The Adaptive Market Hypothesis (AMH) proposes that financial markets evolve and adapt similarly to biological systems, challenging traditional efficient market theories. It suggests that market efficiency is not constant but fluctuates based on environmental conditions, investor behavior, and learning processes. Discover how this dynamic perspective can reshape your understanding of market strategies by reading the full article.

Table of Comparison

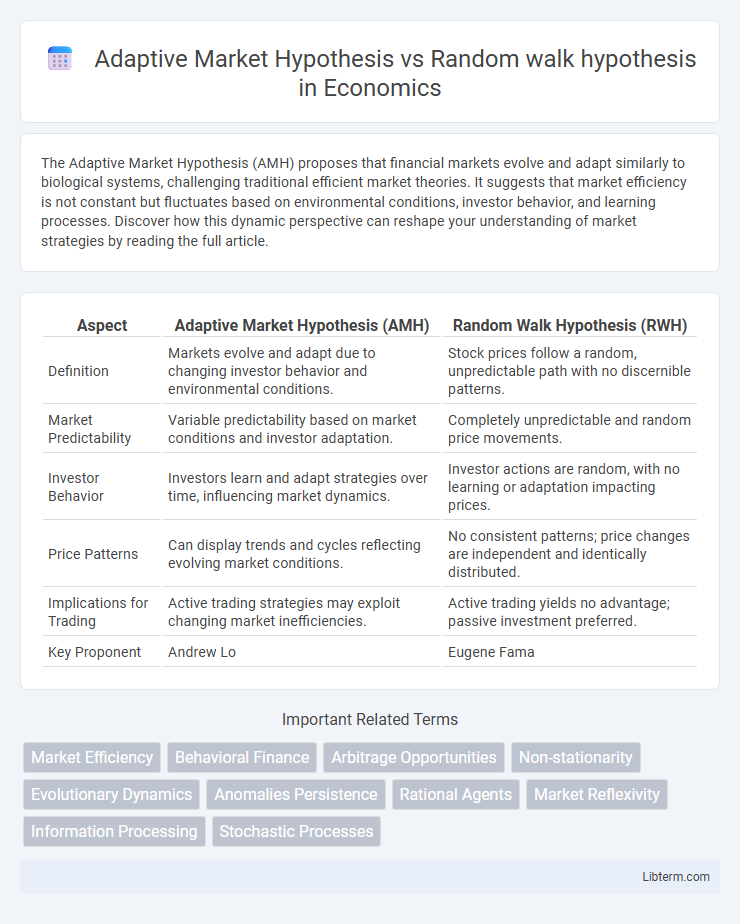

| Aspect | Adaptive Market Hypothesis (AMH) | Random Walk Hypothesis (RWH) |

|---|---|---|

| Definition | Markets evolve and adapt due to changing investor behavior and environmental conditions. | Stock prices follow a random, unpredictable path with no discernible patterns. |

| Market Predictability | Variable predictability based on market conditions and investor adaptation. | Completely unpredictable and random price movements. |

| Investor Behavior | Investors learn and adapt strategies over time, influencing market dynamics. | Investor actions are random, with no learning or adaptation impacting prices. |

| Price Patterns | Can display trends and cycles reflecting evolving market conditions. | No consistent patterns; price changes are independent and identically distributed. |

| Implications for Trading | Active trading strategies may exploit changing market inefficiencies. | Active trading yields no advantage; passive investment preferred. |

| Key Proponent | Andrew Lo | Eugene Fama |

Introduction to Market Hypotheses

The Adaptive Market Hypothesis (AMH) challenges the traditional Random Walk Hypothesis by suggesting that market efficiency evolves over time based on environmental changes and investor behavior. While the Random Walk Hypothesis posits that stock prices follow an unpredictable path, making it impossible to consistently outperform the market, AMH integrates principles from behavioral finance and evolutionary biology to explain market dynamics. This approach provides a more flexible framework for understanding price movements and anomalies in financial markets.

Defining the Adaptive Market Hypothesis (AMH)

The Adaptive Market Hypothesis (AMH) posits that financial markets evolve through a dynamic process where investor behavior adapts to changing environments, blending principles of market efficiency with behavioral finance. Unlike the Random Walk Hypothesis, which assumes price changes are completely unpredictable and independent, AMH suggests that market efficiency is not static but varies over time based on factors like competition, innovation, and market participants' learning. This framework emphasizes that market predictability and arbitrage opportunities fluctuate, reflecting an adaptive ecosystem rather than a purely random price pattern.

Understanding the Random Walk Hypothesis (RWH)

The Random Walk Hypothesis (RWH) posits that stock prices evolve according to a random walk, making future price movements unpredictable and independent of past trends. This theory implies market efficiency, where all available information is already reflected in asset prices, eliminating chances of consistently outperforming the market. Empirical evidence supporting RWH highlights the challenges in timing the market or exploiting historical data for reliable investment strategies.

Historical Background of AMH and RWH

The Adaptive Market Hypothesis (AMH), proposed by Andrew Lo in 2004, integrates principles of evolutionary biology with financial market behavior, challenging the classical Efficient Market Hypothesis by emphasizing market dynamics over time. The Random Walk Hypothesis (RWH), rooted in the early 20th century work of mathematicians like Louis Bachelier and later popularized by Eugene Fama in the 1960s, asserts that stock prices follow a path independent of past movements, implying market unpredictability. AMH's historical development addresses the limitations of RWH by incorporating behavioral finance and ecological concepts to explain shifting market efficiency and investor adaptability.

Core Principles of Adaptive Market Hypothesis

The Adaptive Market Hypothesis (AMH) posits that market efficiency evolves in response to changing environments and investor behavior, integrating principles of natural selection and behavioral finance. Unlike the Random Walk Hypothesis, which assumes price movements are entirely unpredictable and follow a random pattern, AMH suggests that market dynamics adapt over time, allowing for periods of both efficiency and inefficiency. Core principles of AMH emphasize the adaptability of market participants, the impact of past experiences on decision-making, and the role of environmental factors in shaping market outcomes.

Key Concepts of Random Walk Hypothesis

The Random Walk Hypothesis asserts that stock prices evolve according to a random path, making future movements inherently unpredictable and independent of past trends. This key concept implies market efficiency, where all available information is instantly reflected in asset prices, rendering technical analysis ineffective. Consequently, the hypothesis supports the idea that price changes are normally distributed and follow a martingale process, emphasizing the unpredictability of financial markets.

Comparative Analysis: AMH vs RWH

The Adaptive Market Hypothesis (AMH) posits that market efficiency evolves with changing environments, incorporating behavioral biases and learning effects, whereas the Random Walk Hypothesis (RWH) assumes price changes are independent and identically distributed, implying markets are perfectly efficient. Empirical evidence supports AMH's flexibility in explaining anomalies and market dynamics over time, contrasting with RWH's static view that often fails to account for predictable patterns. AMH integrates evolutionary principles and investor adaptation, offering a more nuanced framework for understanding financial market behavior compared to RWH's reliance on fixed probabilistic distributions.

Empirical Evidence Supporting Each Hypothesis

Empirical evidence supporting the Adaptive Market Hypothesis (AMH) includes studies demonstrating that market efficiency evolves with investors' behavior, technological changes, and market conditions, showing periods of predictability mixed with randomness. Research on the Random Walk Hypothesis (RWH) emphasizes that stock price changes are largely unpredictable and follow a stochastic process, supported by statistical tests failing to identify consistent patterns or autocorrelations in asset returns. Comparative analyses reveal that markets may exhibit characteristics of both hypotheses depending on time frames and market environments, suggesting a more nuanced understanding of price dynamics.

Implications for Investors and Market Strategies

The Adaptive Market Hypothesis (AMH) suggests investors should adopt flexible strategies that evolve with changing market conditions, enhancing risk management and exploiting market inefficiencies. In contrast, the Random Walk Hypothesis (RWH) implies that market prices follow a purely stochastic process, rendering active trading and prediction futile, thus favoring passive investment approaches such as index fund investing. Embracing AMH encourages dynamic asset allocation and behavioral finance integration, while RWH supports long-term buy-and-hold strategies to optimize returns.

Conclusion: Future of Market Efficiency Theories

The future of market efficiency theories lies in integrating the Adaptive Market Hypothesis, which acknowledges evolving investor behavior and market conditions, with traditional Random Walk Hypothesis principles that emphasize price unpredictability. Empirical evidence increasingly supports markets as neither fully efficient nor entirely random, suggesting a dynamic interplay influenced by innovation, regulation, and behavioral finance. Advanced machine learning models and real-time data analytics will likely play a crucial role in refining these theories to better capture market complexity and improve investment strategies.

Adaptive Market Hypothesis Infographic

libterm.com

libterm.com