Currency stabilization enhances economic stability by reducing exchange rate volatility and fostering investor confidence. Effective policies and interventions can protect your national currency from rapid depreciation or excessive fluctuations. Explore the rest of the article to understand key strategies and benefits of currency stabilization.

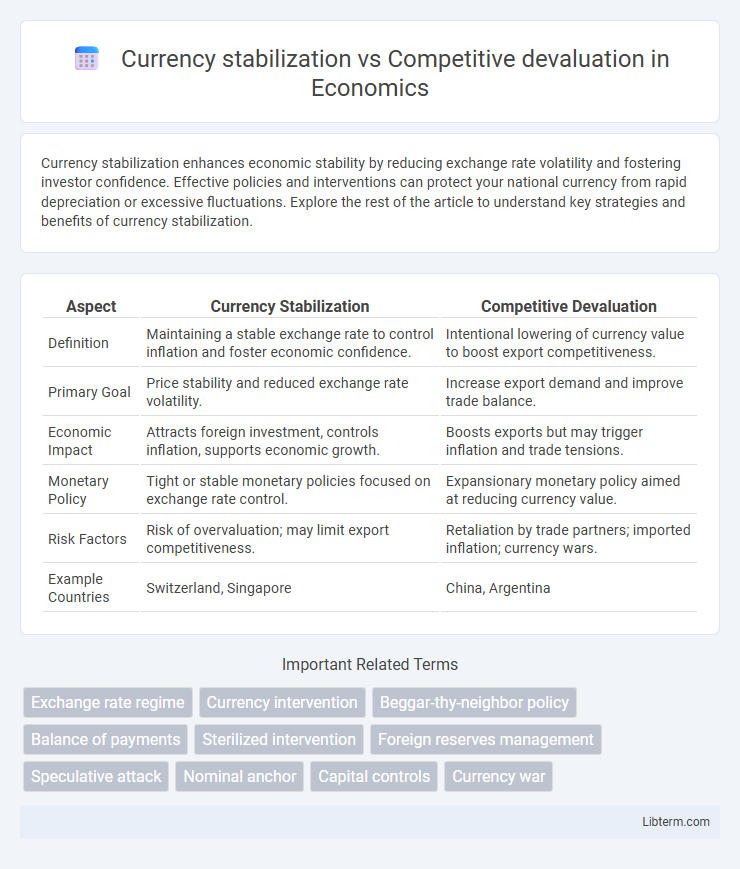

Table of Comparison

| Aspect | Currency Stabilization | Competitive Devaluation |

|---|---|---|

| Definition | Maintaining a stable exchange rate to control inflation and foster economic confidence. | Intentional lowering of currency value to boost export competitiveness. |

| Primary Goal | Price stability and reduced exchange rate volatility. | Increase export demand and improve trade balance. |

| Economic Impact | Attracts foreign investment, controls inflation, supports economic growth. | Boosts exports but may trigger inflation and trade tensions. |

| Monetary Policy | Tight or stable monetary policies focused on exchange rate control. | Expansionary monetary policy aimed at reducing currency value. |

| Risk Factors | Risk of overvaluation; may limit export competitiveness. | Retaliation by trade partners; imported inflation; currency wars. |

| Example Countries | Switzerland, Singapore | China, Argentina |

Introduction to Currency Stabilization and Competitive Devaluation

Currency stabilization involves implementing policies to maintain a stable exchange rate, reducing volatility to foster investor confidence and economic predictability. Competitive devaluation occurs when countries intentionally lower their currency value to boost export competitiveness by making goods cheaper on the international market. Both strategies impact trade balances and inflation, but stabilization prioritizes economic steadiness while devaluation aims at short-term export growth.

Defining Currency Stabilization: Concepts and Objectives

Currency stabilization involves implementing policies to maintain a stable exchange rate, minimizing volatility to foster economic predictability and investor confidence. It aims to control inflation, reduce uncertainty in international trade, and support sustainable economic growth by preventing abrupt currency fluctuations. Central banks often use foreign exchange interventions, interest rate adjustments, and monetary policy tools to achieve currency stabilization objectives.

Understanding Competitive Devaluation: Strategies and Motivations

Competitive devaluation involves a country deliberately lowering its currency's value to boost export competitiveness by making goods cheaper on the global market. This strategy aims to improve trade balances and stimulate economic growth but risks triggering retaliatory devaluations and currency wars. Understanding competitive devaluation includes analyzing government motivations such as addressing trade imbalances, reducing external debt burdens, and enhancing domestic employment through export-driven industries.

Historical Context: Notable Episodes of Currency Stabilization and Devaluation

Notable episodes of currency stabilization include the 1944 Bretton Woods Agreement, which established fixed exchange rates to promote global economic stability post-World War II, and the European Exchange Rate Mechanism (ERM) in the late 20th century aimed at reducing volatility among European currencies. In contrast, competitive devaluation was prominently employed during the Great Depression, where countries like the United Kingdom in 1931 and the United States in 1933 deliberately lowered their currency values to boost export competitiveness. These historical contexts highlight the strategic shifts between maintaining fixed currency values to foster stability and intentional currency depreciation to gain trade advantages.

Key Economic Drivers Behind Exchange Rate Policies

Currency stabilization aims to maintain a stable exchange rate to control inflation and foster investor confidence, often supported by strong monetary policy and foreign exchange reserves. Competitive devaluation intentionally lowers a nation's currency value to boost export competitiveness and stimulate economic growth, influenced by trade imbalances and global market pressures. Key economic drivers behind these exchange rate policies include inflation rates, trade deficits, capital flows, and central bank interventions.

Impacts on Domestic Economy: Growth, Inflation, and Employment

Currency stabilization promotes long-term economic growth by providing price predictability, reducing inflation volatility, and fostering investor confidence, which supports stable employment levels. Competitive devaluation can boost short-term export competitiveness and employment by making domestic goods cheaper internationally, but risks triggering inflationary pressures and retaliatory currency devaluations. Sustained reliance on competitive devaluation may lead to economic instability, higher inflation rates, and uncertain employment prospects due to fluctuating costs and trade tensions.

International Trade Effects: Exports, Imports, and Balance of Payments

Currency stabilization enhances international trade by reducing exchange rate volatility, leading to more predictable export and import prices and improving the balance of payments through steady trade surpluses or deficits. Competitive devaluation aims to boost exports by making them cheaper globally, but it often increases the cost of imports, potentially worsening the balance of payments if imported goods are essential. While currency stabilization fosters long-term trade relationships and investor confidence, competitive devaluation may trigger retaliatory devaluations, creating instability in trade flows and balance of payments dynamics.

Policy Tools for Stabilization vs. Devaluation: Methods and Mechanisms

Currency stabilization policies primarily utilize interest rate adjustments, foreign exchange interventions, and capital controls to maintain exchange rate stability and curb volatility. Competitive devaluation relies on strategically lowering a currency's value through direct market intervention or expansionary monetary policies to enhance export competitiveness and correct trade imbalances. Stabilization leverages balanced policy tools to promote confidence and inflation control, whereas devaluation emphasizes aggressive methods aimed at gaining short-term trade advantages.

Global Reactions: Multilateral Responses and Currency Wars

Global reactions to currency stabilization often involve coordinated multilateral interventions by institutions like the IMF and G20 to prevent competitive devaluations that can trigger destructive currency wars. Competitive devaluation prompts retaliatory measures, escalating tensions among trading nations and disrupting global financial markets. Multilateral responses emphasize currency alignment and economic policy cooperation to maintain exchange rate stability and avoid destabilizing currency battles.

Future Outlook: Choosing Between Currency Stability and Competitive Edge

Future outlook debates emphasize currency stabilization as essential for long-term economic confidence, reducing inflation volatility and attracting foreign investment. Competitive devaluation offers short-term export advantages but risks retaliatory measures and inflationary pressures that can destabilize markets. Policymakers must balance stable exchange rates with strategic competitiveness to sustain growth amidst evolving global trade dynamics.

Currency stabilization Infographic

libterm.com

libterm.com