Monetary autonomy dilemma arises when a country struggles to balance control over its own currency with the pressures of global economic integration. This conflict often forces nations to choose between maintaining independent monetary policies and joining larger economic unions or adopting fixed exchange rates. Discover how this dilemma impacts your economy and what strategies can address it in the rest of the article.

Table of Comparison

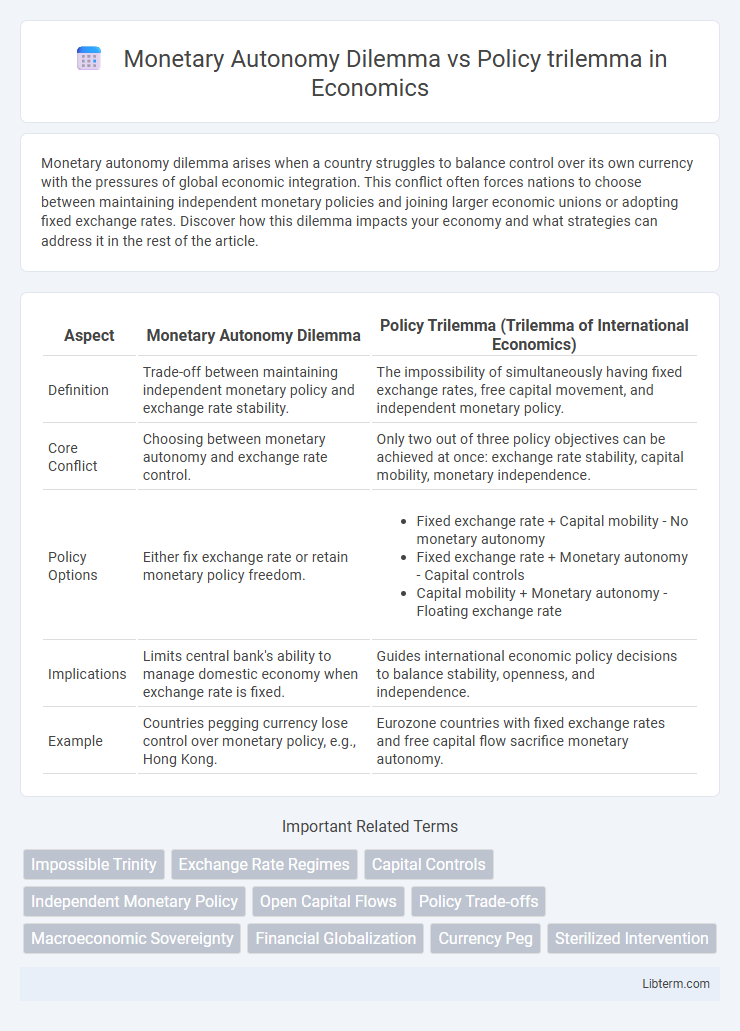

| Aspect | Monetary Autonomy Dilemma | Policy Trilemma (Trilemma of International Economics) |

|---|---|---|

| Definition | Trade-off between maintaining independent monetary policy and exchange rate stability. | The impossibility of simultaneously having fixed exchange rates, free capital movement, and independent monetary policy. |

| Core Conflict | Choosing between monetary autonomy and exchange rate control. | Only two out of three policy objectives can be achieved at once: exchange rate stability, capital mobility, monetary independence. |

| Policy Options | Either fix exchange rate or retain monetary policy freedom. |

|

| Implications | Limits central bank's ability to manage domestic economy when exchange rate is fixed. | Guides international economic policy decisions to balance stability, openness, and independence. |

| Example | Countries pegging currency lose control over monetary policy, e.g., Hong Kong. | Eurozone countries with fixed exchange rates and free capital flow sacrifice monetary autonomy. |

Understanding Monetary Autonomy

Monetary autonomy refers to a country's ability to independently set its own monetary policy without external constraints, allowing it to control inflation and stabilize the economy. The Monetary Autonomy Dilemma highlights the trade-offs between maintaining monetary sovereignty and managing exchange rates in an interconnected global economy. Understanding this dilemma is essential for navigating the Policy Trilemma, which asserts that it is impossible to simultaneously achieve full monetary autonomy, fixed exchange rates, and free capital mobility.

The Concept of Policy Trilemma

The policy trilemma, also known as the impossible trinity, posits that a country cannot simultaneously achieve full monetary autonomy, exchange rate stability, and free capital mobility. This framework highlights the inherent trade-offs policymakers face, forcing a choice between maintaining control over domestic monetary policy, stabilizing currency values, or allowing unrestricted capital flows. Understanding the policy trilemma is essential for analyzing the constraints on economic policy decisions in an interconnected global financial system.

Historical Background of Monetary Autonomy

Monetary autonomy historically emerged as central in the debate over optimal currency areas and international capital mobility during the Bretton Woods era. The Monetary Autonomy Dilemma highlights the trade-offs central banks face between independent monetary policy and exchange rate stability, contrasting with the Policy Trilemma which posits that no country can simultaneously achieve full monetary autonomy, exchange rate stability, and capital mobility. Key episodes such as the collapse of the gold standard in the 1930s and the breakdown of the Bretton Woods system in 1971 underscore the challenges nations faced in maintaining monetary sovereignty amid growing financial globalization.

Core Elements of the Policy Trilemma

The Policy Trilemma, also known as the Impossible Trinity, highlights the core elements of monetary policy autonomy, fixed exchange rates, and capital mobility, where only two can coexist simultaneously. This framework underscores the Monetary Autonomy Dilemma, illustrating the trade-off policymakers face when choosing between independent monetary policy and exchange rate stability in an open capital market. Understanding these core elements aids in analyzing how countries prioritize economic goals amid global financial integration.

Contrasting Monetary Autonomy Dilemma and Policy Trilemma

The Monetary Autonomy Dilemma highlights the challenge of maintaining independent monetary policy while managing external financial conditions, emphasizing trade-offs between capital mobility and exchange rate stability. In contrast, the Policy Trilemma, or impossible trinity, states that a country cannot simultaneously achieve full monetary autonomy, fixed exchange rates, and free capital movement; it must choose only two out of the three. While both concepts address constraints on monetary policy, the Monetary Autonomy Dilemma focuses more on practical tensions within policy choices, whereas the Policy Trilemma provides a formal framework explaining the inherent incompatibility of three key economic goals.

Impacts on Exchange Rate Regimes

Monetary Autonomy Dilemma limits a country's ability to maintain independent monetary policy while managing exchange rate stability and capital mobility, leading to trade-offs in exchange rate regimes. The Policy Trilemma, also known as the Impossible Trinity, asserts that it is impossible to simultaneously achieve fixed exchange rates, free capital movement, and independent monetary policy, forcing countries to prioritize two of these objectives. As a result, countries often choose between floating exchange rates to preserve monetary autonomy or fixed regimes to promote exchange rate stability at the cost of policy flexibility.

Policy Choices in an Interconnected World

The Monetary Autonomy Dilemma highlights the challenge of maintaining independent monetary policy while managing exchange rate stability and capital mobility. The Policy Trilemma, or Impossible Trinity, asserts that countries can only achieve two out of three goals: fixed exchange rates, free capital movement, and monetary policy autonomy. In an interconnected global economy, policymakers must strategically prioritize combinations of these objectives to balance economic growth, financial stability, and external competitiveness.

Case Studies: Country Approaches to Monetary Autonomy

Countries like China and Vietnam navigate the Monetary Autonomy Dilemma by prioritizing monetary autonomy while managing exchange rate stability, often employing capital controls to prevent financial volatility. In contrast, the United States exemplifies the Policy Trilemma by sacrificing exchange rate stability to maintain open capital markets and autonomous monetary policy, reinforcing the trade-offs inherent in global financial integration. Emerging economies often adopt hybrid approaches, balancing these objectives based on unique economic conditions and development goals.

Challenges for Emerging Markets

Emerging markets face significant challenges in balancing the Monetary Autonomy Dilemma and the Policy Trilemma, which involves the trade-offs between exchange rate stability, monetary policy independence, and capital mobility. Limited monetary autonomy restricts their ability to respond effectively to external shocks, while pursuing open capital accounts increases vulnerability to financial instability. These constraints complicate macroeconomic management, often forcing emerging markets into suboptimal policy combinations that hinder sustainable growth and financial resilience.

Future Prospects and Global Policy Implications

The Monetary Autonomy Dilemma highlights the trade-off between maintaining independent monetary policy and managing exchange rate stability, directly impacting countries' ability to respond to global economic shocks. In contrast, the Policy Trilemma illustrates the impossibility of simultaneously achieving monetary autonomy, exchange rate stability, and free capital movement, forcing policymakers to prioritize objectives based on national economic priorities. Future prospects emphasize adaptive frameworks incorporating digital currencies and enhanced international coordination to balance these trade-offs, shaping global policy by fostering financial stability and mitigating systemic risks.

Monetary Autonomy Dilemma Infographic

libterm.com

libterm.com