Legal incidence determines who ultimately bears the burden of a law or regulation, regardless of whom it is initially imposed upon. Understanding legal incidence helps you evaluate the true impact of taxes, fines, or mandates on individuals and businesses. Explore this article to uncover how legal incidence shapes economic and social outcomes.

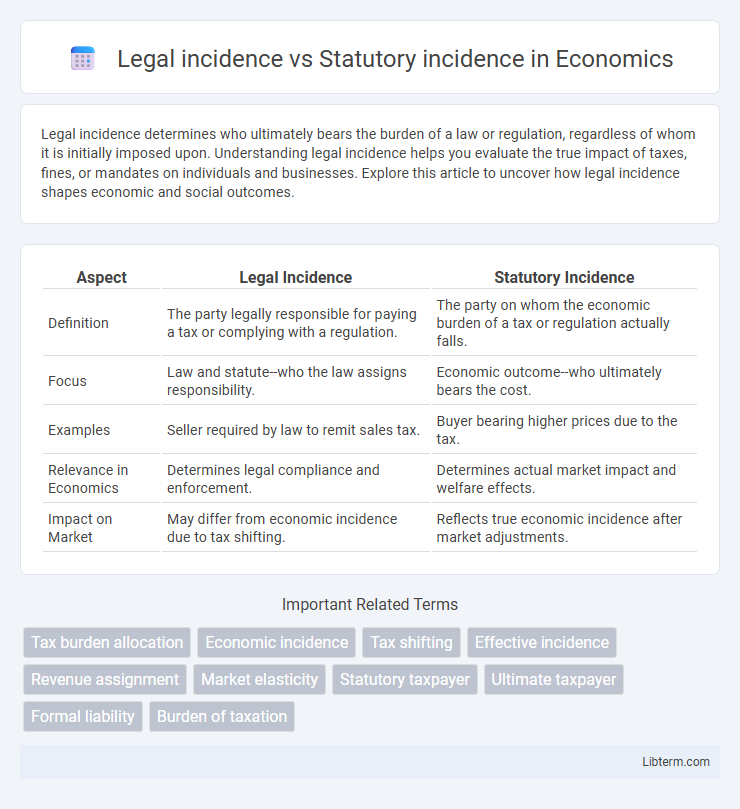

Table of Comparison

| Aspect | Legal Incidence | Statutory Incidence |

|---|---|---|

| Definition | The party legally responsible for paying a tax or complying with a regulation. | The party on whom the economic burden of a tax or regulation actually falls. |

| Focus | Law and statute--who the law assigns responsibility. | Economic outcome--who ultimately bears the cost. |

| Examples | Seller required by law to remit sales tax. | Buyer bearing higher prices due to the tax. |

| Relevance in Economics | Determines legal compliance and enforcement. | Determines actual market impact and welfare effects. |

| Impact on Market | May differ from economic incidence due to tax shifting. | Reflects true economic incidence after market adjustments. |

Introduction to Tax Incidence

Legal incidence refers to the party statutorily responsible for paying a tax, as defined by law, while statutory incidence identifies who is legally obligated to remit the tax to the government. Tax incidence, in economic terms, analyzes how the actual economic burden of a tax is distributed between buyers and sellers, which often differs from the legal or statutory incidence. Understanding this distinction is crucial for evaluating tax policy impacts, as market adjustments can shift the economic incidence away from the entity legally mandated to pay the tax.

Defining Statutory vs Legal Incidence

Statutory incidence refers to the party legally obligated to pay a tax as specified by law, such as taxpayers who receive the tax bill directly. Legal incidence determines who is responsible for remitting the tax to the government, while economic incidence assesses who actually bears the financial burden after market adjustments. Understanding the distinction between legal incidence and economic incidence is crucial for analyzing tax policy effectiveness and market behavior.

Key Differences Between Legal and Statutory Incidence

Legal incidence refers to the party upon whom a tax is lawfully imposed by statute, while statutory incidence indicates the entity responsible for remitting the tax to the government. Key differences between legal and statutory incidence include the distinction that legal incidence determines the formal tax liability, whereas statutory incidence focuses on practical tax payment obligations. Shifts in economic behavior often cause divergence between the legal and statutory incidence, impacting who ultimately bears the economic burden of the tax.

How Statutory Incidence Works

Statutory incidence refers to the legal assignment of a tax to a specific party, such as the seller or buyer, as determined by law. The party legally responsible for remitting the tax to the government does not necessarily bear the economic burden of the tax, which depends on market prices and elasticity of demand and supply. Understanding statutory incidence is crucial for analyzing tax policy impacts, as it clarifies the initial legal obligation distinct from the ultimate economic incidence borne by individuals or businesses.

Understanding Legal Incidence in Taxation

Legal incidence in taxation refers to the party explicitly obligated by law to pay a tax to the government, such as a business required to remit sales tax. Statutory incidence differs from economic incidence, which considers who ultimately bears the tax burden after market adjustments. Understanding legal incidence helps identify taxpayers responsible for compliance and remittance, crucial for tax administration and enforcement.

Examples Illustrating Legal and Statutory Incidence

Legal incidence refers to the party upon whom the law places the initial tax burden, such as a sales tax legally imposed on sellers in a retail transaction. Statutory incidence, on the other hand, focuses on the economic entity that ultimately bears the tax burden after market adjustments, exemplified by consumers facing higher prices despite the tax being levied on producers. For instance, a gasoline tax legally paid by refiners (legal incidence) often results in higher prices paid by drivers (statutory incidence), illustrating the divergence between who is legally responsible and who economically bears the tax.

Economic Burden vs Legal Responsibility

Legal incidence refers to the party upon whom the law assigns the responsibility to pay a tax or bear a legal duty, while statutory incidence focuses on the economic burden or actual financial cost borne by consumers, producers, or third parties. The economic burden often differs from legal responsibility due to market adjustments, such as price shifts, that redistribute the tax's impact across different stakeholders. Understanding the distinction between legal incidence and statutory incidence is crucial for analyzing the true economic effects of taxation policies and regulatory compliance.

Impact of Tax Incidence on Consumers and Producers

Legal incidence refers to who is legally responsible for paying a tax, while statutory incidence focuses on the actual economic burden borne by consumers or producers regardless of legal responsibility. Tax incidence determines how the tax burden is distributed; if demand is inelastic, consumers bear a larger share of the tax through higher prices, whereas if supply is inelastic, producers absorb more of the tax via reduced revenues. Understanding the distinction between legal and statutory incidence is crucial for policymakers aiming to predict how taxes influence market behavior, consumer prices, and producer profitability.

Policy Implications of Tax Incidence

Legal incidence defines who is statutorily responsible for paying a tax, whereas statutory incidence identifies the actual economic burden resting on consumers or producers. Policy implications of tax incidence require understanding how taxes shift market behavior and who ultimately bears the cost, affecting equity and efficiency in taxation. Effective tax policy must analyze both legal and economic incidence to design measures that minimize adverse effects and promote fair resource allocation.

Conclusion: Insights on Tax Incidence and Public Policy

Legal incidence identifies the party statutorily responsible for tax payment, while statutory incidence reveals who ultimately bears the economic burden after market adjustments. Understanding the divergence between these incidences informs effective tax policy design by highlighting the real economic impact on consumers, producers, or other stakeholders. Policymakers must consider elasticity of supply and demand to predict incidence accurately and ensure equitable tax distribution.

Legal incidence Infographic

libterm.com

libterm.com