost signals, with combined or hybrid approaches often yielding optimized environmental and economic outcomes.

Choosing the Right Approach: Policy Considerations and Future Outlook

Selecting between cap-and-trade and Pigovian tax policies depends on factors like market volatility, administrative complexity, and emission reduction targets. Cap-and-trade provides certainty in emission quantities but may cause price fluctuations, while Pigovian taxes offer price certainty with variable environmental outcomes. Future policy frameworks will likely integrate hybrid models to balance economic efficiency with environmental effectiveness in addressing climate change.

Cap-and-trade Infographic

libterm.com

libterm.com