Inflation premium represents the additional return investors demand to compensate for the expected decrease in purchasing power due to inflation. Understanding how inflation premium affects interest rates and investment decisions is crucial for managing your portfolio effectively. Explore the rest of this article to learn how inflation premium impacts financial markets and your investment strategy.

Table of Comparison

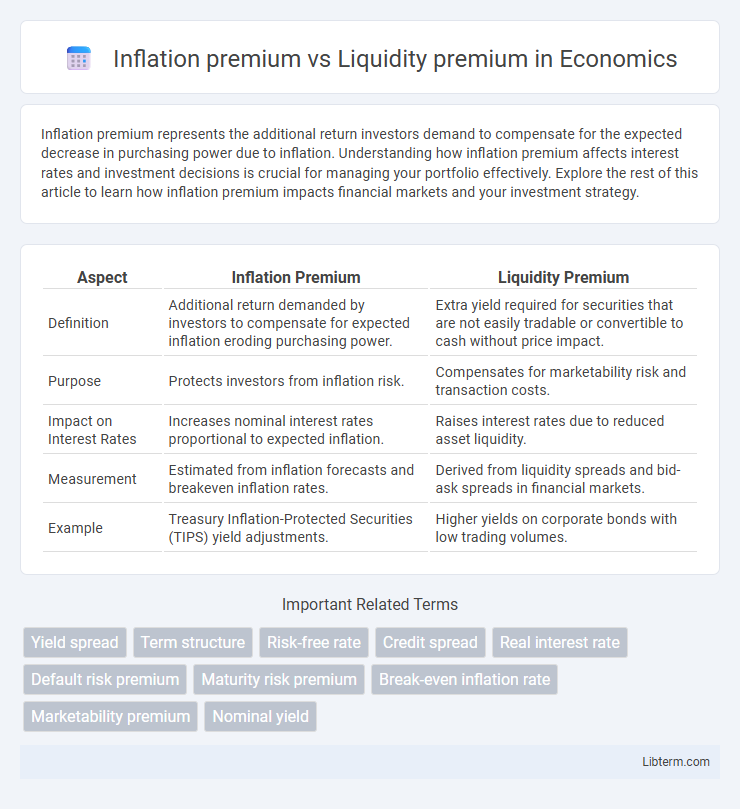

| Aspect | Inflation Premium | Liquidity Premium |

|---|---|---|

| Definition | Additional return demanded by investors to compensate for expected inflation eroding purchasing power. | Extra yield required for securities that are not easily tradable or convertible to cash without price impact. |

| Purpose | Protects investors from inflation risk. | Compensates for marketability risk and transaction costs. |

| Impact on Interest Rates | Increases nominal interest rates proportional to expected inflation. | Raises interest rates due to reduced asset liquidity. |

| Measurement | Estimated from inflation forecasts and breakeven inflation rates. | Derived from liquidity spreads and bid-ask spreads in financial markets. |

| Example | Treasury Inflation-Protected Securities (TIPS) yield adjustments. | Higher yields on corporate bonds with low trading volumes. |

Introduction: Understanding Market Premiums

Inflation premium reflects the extra yield investors demand to compensate for expected inflation eroding purchasing power over time, crucial in fixed-income securities. Liquidity premium represents the additional return required for holding assets that are harder to sell quickly without significant price concessions. Recognizing these premiums is essential for accurately assessing market risks and optimizing investment strategies.

Defining Inflation Premium

Inflation premium refers to the additional yield investors demand on securities to compensate for the expected decrease in purchasing power due to rising inflation over the investment period. This premium is embedded in nominal interest rates and reflects anticipated inflation rates based on market expectations or economic indicators such as the Consumer Price Index (CPI). In contrast, liquidity premium compensates investors for the risk of having difficulty selling an asset quickly without significant price discounts.

Defining Liquidity Premium

Liquidity premium refers to the additional yield investors require for holding assets that cannot be quickly converted into cash without significant price concessions. Unlike the inflation premium, which compensates for expected decreases in purchasing power, liquidity premium specifically addresses the risk associated with the ease of asset trading. Higher liquidity premiums are observed in markets or securities with lower trading volumes or limited marketability.

Core Differences Between Inflation and Liquidity Premiums

Inflation premium reflects the extra yield investors demand to compensate for expected inflation eroding the purchasing power of future cash flows, while liquidity premium compensates for the risk of not being able to quickly sell an asset without a price discount. Inflation premium is closely tied to macroeconomic indicators like the Consumer Price Index (CPI), whereas liquidity premium depends on market conditions, trading volume, and asset liquidity. Core differences lie in their underlying risk drivers: inflation premium addresses inflation risk, whereas liquidity premium addresses marketability risk.

Causes of Inflation Premium in Financial Markets

The inflation premium in financial markets arises primarily due to expectations of rising future inflation, which erodes the real value of fixed-income returns. Investors demand higher yields on nominal bonds to compensate for anticipated inflation-driven declines in purchasing power. This risk adjustment contrasts with the liquidity premium, which compensates investors for the difficulty and cost of converting assets to cash without significant price discounts.

Factors Influencing Liquidity Premium

Liquidity premium reflects the extra yield investors demand for holding assets that cannot be quickly converted into cash without a significant loss in value. Factors influencing liquidity premium include market depth, trading volume, and the ease of buying or selling the asset in secondary markets. Economic conditions, such as financial instability or uncertainty, also increase liquidity premiums as investors prefer highly liquid securities during turbulent times.

Impact on Bond Yields and Interest Rates

Inflation premium increases bond yields as investors demand higher returns to compensate for expected inflation eroding future cash flows, directly influencing nominal interest rates upward. Liquidity premium adds to bond yields by compensating investors for the risk of holding less liquid securities, causing spreads between liquid and illiquid bonds to widen, especially in times of market stress. Together, these premiums raise the overall interest rates demanded by investors, affecting borrowing costs and the valuation of fixed-income securities.

Investor Strategies for Managing Premium Risks

Investors manage inflation premium risks by allocating assets to inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS) and real assets that retain value during rising prices. To mitigate liquidity premium risks, investors maintain diversified portfolios including readily marketable instruments like government bonds and cash equivalents, ensuring quick access to funds without significant price discounts. Balancing these strategies helps optimize returns while controlling exposure to inflation and liquidity-related uncertainties.

Historical Trends: Inflation vs Liquidity Premium

Historical trends reveal that inflation premiums tend to fluctuate significantly during periods of economic instability, reflecting changes in expected inflation rates, while liquidity premiums remain relatively stable but spike during financial crises when market liquidity dries up. Over the past decades, high inflation episodes, such as the 1970s stagflation, led to elevated inflation premiums embedded in bond yields, whereas liquidity premiums surged markedly during the 2008 financial crisis as investors demanded higher compensation for the risk of holding less liquid assets. Empirical data indicates that inflation premiums correlate strongly with inflation expectations from breakeven inflation rates, whereas liquidity premiums depend on market depth, trading volumes, and investor risk aversion metrics.

Conclusion: Choosing Investments Based on Premiums

Investors should consider the inflation premium to protect purchasing power by selecting assets with returns that outpace expected inflation. Incorporating the liquidity premium helps in assessing the trade-off between easily sellable investments and potentially higher yields from less liquid assets. Balancing these premiums is essential for constructing a portfolio aligned with risk tolerance and financial goals.

Inflation premium Infographic

libterm.com

libterm.com