The efficient frontier represents the set of optimal portfolios that offer the highest expected return for a given level of risk or the lowest risk for a given expected return, forming a crucial concept in modern portfolio theory. Understanding how to construct and analyze the efficient frontier helps investors maximize portfolio performance by balancing risk and return effectively. Explore the rest of this article to learn how you can apply the efficient frontier to enhance your investment strategy.

Table of Comparison

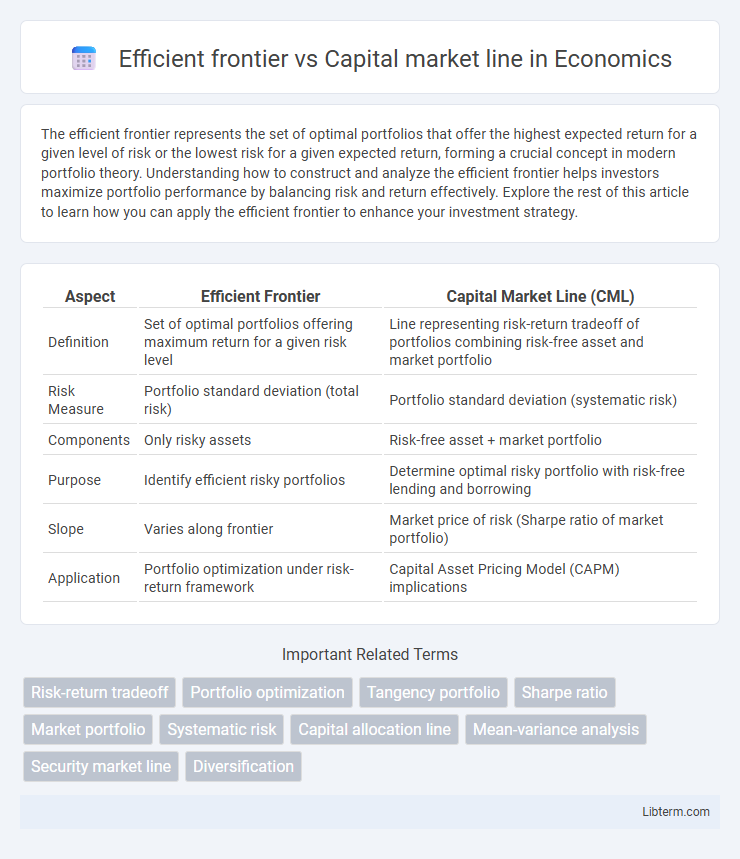

| Aspect | Efficient Frontier | Capital Market Line (CML) |

|---|---|---|

| Definition | Set of optimal portfolios offering maximum return for a given risk level | Line representing risk-return tradeoff of portfolios combining risk-free asset and market portfolio |

| Risk Measure | Portfolio standard deviation (total risk) | Portfolio standard deviation (systematic risk) |

| Components | Only risky assets | Risk-free asset + market portfolio |

| Purpose | Identify efficient risky portfolios | Determine optimal risky portfolio with risk-free lending and borrowing |

| Slope | Varies along frontier | Market price of risk (Sharpe ratio of market portfolio) |

| Application | Portfolio optimization under risk-return framework | Capital Asset Pricing Model (CAPM) implications |

Introduction to the Efficient Frontier

The efficient frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, constructed through diversification of assets. It is derived using mean-variance optimization based on asset return correlations, variances, and expected returns. The capital market line extends the efficient frontier by incorporating a risk-free asset, illustrating the best possible capital allocation between risk-free investment and the market portfolio.

Overview of the Capital Market Line (CML)

The Capital Market Line (CML) represents the risk-return trade-off of efficient portfolios that combine a risk-free asset with the market portfolio, providing the highest expected return for each level of risk. It serves as a benchmark for optimal portfolio selection, where the slope of the CML is the Sharpe ratio of the market portfolio, reflecting the best possible risk-adjusted return. Unlike the Efficient Frontier, which includes only risky assets, the CML incorporates a risk-free asset, enabling investors to achieve superior returns through portfolio diversification.

Key Differences between Efficient Frontier and CML

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk based on asset combinations without a risk-free asset. The Capital Market Line (CML) extends this concept by incorporating a risk-free asset, illustrating portfolios that combine the risk-free asset with the market portfolio to optimize returns per unit of risk. Key differences include the presence of a risk-free asset in CML, linear versus curved risk-return relationship, and the focus on efficient portfolios (Efficient Frontier) versus market equilibrium portfolios (CML).

Role of Risk and Return in Portfolio Optimization

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, emphasizing the trade-off between portfolio volatility and return. The Capital Market Line (CML) extends this concept by incorporating a risk-free asset, illustrating the risk-return combinations achievable through mixing the market portfolio with risk-free borrowing or lending. In portfolio optimization, risk is measured by standard deviation, while return is expected portfolio performance, with the CML providing a superior risk-adjusted return compared to portfolios strictly on the Efficient Frontier.

Underlying Assumptions of Both Concepts

The Efficient Frontier assumes investors seek to maximize returns for a given level of risk, considering only risky assets while assuming markets are frictionless and investors are rational with homogeneous expectations. The Capital Market Line extends this concept by incorporating a risk-free asset, assuming unlimited borrowing and lending at a constant risk-free rate, and perfect market conditions without taxes or transaction costs. Both models depend on the assumptions of efficient markets, investor rationality, and normally distributed returns to define optimal portfolios.

The Significance of the Risk-Free Asset

The significance of the risk-free asset lies in its role in extending the Efficient Frontier into the Capital Market Line (CML), enabling investors to achieve higher expected returns for a given level of risk through combinations of the risk-free asset and the market portfolio. The CML represents portfolios that optimally blend the risk-free asset with risky assets, offering superior risk-return trade-offs compared to portfolios solely on the Efficient Frontier. Incorporating the risk-free asset allows for capital allocation decisions that maximize the Sharpe ratio, facilitating improved portfolio efficiency and investment outcomes.

Portfolio Selection on the Efficient Frontier

The Efficient Frontier represents the set of optimal portfolios offering the maximum expected return for a given level of risk, derived from combinations of risky assets. Portfolio selection on the Efficient Frontier involves identifying portfolios that maximize risk-adjusted returns without considering a risk-free asset. In contrast, the Capital Market Line extends this concept by incorporating a risk-free asset, illustrating the best possible capital allocation between the risk-free asset and the market portfolio.

Market Portfolio and Its Impact on the CML

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, while the Capital Market Line (CML) extends this concept by incorporating the risk-free asset, creating a linear relationship between risk and return. The Market Portfolio, consisting of all investable assets weighted by market value, lies at the tangency point between the Efficient Frontier and the CML, serving as the optimal risky portfolio. This Market Portfolio's composition directly impacts the slope and position of the CML, influencing investors' risk-return trade-offs and portfolio allocation decisions.

Practical Applications in Investment Strategies

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, serving as a crucial tool for portfolio diversification and risk management. The Capital Market Line (CML) extends the Efficient Frontier by incorporating a risk-free asset, allowing investors to achieve better risk-return combinations through leveraged portfolios and more precise allocation between risky assets and risk-free securities. Practical investment strategies leverage the CML to identify the optimal risk-free borrowing or lending positions, enhancing portfolio performance beyond the traditional efficient portfolios.

Conclusion: Choosing Between Efficient Frontier and CML

The Efficient Frontier represents the set of optimal portfolios offering the highest expected return for a given level of risk, while the Capital Market Line (CML) incorporates a risk-free asset, enabling investors to achieve better risk-return combinations by mixing the market portfolio with the risk-free asset. Investors focused on maximizing returns for a specific risk tolerance benefit from the Efficient Frontier, but those seeking portfolios combining risk-free assets and market portfolios to optimize Sharpe ratios should prioritize the CML. Ultimately, the choice depends on investment constraints and preferences, with the CML providing a more practical framework for portfolio selection in the presence of a risk-free asset.

Efficient frontier Infographic

libterm.com

libterm.com