Interest on reserves is the payment made by central banks to commercial banks on the funds they hold as reserves. This mechanism helps manage monetary policy by influencing banks' willingness to lend and maintain liquidity in the financial system. Discover how interest on reserves impacts your financial decisions and the broader economy in the rest of this article.

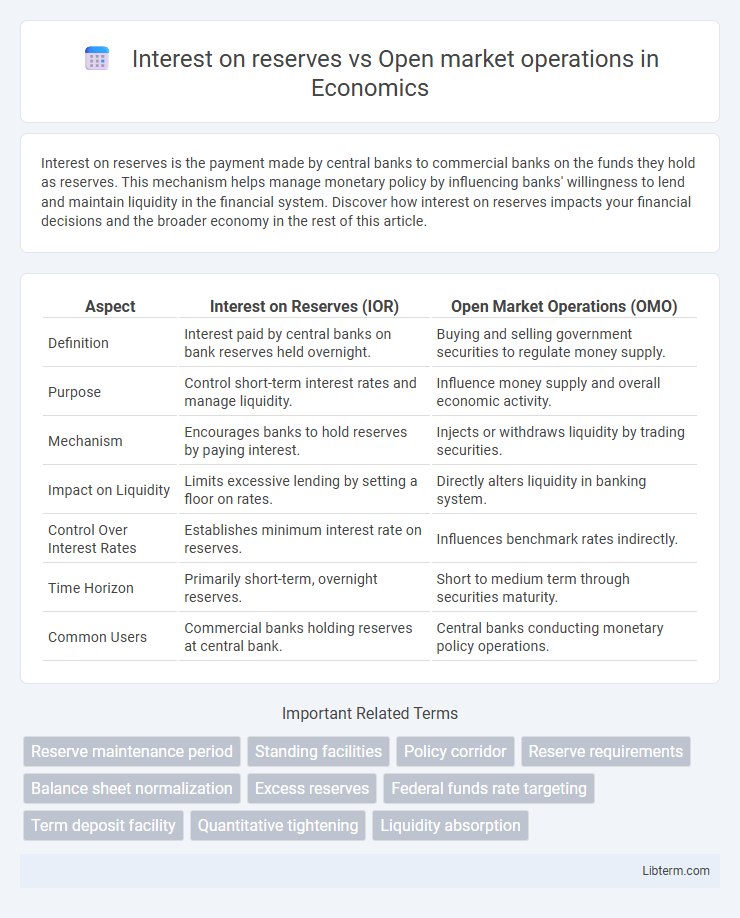

Table of Comparison

| Aspect | Interest on Reserves (IOR) | Open Market Operations (OMO) |

|---|---|---|

| Definition | Interest paid by central banks on bank reserves held overnight. | Buying and selling government securities to regulate money supply. |

| Purpose | Control short-term interest rates and manage liquidity. | Influence money supply and overall economic activity. |

| Mechanism | Encourages banks to hold reserves by paying interest. | Injects or withdraws liquidity by trading securities. |

| Impact on Liquidity | Limits excessive lending by setting a floor on rates. | Directly alters liquidity in banking system. |

| Control Over Interest Rates | Establishes minimum interest rate on reserves. | Influences benchmark rates indirectly. |

| Time Horizon | Primarily short-term, overnight reserves. | Short to medium term through securities maturity. |

| Common Users | Commercial banks holding reserves at central bank. | Central banks conducting monetary policy operations. |

Introduction to Monetary Policy Tools

Interest on reserves directly influences banks' willingness to lend by setting a floor for short-term interest rates, impacting liquidity and credit expansion. Open market operations involve the central bank's buying or selling of government securities to regulate money supply and stabilize economic activity. Both tools are essential in controlling inflation and steering monetary policy to achieve economic growth and price stability.

Understanding Interest on Reserves (IOR)

Interest on Reserves (IOR) is a monetary policy tool that central banks use to influence short-term interest rates by paying banks interest on their excess reserves held at the central bank. Unlike Open Market Operations (OMO), which involve buying or selling government securities to adjust the money supply and influence liquidity, IOR directly sets a floor for the federal funds rate by providing banks with an incentive to hold reserves. This mechanism helps stabilize the banking system and control inflation by guiding lending behaviors without the frequent market transactions characteristic of OMOs.

What Are Open Market Operations (OMO)?

Open Market Operations (OMO) involve the central bank buying or selling government securities in the open market to regulate money supply and influence short-term interest rates. This tool adjusts liquidity by increasing reserves when buying securities and decreasing reserves when selling them, impacting bank lending and economic activity. Unlike Interest on Reserves, which sets a floor on short-term interest rates by paying banks on excess reserves, OMO directly alters the amount of reserves in the banking system.

Mechanisms: How IOR Influences the Economy

Interest on reserves (IOR) influences the economy by providing banks with a direct incentive to hold excess reserves, effectively setting a floor on short-term interest rates and controlling liquidity. Open market operations (OMOs) adjust the money supply by buying or selling government securities, influencing reserves and broader credit conditions. While OMOs primarily manage liquidity through market transactions, IOR stabilizes the banking system by affecting banks' opportunity costs and lending behaviors.

Mechanisms: How OMO Affects Liquidity

Open market operations (OMO) influence liquidity by central banks buying or selling government securities to inject or withdraw funds from the banking system, directly altering reserve levels and short-term interest rates. In contrast, interest on reserves sets a floor for the rates banks are willing to lend reserves, indirectly controlling liquidity by providing banks with incentives to hold excess reserves rather than increase lending. OMOs provide immediate and dynamic liquidity adjustments, while interest on reserves stabilizes the demand for reserves by influencing banks' opportunity costs.

Comparative Effectiveness: IOR vs OMO

Interest on Reserves (IOR) directly influences banks' willingness to lend by setting a floor on the short-term interest rates, thereby providing a precise tool for monetary policy implementation. Open Market Operations (OMO) adjust liquidity through buying or selling government securities, impacting broader money supply and interest rates with less immediate precision. IOR offers a more targeted and timely mechanism for controlling the federal funds rate compared to the often slower and less predictable effects of OMOs.

Impact on Bank Lending and Financial Markets

Interest on reserves directly influences banks' willingness to lend by setting a floor on the return for holding excess reserves, often reducing incentives to extend loans during high interest payments. Open market operations adjust liquidity and short-term interest rates through buying or selling government securities, which impacts borrowing costs and credit availability, thereby stimulating or restraining bank lending. Financial markets respond to these tools as interest on reserves stabilizes reserve supply, while open market operations affect market interest rate volatility and liquidity conditions, influencing asset prices and investor behavior.

Policy Flexibility and Implementation

Interest on reserves (IOR) grants central banks enhanced policy flexibility by directly influencing banks' incentives to hold excess reserves, thereby stabilizing short-term interest rates without altering the monetary base. Open market operations (OMOs) adjust liquidity by buying or selling government securities, impacting reserves indirectly and requiring continual calibration to maintain target rates. IOR simplifies implementation by setting a floor on interest rates, reducing the need for frequent OMO interventions to manage reserve supply and control monetary conditions.

Recent Trends and Global Perspectives

Interest on reserves (IOR) and open market operations (OMO) remain critical tools in central banking for managing liquidity and guiding monetary policy. Recent trends highlight a global shift towards using IOR to set effective floor rates, with countries like the U.S., Eurozone, and Japan fine-tuning reserve remuneration to control inflation and stabilize financial markets amid economic uncertainties. Globally, OMO continue to adapt, utilizing large-scale asset purchases and sales in response to pandemic-induced shocks, signaling a nuanced interplay between IOR settings and market-based liquidity management.

Conclusion: Choosing Between IOR and OMO

Interest on Reserves (IOR) provides central banks with a direct tool to influence short-term interest rates by setting the floor for the federal funds rate, offering precise control over banking system liquidity. Open Market Operations (OMO) remain essential for managing overall money supply and long-term rate stability through buying and selling government securities. Selecting between IOR and OMO depends on the central bank's specific monetary policy goals, with IOR favored for fine-tuning rate control and OMO for broader liquidity management.

Interest on reserves Infographic

libterm.com

libterm.com