Austrian economics emphasizes individual choice, spontaneous order, and the importance of time and uncertainty in economic processes. It critiques central planning and advocates for free markets as the most effective means to allocate resources. Discover how Austrian economics can deepen your understanding of market dynamics by reading the full article.

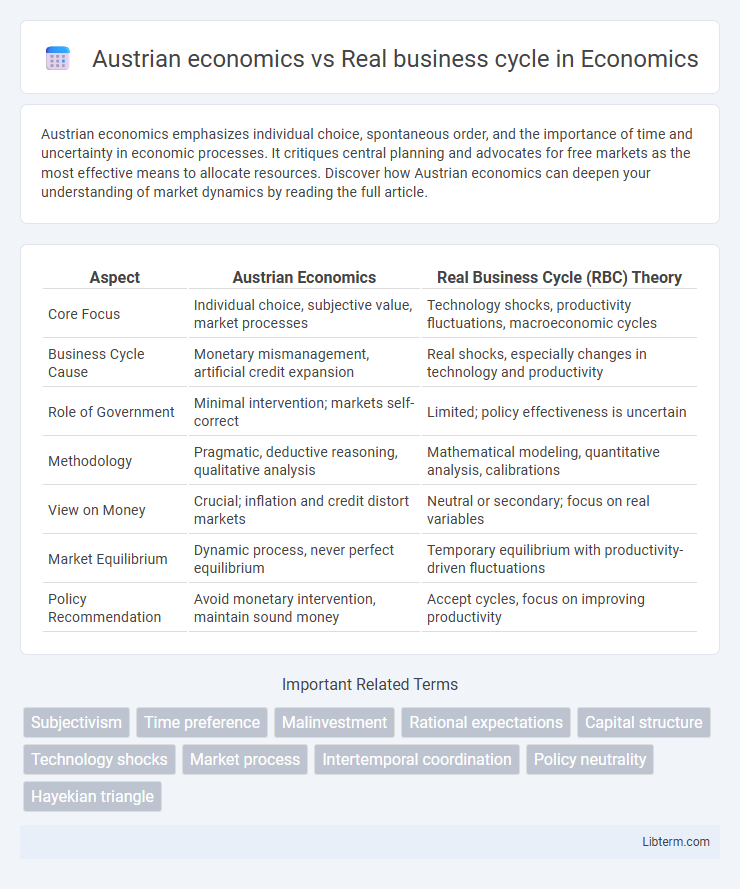

Table of Comparison

| Aspect | Austrian Economics | Real Business Cycle (RBC) Theory |

|---|---|---|

| Core Focus | Individual choice, subjective value, market processes | Technology shocks, productivity fluctuations, macroeconomic cycles |

| Business Cycle Cause | Monetary mismanagement, artificial credit expansion | Real shocks, especially changes in technology and productivity |

| Role of Government | Minimal intervention; markets self-correct | Limited; policy effectiveness is uncertain |

| Methodology | Pragmatic, deductive reasoning, qualitative analysis | Mathematical modeling, quantitative analysis, calibrations |

| View on Money | Crucial; inflation and credit distort markets | Neutral or secondary; focus on real variables |

| Market Equilibrium | Dynamic process, never perfect equilibrium | Temporary equilibrium with productivity-driven fluctuations |

| Policy Recommendation | Avoid monetary intervention, maintain sound money | Accept cycles, focus on improving productivity |

Introduction to Austrian Economics and Real Business Cycle Theory

Austrian Economics emphasizes the importance of individual choices, spontaneous order, and entrepreneurial discovery in driving economic cycles, rejecting aggregate demand models in favor of capital structure and time preference analysis. Real Business Cycle (RBC) Theory models economic fluctuations as the result of real shocks, such as technology changes, assuming rational expectations and market clearing without nominal rigidities. While Austrian Economics highlights the role of monetary interventions and capital malinvestment, RBC Theory focuses on productivity shocks and intertemporal optimization as fundamental to business cycle dynamics.

Core Principles of Austrian Economics

Austrian economics emphasizes individual choice, subjective value, and the importance of spontaneous order in markets, highlighting the role of entrepreneurship and time preference in economic coordination. Core principles include methodological individualism, skepticism toward mathematical modeling, and a focus on dynamic processes rather than equilibrium states. In contrast, Real Business Cycle theory relies on aggregate shocks and rational expectations within a general equilibrium framework, often neglecting the subjective and qualitative aspects central to Austrian thought.

Fundamental Concepts of Real Business Cycle Theory

Real Business Cycle (RBC) theory centers on the idea that economic fluctuations result primarily from real shocks, such as changes in technology or productivity, rather than monetary disturbances. It models the economy using microeconomic foundations, emphasizing intertemporal optimization by rational agents who respond to these external shocks in a frictionless market setting. Austrian economics contrasts this by rejecting equilibrium-focused models and instead highlighting the role of entrepreneurial discovery, market process, and time preference in driving economic cycles.

Methodological Differences: Subjectivism vs. Rational Expectations

Austrian economics emphasizes subjectivism, highlighting individual preferences and the role of human action in economic decision-making, whereas Real Business Cycle (RBC) theory relies on rational expectations, assuming agents have perfect foresight and optimize intertemporally based on all available information. The Austrian approach critiques the reliance on mathematical models and equilibrium conditions used by RBC, arguing that knowledge is dispersed and cannot be fully aggregated into representative agent models. RBC models focus on exogenous productivity shocks as drivers of economic fluctuations, while Austrian economics centers its analysis on the entrepreneurial discovery process and the temporal coordination of plans under uncertainty.

Role of Money and Credit in Economic Fluctuations

Austrian economics emphasizes that fluctuations in money supply and credit expansion, primarily driven by central banks, distort interest rates and misallocate resources, leading to unsustainable boom-bust cycles. In contrast, Real Business Cycle (RBC) theory downplays the role of money and credit, attributing economic fluctuations to real shocks such as technology changes, with money viewed as neutral and insufficient to cause cycles. Austrian economists argue that artificial credit creation fuels malinvestment, while RBC models consider monetary factors largely irrelevant to the amplitude and duration of economic cycles.

Explaining Recessions: Austrian vs. RBC Perspectives

Austrian economics attributes recessions to malinvestment caused by artificial interest rate manipulation, emphasizing the distortion of capital structure and misallocation of resources. Real Business Cycle (RBC) theory explains recessions as optimal responses to real shocks, such as technology changes or productivity declines, highlighting labor supply adjustments and temporary output fluctuations. While Austrian theory centers on monetary distortions triggering boom-bust cycles, RBC models treat recessions as natural economic fluctuations driven by exogenous shocks without inherent market failures.

Policy Implications: Government Intervention vs. Market Solutions

Austrian economics advocates for minimal government intervention, emphasizing market-driven solutions and the self-regulating nature of supply and demand to correct economic imbalances. Real business cycle theory supports policy neutrality, arguing that economic fluctuations result from real shocks rather than monetary factors, thus government interference often distorts natural adjustment processes. Both perspectives caution against interventionist policies, but Austrian economics strongly prioritizes individual entrepreneurial discovery, while real business cycle models emphasize structural responses to technological changes.

Criticisms of Austrian Economics

Criticisms of Austrian economics often highlight its lack of empirical testing and reliance on deductive reasoning rather than mathematical modeling, which contrasts with the data-driven Real Business Cycle (RBC) theory. Austrian economics faces challenges in explaining economic fluctuations quantitatively, as it emphasizes subjective value and market processes over rigorous statistical validation. Critics argue that this limits its predictive power and policy applicability compared to the RBC model's use of aggregate shocks and dynamic stochastic general equilibrium frameworks.

Criticisms of Real Business Cycle Theory

Real Business Cycle (RBC) theory faces significant criticism for its assumption that all economic fluctuations are driven by technology shocks, ignoring the role of monetary and demand-side factors. Critics argue that RBC models underestimate the impact of market imperfections, such as price stickiness and information asymmetries, which Austrian economics emphasizes as central to understanding business cycles. Austrian economists also challenge RBC's reliance on equilibrium models, contending that real-world economic dynamics involve uncertainty and entrepreneurial discovery processes that RBC theory fails to capture.

Comparative Analysis and Contemporary Relevance

Austrian economics emphasizes the role of individual decision-making, subjective value, and market process in economic fluctuations, contrasting with Real Business Cycle (RBC) theory's focus on technology shocks and aggregate productivity changes as primary drivers of economic cycles. Austrian theory critiques RBC for its reliance on equilibrium models and neglect of monetary factors, while RBC proponents argue their framework better explains observed macroeconomic data through micro-founded shocks. Contemporary relevance is seen in policy debates where Austrian insights influence critiques of government intervention, whereas RBC models underpin quantitative macroeconomic forecasting and structural policy analysis.

Austrian economics Infographic

libterm.com

libterm.com