Traditional welfare programs provide essential support such as unemployment benefits, food assistance, and housing subsidies to individuals facing financial hardships. These programs aim to alleviate poverty and promote economic stability by offering a safety net for vulnerable populations. Explore the rest of the article to understand how these initiatives impact your community and what future reforms are proposed.

Table of Comparison

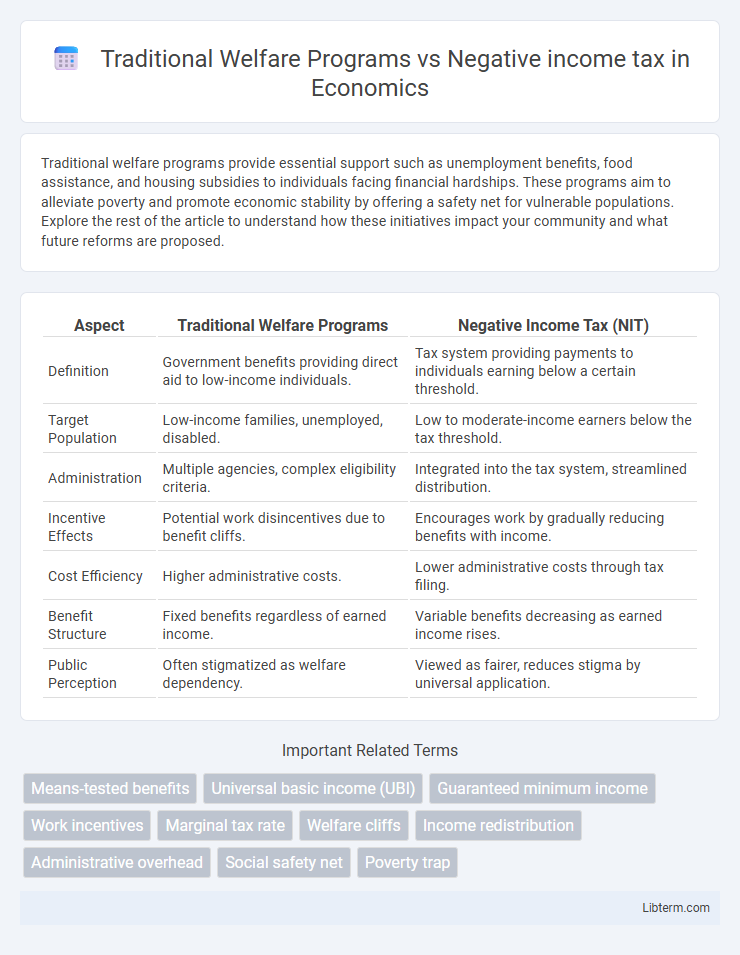

| Aspect | Traditional Welfare Programs | Negative Income Tax (NIT) |

|---|---|---|

| Definition | Government benefits providing direct aid to low-income individuals. | Tax system providing payments to individuals earning below a certain threshold. |

| Target Population | Low-income families, unemployed, disabled. | Low to moderate-income earners below the tax threshold. |

| Administration | Multiple agencies, complex eligibility criteria. | Integrated into the tax system, streamlined distribution. |

| Incentive Effects | Potential work disincentives due to benefit cliffs. | Encourages work by gradually reducing benefits with income. |

| Cost Efficiency | Higher administrative costs. | Lower administrative costs through tax filing. |

| Benefit Structure | Fixed benefits regardless of earned income. | Variable benefits decreasing as earned income rises. |

| Public Perception | Often stigmatized as welfare dependency. | Viewed as fairer, reduces stigma by universal application. |

Introduction to Welfare: Traditional vs Negative Income Tax

Traditional welfare programs provide direct assistance through means-tested benefits, targeting specific populations such as low-income families, unemployed individuals, and the elderly. Negative income tax (NIT) proposes a system where individuals earning below a certain threshold receive supplemental payments via the tax code, promoting income support with less administrative complexity. Comparing these approaches reveals differences in efficiency, work incentives, and poverty alleviation methods within social safety nets.

Historical Background of Welfare Programs

Traditional welfare programs in the United States originated during the Great Depression with the Social Security Act of 1935, aimed at providing direct support to the elderly, unemployed, and disadvantaged populations. These programs expanded throughout the 20th century, emphasizing categorical aid such as Aid to Families with Dependent Children (AFDC) and food stamps, based on income thresholds and family circumstances. Negative income tax (NIT), proposed by economist Milton Friedman in the 1960s, emerged as an alternative approach to streamline welfare by providing guaranteed minimum income through tax code adjustments to reduce poverty and bureaucratic complexity.

Defining Traditional Welfare Systems

Traditional welfare systems consist of government-funded programs designed to provide financial assistance, healthcare, food, and housing support to low-income individuals and families. These programs often include Temporary Assistance for Needy Families (TANF), Supplemental Nutrition Assistance Program (SNAP), Medicaid, and housing vouchers, each targeting specific social needs through eligibility requirements and benefit caps. The primary goal is to alleviate poverty and improve living standards by offering direct support, though these programs can sometimes create work disincentives and administrative complexities.

Understanding Negative Income Tax (NIT)

Negative Income Tax (NIT) provides a guaranteed minimum income by directly supplementing earnings for individuals below a certain income threshold, in contrast to Traditional Welfare Programs which often involve multiple conditional benefits and bureaucratic oversight. NIT simplifies welfare distribution by replacing various targeted assistance programs with a single, automatic payment based on income level, reducing administrative costs and work disincentives commonly associated with conventional welfare. Economic studies indicate that NIT can enhance labor market participation and reduce poverty more efficiently by ensuring a predictable income floor without the complexity of eligibility requirements found in traditional welfare systems.

Eligibility Criteria and Distribution Mechanisms

Traditional welfare programs require applicants to meet strict eligibility criteria such as income thresholds, family size, and employment status, often involving extensive documentation and periodic reviews. These programs distribute benefits through in-kind services, vouchers, or direct cash transfers targeted at specific needs like housing, healthcare, or food assistance. In contrast, negative income tax systems use a simplified eligibility process based solely on income levels beneath a defined threshold, providing direct cash payments that increase as income decreases, ensuring efficient, automatic distribution without extensive administrative oversight.

Economic Efficiency: Comparative Analysis

Traditional welfare programs often suffer from high administrative costs and create disincentives to work due to benefit cliffs, reducing economic efficiency by discouraging labor force participation. Negative income tax (NIT) systems streamline benefits through direct cash transfers that gradually phase out as income rises, minimizing marginal tax rate distortions and encouraging continuous employment. Comparative studies show NIT can enhance economic efficiency by lowering government spending on overhead and maintaining stronger workforce incentives compared to conventional welfare approaches.

Social Impacts and Poverty Reduction Outcomes

Traditional welfare programs provide direct financial assistance and social services targeting low-income populations, often creating dependency and administrative inefficiencies that can limit long-term poverty alleviation. Negative income tax schemes offer a guaranteed minimum income by supplementing earnings below a certain threshold, which streamlines benefits distribution and incentivizes employment while reducing poverty more effectively. Studies demonstrate that negative income tax models lead to improved social mobility and lower poverty rates by encouraging workforce participation and reducing the stigma associated with welfare.

Administrative Complexity and Costs

Traditional welfare programs often involve extensive bureaucratic procedures, leading to high administrative complexity and costs due to multiple overlapping eligibility criteria and benefit structures. Negative income tax systems simplify administration by providing direct cash transfers based on income thresholds, reducing the need for detailed eligibility assessments and frequent monitoring. This streamlined approach results in lower administrative expenditures while maintaining targeted support for low-income individuals.

Addressing Work Incentives and Labor Market Effects

Traditional welfare programs often reduce work incentives by imposing high effective marginal tax rates through benefit phase-outs, discouraging labor force participation and limiting earnings growth. Negative income tax (NIT) systems provide a guaranteed minimum income while gradually reducing benefits as earnings rise, maintaining stronger work incentives by allowing recipients to keep a larger portion of additional income. Empirical studies suggest that NIT models can lead to higher labor supply compared to conventional welfare, as their design minimizes disincentives and promotes gradual income supplementation.

Future Prospects for Welfare Reform

Traditional welfare programs face challenges such as administrative complexity and disincentives to work, prompting interest in the Negative Income Tax (NIT) as a streamlined alternative that guarantees a minimum income while encouraging employment. Future welfare reform may integrate NIT models with advancements in technology to improve targeting efficiency and reduce fraud, enhancing overall program sustainability. Policymakers are increasingly considering hybrid approaches that combine traditional support mechanisms with NIT principles to address evolving economic inequalities and labor market shifts.

Traditional Welfare Programs Infographic

libterm.com

libterm.com