Market equilibrium occurs when the quantity of goods supplied matches the quantity demanded, resulting in a stable price point where no surplus or shortage exists. This balance ensures efficient resource allocation and maximizes consumer and producer satisfaction. Explore the rest of the article to understand how market equilibrium impacts your daily economic decisions.

Table of Comparison

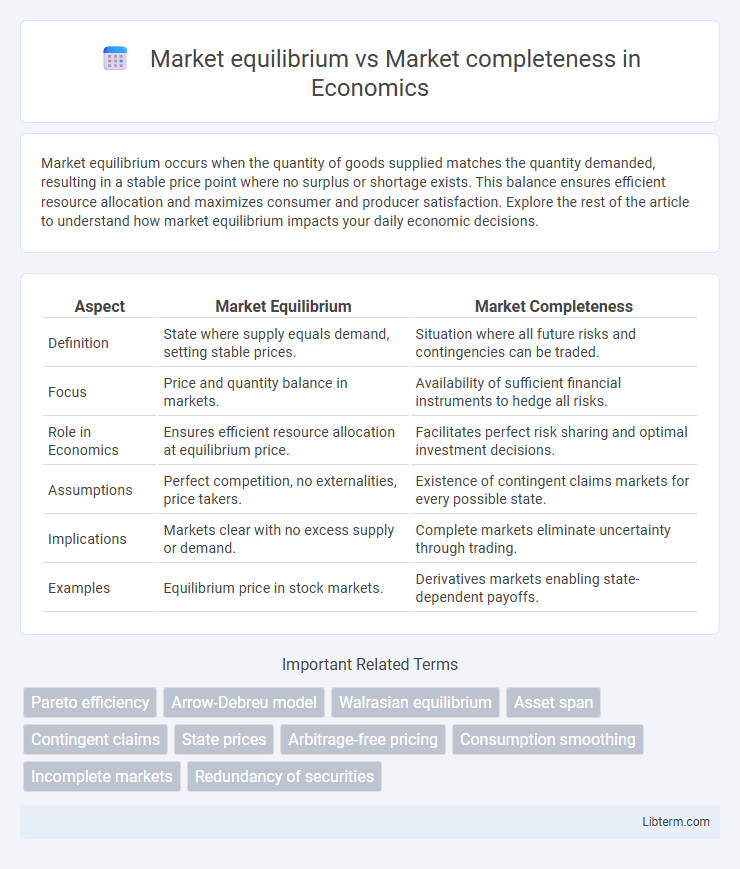

| Aspect | Market Equilibrium | Market Completeness |

|---|---|---|

| Definition | State where supply equals demand, setting stable prices. | Situation where all future risks and contingencies can be traded. |

| Focus | Price and quantity balance in markets. | Availability of sufficient financial instruments to hedge all risks. |

| Role in Economics | Ensures efficient resource allocation at equilibrium price. | Facilitates perfect risk sharing and optimal investment decisions. |

| Assumptions | Perfect competition, no externalities, price takers. | Existence of contingent claims markets for every possible state. |

| Implications | Markets clear with no excess supply or demand. | Complete markets eliminate uncertainty through trading. |

| Examples | Equilibrium price in stock markets. | Derivatives markets enabling state-dependent payoffs. |

Introduction to Market Equilibrium and Market Completeness

Market equilibrium occurs when supply matches demand, resulting in a stable price where no participant can improve their outcome without making others worse off. Market completeness refers to the availability of a full set of assets that allows agents to fully insure against all possible future states of nature. Understanding both concepts is essential for analyzing efficient resource allocation and risk-sharing in economic models.

Defining Market Equilibrium: Core Concepts

Market equilibrium occurs when supply equals demand, resulting in a stable price where no agent has an incentive to change behavior. It reflects a state where all markets clear, and resources are efficiently allocated given existing preferences and technologies. In contrast, market completeness refers to a setting where every conceivable risk can be traded, enabling full risk-sharing and leading to unique equilibrium prices in financial markets.

Understanding Market Completeness: Key Aspects

Market completeness refers to the availability of a full range of assets that allow agents to perfectly hedge all future states of the world. In a complete market, every contingent claim can be replicated and traded, ensuring Pareto-efficient allocations and no arbitrage opportunities. Understanding market completeness involves analyzing the structure of asset payoffs, state-contingent securities, and the feasibility of spanning all possible risk scenarios in financial markets.

Differences Between Market Equilibrium and Market Completeness

Market equilibrium refers to the state where supply equals demand, resulting in stable prices within a market. Market completeness describes a condition where all possible contingent claims can be traded, enabling full risk-sharing among participants. The key difference lies in that market equilibrium addresses price and quantity balance at a moment, whereas market completeness concerns the availability of instruments that allow for optimal allocation of resources under uncertainty.

Conditions Required for Market Equilibrium

Market equilibrium requires the alignment of supply and demand where no participant can improve their position given current prices, necessitating perfect information and rational behavior among agents. Market equilibrium conditions include price flexibility, allowing adjustments to clear markets, and the absence of arbitrage opportunities ensuring that all economic agents are optimizing efficiently. Achieving market equilibrium further depends on the completeness of markets, where all possible contingent claims or assets exist, enabling proper risk sharing and allocation of resources.

Prerequisites for Market Completeness

Market completeness requires a framework where every contingent claim can be traded, ensuring all possible future states are accounted for in the market. Prerequisites include a sufficient number of securities to span the entire state space and transparent information flow to accurately price assets. This contrasts with market equilibrium, which centers on price-setting where supply meets demand without necessarily achieving full market completion.

Impact of Market Equilibrium on Economic Efficiency

Market equilibrium occurs when supply equals demand, leading to an optimal allocation of resources and maximizing economic efficiency by minimizing shortages and surpluses. In contrast, market completeness refers to the availability of a full set of financial instruments to hedge against all possible risks, which complements equilibrium by enabling better risk-sharing and investment decisions. The impact of market equilibrium on economic efficiency is significant because it ensures price stability, promotes optimal resource utilization, and fosters predictable market outcomes critical for economic growth.

Role of Market Completeness in Risk Allocation

Market completeness significantly enhances risk allocation by enabling agents to trade a comprehensive set of contingent claims, effectively diversifying and hedging against various states of the world. In contrast, market equilibrium in incomplete markets often leads to suboptimal risk-sharing due to the absence of securities that span all possible uncertainties. Therefore, market completeness is crucial for achieving efficient risk distribution and optimal allocation of resources in financial economies.

Real-World Examples: Equilibrium vs Completeness

Market equilibrium occurs when supply matches demand at a specific price point, as seen in stock exchanges where share prices adjust to balance buy and sell orders. Market completeness refers to the availability of a full range of securities or contracts to hedge all possible risks, exemplified by financial derivatives markets that enable comprehensive risk management. Real-world markets often achieve equilibrium without completeness, illustrated by commodity markets balancing supply and demand but lacking instruments for every potential risk scenario.

Policy Implications and Conclusion

Market equilibrium ensures supply equals demand at prevailing prices, crucial for efficient resource allocation and stable markets. Market completeness, where all risks can be traded and hedged, enhances economic resilience and minimizes distortions in financial markets. Policy implications include the need for regulations promoting transparency, asset diversity, and risk-sharing mechanisms to support both equilibrium and completeness for sustained economic growth.

Market equilibrium Infographic

libterm.com

libterm.com