Tier 1 capital ratio measures a bank's core equity capital compared with its total risk-weighted assets, reflecting financial strength and stability. Regulators use this ratio to ensure banks can absorb losses and protect depositors during economic downturns. Discover how understanding your bank's Tier 1 capital ratio can influence your financial security by reading the full article.

Table of Comparison

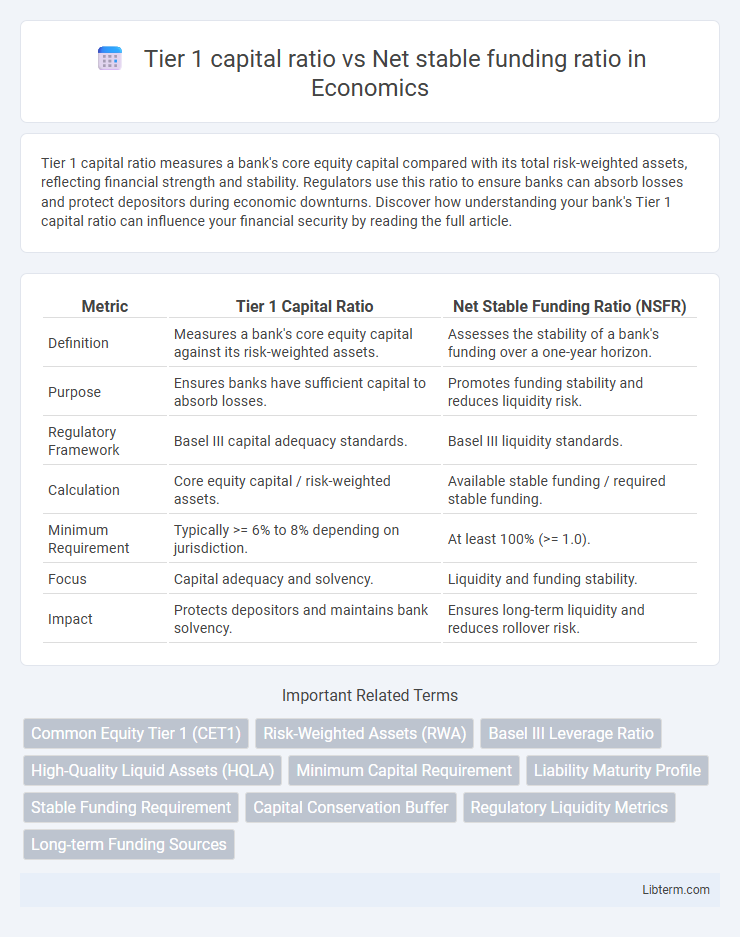

| Metric | Tier 1 Capital Ratio | Net Stable Funding Ratio (NSFR) |

|---|---|---|

| Definition | Measures a bank's core equity capital against its risk-weighted assets. | Assesses the stability of a bank's funding over a one-year horizon. |

| Purpose | Ensures banks have sufficient capital to absorb losses. | Promotes funding stability and reduces liquidity risk. |

| Regulatory Framework | Basel III capital adequacy standards. | Basel III liquidity standards. |

| Calculation | Core equity capital / risk-weighted assets. | Available stable funding / required stable funding. |

| Minimum Requirement | Typically >= 6% to 8% depending on jurisdiction. | At least 100% (>= 1.0). |

| Focus | Capital adequacy and solvency. | Liquidity and funding stability. |

| Impact | Protects depositors and maintains bank solvency. | Ensures long-term liquidity and reduces rollover risk. |

Introduction to Tier 1 Capital Ratio and Net Stable Funding Ratio

The Tier 1 Capital Ratio measures a bank's core equity capital relative to its total risk-weighted assets, serving as a vital indicator of financial strength and regulatory compliance under Basel III standards. The Net Stable Funding Ratio (NSFR) assesses the stability of a bank's funding structure by comparing available stable funding against required stable funding over a one-year horizon to promote long-term resilience. Both metrics are essential for evaluating a bank's ability to withstand financial stress, with Tier 1 Capital Ratio focusing on capital adequacy and NSFR emphasizing funding stability.

Definition of Tier 1 Capital Ratio

The Tier 1 capital ratio measures a bank's core equity capital compared to its total risk-weighted assets, serving as a key indicator of financial strength and regulatory compliance. It primarily includes common stock, retained earnings, and other comprehensive income, reflecting the bank's capacity to absorb losses. The Net Stable Funding Ratio (NSFR) complements this by assessing the stability of a bank's funding over a one-year horizon, ensuring long-term resilience.

Definition of Net Stable Funding Ratio (NSFR)

The Net Stable Funding Ratio (NSFR) is a regulatory liquidity measure designed to ensure that banks maintain a stable funding profile relative to the composition of their assets and off-balance sheet activities over a one-year horizon. Unlike the Tier 1 capital ratio, which assesses a bank's core equity capital against its risk-weighted assets to measure financial strength, the NSFR focuses on the stability of funding sources, requiring a minimum amount of stable funding to cover long-term assets. This ratio promotes resilience by reducing funding risk and encouraging banks to rely more on stable liabilities rather than short-term wholesale funding.

Key Components of Tier 1 Capital

Tier 1 capital ratio emphasizes the core equity capital, including common stock, retained earnings, and disclosed reserves, as key components that ensure a bank's financial strength and ability to absorb losses. These elements distinguish Tier 1 capital from Tier 2 capital, which comprises subordinated debt and other supplementary resources. In contrast, the Net Stable Funding Ratio (NSFR) focuses on the stability of a bank's funding sources over a one-year horizon rather than capital adequacy.

Core Elements of Net Stable Funding Ratio

Tier 1 capital ratio measures a bank's core equity capital compared to its total risk-weighted assets, reflecting financial strength and loss-absorbing capacity. The Net Stable Funding Ratio (NSFR) focuses on the stability of a bank's funding profile over a one-year horizon, emphasizing available stable funding (ASF) against required stable funding (RSF). Core elements of NSFR include the classification of funding sources by tenor and liquidity, with longer-term liabilities and equity contributing to ASF, while assets and off-balance-sheet exposures determine RSF, ensuring banks maintain a stable funding structure to mitigate liquidity risk.

Calculation Methods for Tier 1 Capital Ratio vs. NSFR

Tier 1 Capital Ratio calculates the bank's core equity capital against its risk-weighted assets, primarily focusing on Tier 1 capital elements such as common shares and retained earnings divided by risk-weighted assets. Net Stable Funding Ratio (NSFR) measures the amount of available stable funding relative to the required stable funding over a one-year horizon, calculated by dividing available stable funding (ASF) by required stable funding (RSF). While Tier 1 Capital Ratio emphasizes capital adequacy against credit risk, NSFR concentrates on funding liquidity over the long term, with distinct asset classifications influencing their respective calculations.

Regulatory Requirements and Basel III Standards

The Tier 1 capital ratio, a core measure of a bank's financial strength, is mandated by Basel III standards to ensure institutions maintain a minimum level of high-quality capital relative to risk-weighted assets, promoting resilience against financial stress. The Net Stable Funding Ratio (NSFR), also under Basel III, requires banks to maintain a stable funding profile relative to the composition of their assets and off-balance sheet activities, mitigating liquidity risk over a one-year horizon. Regulatory requirements enforce strict adherence to both ratios to strengthen the banking sector's stability and reduce systemic risk.

Importance in Bank Risk Management

The Tier 1 capital ratio measures a bank's core equity capital relative to its risk-weighted assets, serving as a crucial indicator of financial strength and ability to absorb losses. The Net Stable Funding Ratio (NSFR) ensures banks maintain a stable funding profile over a one-year horizon, reducing liquidity risk by matching long-term assets with stable liabilities. Together, these ratios are essential in bank risk management by promoting solvency and liquidity resilience, thereby enhancing overall financial stability.

Impact on Financial Stability and Lending

Tier 1 capital ratio measures a bank's core equity capital relative to its risk-weighted assets, ensuring sufficient capital buffers to absorb losses and support lending activities during financial stress. Net stable funding ratio (NSFR) mandates banks to hold stable funding sources for their long-term assets, promoting liquidity and reducing reliance on short-term wholesale funding. Together, a strong Tier 1 capital ratio and high NSFR enhance financial stability by reinforcing a bank's resilience and encouraging sustained lending to the economy.

Comparison: Tier 1 Capital Ratio vs Net Stable Funding Ratio

Tier 1 Capital Ratio measures a bank's core equity capital against its risk-weighted assets, indicating financial strength and ability to absorb losses. Net Stable Funding Ratio (NSFR) assesses the stability of a bank's funding profile over a one-year horizon by comparing available stable funding to required stable funding. While Tier 1 Capital Ratio focuses on capital adequacy and loss absorption, NSFR emphasizes liquidity risk and funding stability, both essential for regulatory compliance under Basel III standards.

Tier 1 capital ratio Infographic

libterm.com

libterm.com