The consumption function illustrates the relationship between total consumption and disposable income, revealing how changes in income levels impact consumer spending. Understanding this function helps predict economic behavior and assess fiscal policy effects on demand. Explore the rest of the article to deepen your grasp of how the consumption function influences economic decision-making.

Table of Comparison

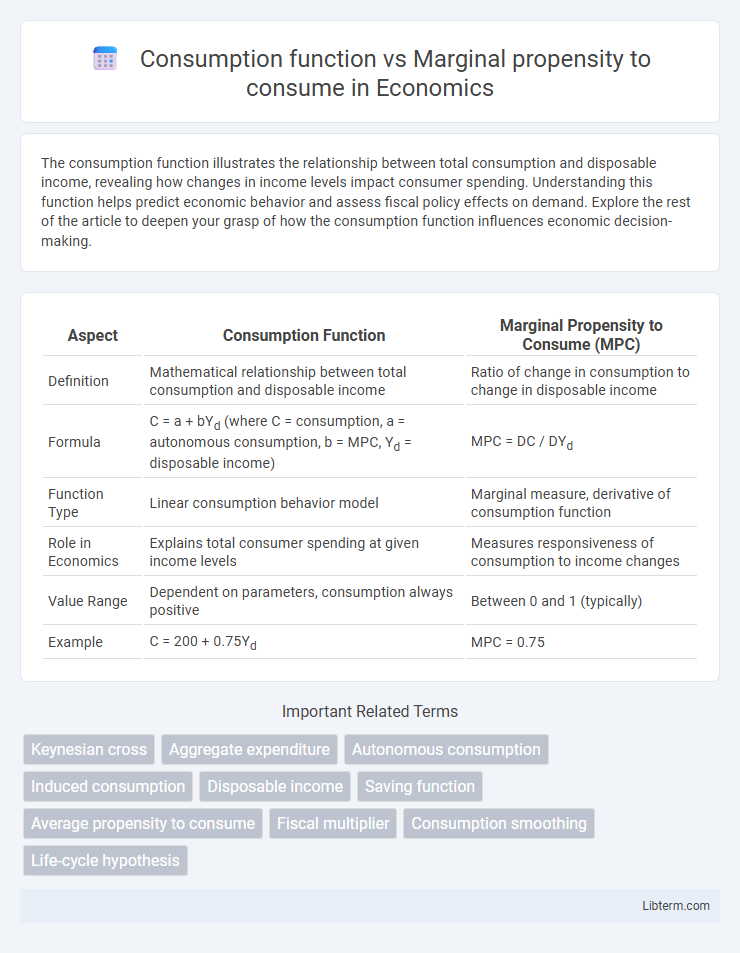

| Aspect | Consumption Function | Marginal Propensity to Consume (MPC) |

|---|---|---|

| Definition | Mathematical relationship between total consumption and disposable income | Ratio of change in consumption to change in disposable income |

| Formula | C = a + bYd (where C = consumption, a = autonomous consumption, b = MPC, Yd = disposable income) | MPC = DC / DYd |

| Function Type | Linear consumption behavior model | Marginal measure, derivative of consumption function |

| Role in Economics | Explains total consumer spending at given income levels | Measures responsiveness of consumption to income changes |

| Value Range | Dependent on parameters, consumption always positive | Between 0 and 1 (typically) |

| Example | C = 200 + 0.75Yd | MPC = 0.75 |

Understanding the Consumption Function

The consumption function describes the relationship between total consumption and disposable income, illustrating how households allocate their income to spending. Marginal propensity to consume (MPC) measures the change in consumption resulting from a one-unit change in disposable income, representing the slope of the consumption function. Understanding the consumption function helps economists predict consumer behavior and assess the impact of fiscal policies on aggregate demand.

Defining Marginal Propensity to Consume (MPC)

Marginal Propensity to Consume (MPC) measures the proportion of additional income that a household spends on consumption rather than saving, reflecting consumer behavior in response to income changes. It is a key parameter within the Consumption Function, which models total consumption as a function of disposable income. Understanding MPC is crucial for predicting the impact of fiscal policy and economic stimulus on aggregate demand.

Theoretical Foundations of Consumption Analysis

The consumption function models the relationship between total consumption and disposable income, reflecting how consumers allocate income over time based on Keynesian theory. Marginal propensity to consume (MPC) quantifies the incremental change in consumption resulting from a one-unit change in disposable income, serving as a critical parameter in consumption analysis. Theoretical foundations emphasize that MPC influences aggregate demand dynamics and the multiplier effect within macroeconomic frameworks.

Key Differences Between Consumption Function and MPC

The consumption function represents the relationship between total consumption and disposable income, illustrating how households allocate income to spending at various income levels. Marginal propensity to consume (MPC) quantifies the change in consumption resulting from a one-unit change in disposable income, typically expressed as a ratio or fraction. Key differences include that the consumption function is a broader behavioral model depicting total consumption patterns, while MPC specifically measures responsiveness or sensitivity of consumption to incremental income changes.

Mathematical Representation of Consumption Function

The consumption function is mathematically represented as C = a + bY, where C denotes total consumption, a represents autonomous consumption independent of income, and b is the marginal propensity to consume (MPC), indicating the change in consumption resulting from a one-unit change in income (Y). MPC is crucial as it quantifies the slope of the consumption function, measuring the proportion of additional income spent on consumption. This linear relationship forms the basis for analyzing consumer behavior and predicting aggregate demand in macroeconomic models.

Calculating and Interpreting MPC

The consumption function illustrates the relationship between total consumption and disposable income, often expressed as C = a + bYd, where b represents the marginal propensity to consume (MPC). Calculating MPC involves determining the change in consumption divided by the change in disposable income (DC/DYd), quantifying how much consumption varies with income fluctuations. Interpreting MPC reveals the proportion of additional income that households spend rather than save, with values between 0 and 1 indicating the intensity of consumption response to income changes.

Factors Influencing Consumption Patterns

Consumption function quantifies the relationship between total consumption and disposable income, reflecting how households allocate income toward spending. Marginal propensity to consume (MPC) measures the incremental change in consumption resulting from an additional unit of income, indicating consumer spending sensitivity. Factors influencing consumption patterns include income levels, consumer confidence, interest rates, wealth effects, and expectations about future economic conditions, which collectively affect both the consumption function slope and MPC values.

Real-World Applications in Economic Policy

The consumption function models the relationship between total consumer spending and disposable income, guiding policymakers in predicting aggregate demand shifts during fiscal interventions. Marginal propensity to consume (MPC) quantifies the incremental increase in consumption from additional income, crucial for designing effective stimulus packages that target spending multipliers. Understanding these concepts enables governments to calibrate tax cuts or transfers to maximize economic growth and stabilize fluctuations in real-world economic cycles.

Implications for Fiscal Stimulus and Economic Growth

The consumption function, which represents the relationship between total consumer spending and disposable income, directly influences the marginal propensity to consume (MPC), indicating the portion of additional income spent rather than saved. A higher MPC amplifies the effectiveness of fiscal stimulus by increasing aggregate demand, accelerating economic growth through enhanced consumption-driven multiplier effects. Policymakers targeting economies with elevated MPCs can expect more pronounced impacts from stimulus measures, fostering quicker recovery and expansion.

Comparing Predictive Power in Economic Models

The consumption function models total consumer spending based on income, offering a broad predictive framework for aggregate demand in economic models. In contrast, the marginal propensity to consume (MPC) measures the incremental change in consumption resulting from a change in disposable income, providing more precise insights into short-term consumption behavior and fiscal policy effects. Comparing their predictive power, the consumption function excels in long-run aggregate forecasts, while MPC delivers superior accuracy in evaluating immediate responses to income variations and stimulus measures.

Consumption function Infographic

libterm.com

libterm.com