The black market price often deviates significantly from official pricing due to the illegal nature of the goods or services being exchanged, influenced by scarcity, risk, and demand factors. Understanding these price variations is crucial for recognizing the broader economic and social impacts of illicit trade. Explore the rest of the article to learn how black market prices affect your daily life and the global economy.

Table of Comparison

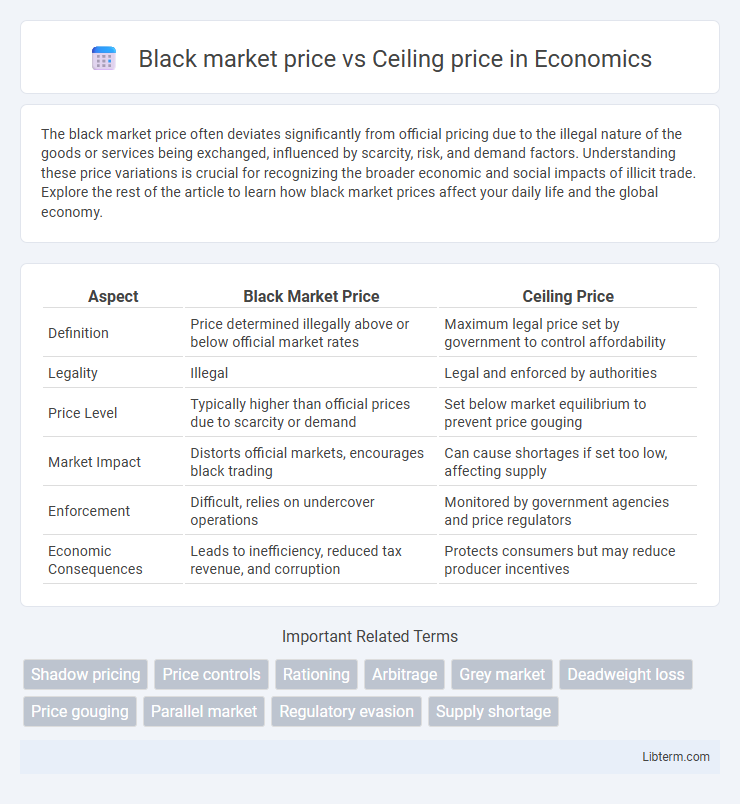

| Aspect | Black Market Price | Ceiling Price |

|---|---|---|

| Definition | Price determined illegally above or below official market rates | Maximum legal price set by government to control affordability |

| Legality | Illegal | Legal and enforced by authorities |

| Price Level | Typically higher than official prices due to scarcity or demand | Set below market equilibrium to prevent price gouging |

| Market Impact | Distorts official markets, encourages black trading | Can cause shortages if set too low, affecting supply |

| Enforcement | Difficult, relies on undercover operations | Monitored by government agencies and price regulators |

| Economic Consequences | Leads to inefficiency, reduced tax revenue, and corruption | Protects consumers but may reduce producer incentives |

Understanding Black Market Price and Ceiling Price

Black market price refers to the cost of goods or services sold illegally, often exceeding the government-mandated ceiling price set to regulate affordability. Ceiling price acts as the maximum limit imposed to protect consumers from price gouging during shortages or inflation. Understanding the disparity between these prices highlights how supply shortages or high demand drive black market activities beyond regulated limits.

Key Differences Between Black Market and Ceiling Price

Black market price refers to the higher, unauthorized selling price of goods or services traded illegally, while ceiling price is the legally imposed maximum price set by authorities to control inflation and protect consumers. The key difference lies in legality: black market prices emerge from scarcity or demand exceeding supply, bypassing regulations, whereas ceiling prices are official limits designed to prevent price gouging. Enforcement and penalties typically target black market transactions, making these prices not only higher but also riskier compared to legally capped ceiling prices.

Causes of Black Market Emergence

Black markets emerge when the ceiling price set by authorities is significantly lower than the market equilibrium price, causing a shortage of goods as suppliers reduce production or restrict availability. Consumers willing to pay more than the ceiling price turn to unofficial channels where prices reflect true demand and supply conditions. This gap incentivizes illicit trading, leading to the proliferation of black market activities.

Government Role in Setting Price Ceilings

Government sets price ceilings to protect consumers from exorbitant costs by capping prices below market equilibrium, often leading to shortages. These ceilings can create black markets where goods sell at higher prices due to restricted supply and unmet demand. Regulatory enforcement and monitoring are essential roles for governments to minimize black market activity and ensure fair access to essential products.

Economic Impacts of Ceiling Prices

Ceiling prices, set below equilibrium market rates, can lead to shortages as supply diminishes while demand remains high, incentivizing the emergence of black markets where goods are sold at inflated prices. These illegal markets undermine official price controls, causing revenue losses for legitimate businesses and governments. Consequently, ceiling prices distort market efficiency, reduce product quality, and create economic inefficiencies through resource misallocation.

Consequences of Black Market Activities

Black market prices exceed ceiling prices, resulting in consumers paying significantly more for essential goods, which undermines economic equity and access. Scarcity and unlawful distribution linked to black market activities distort market regulation and fiscal policy effectiveness. These practices fuel illegal profits and erode public trust in government-imposed pricing controls.

Case Studies: Black Markets and Price Ceilings

Black market prices often emerge well above legally imposed ceiling prices, highlighting the inefficiencies of price controls in markets such as rental housing in New York City and fuel in Venezuela. Case studies reveal that strict price ceilings lead to shortages and incentivize black markets where goods are sold at premium rates, bypassing official regulations. These dynamics demonstrate how price ceilings, while intended to make products affordable, can paradoxically escalate costs and reduce supply.

Consumer Behavior Under Price Controls

Consumers often turn to black markets when ceiling prices set by governments are below the equilibrium price, causing shortages in legal markets. This behavior reflects increased willingness to pay more for scarce goods, bypassing price controls that restrict supply and lead to unmet demand. The interaction between black market prices and ceiling prices highlights how consumers prioritize access over legality when official prices distort market balance.

Solutions to Mitigate Black Market Growth

Implementing strict regulatory enforcement and increasing surveillance can effectively curb the expansion of black markets by ensuring adherence to ceiling prices. Promoting transparency in supply chains and enhancing consumer awareness about legitimate pricing fosters trust and reduces black market demand. Leveraging technology such as blockchain for real-time price monitoring aids in detecting and preventing unlawful price manipulation.

Future Trends in Price Regulation and Market Dynamics

Black market prices often exceed official ceiling prices due to supply shortages and regulatory constraints, highlighting inefficiencies in price control mechanisms. Future trends in price regulation may include dynamic pricing models and increased use of blockchain for transparency, aiming to reduce black market activities. Evolving market dynamics suggest enhanced enforcement and adaptive policies to better align ceiling prices with actual market demand and supply conditions.

Black market price Infographic

libterm.com

libterm.com