A soft budget constraint occurs when an organization or government receives financial support that exceeds its revenue, leading to less pressure to operate efficiently. This phenomenon often results in persistent inefficiencies and dependency on external bailout funds. Discover how understanding soft budget constraints can improve Your approach to managing resources effectively in this detailed article.

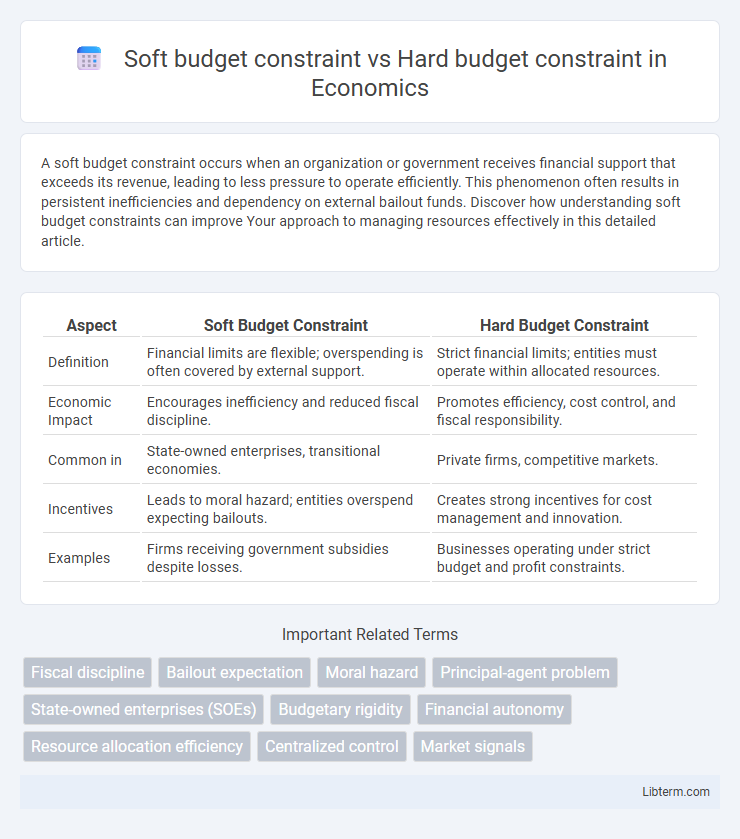

Table of Comparison

| Aspect | Soft Budget Constraint | Hard Budget Constraint |

|---|---|---|

| Definition | Financial limits are flexible; overspending is often covered by external support. | Strict financial limits; entities must operate within allocated resources. |

| Economic Impact | Encourages inefficiency and reduced fiscal discipline. | Promotes efficiency, cost control, and fiscal responsibility. |

| Common in | State-owned enterprises, transitional economies. | Private firms, competitive markets. |

| Incentives | Leads to moral hazard; entities overspend expecting bailouts. | Creates strong incentives for cost management and innovation. |

| Examples | Firms receiving government subsidies despite losses. | Businesses operating under strict budget and profit constraints. |

Understanding Soft vs Hard Budget Constraints

Soft budget constraints occur when organizations, often state-owned enterprises, receive continuous external financial support despite inefficiencies, leading to reduced incentives for cost control and productivity improvement. Hard budget constraints force firms to operate within strict financial limits, promoting efficient resource allocation, competitive behavior, and financial discipline. Understanding the distinction between these constraints is crucial for policymakers aiming to design effective economic reforms and improve institutional performance.

Historical Evolution of Budget Constraints

The historical evolution of budget constraints reveals a shift from hard budget constraints, characterized by strict financial discipline and limited external bailouts, to soft budget constraints, which emerged prominently in socialist economies during the 20th century where enterprises relied on state support despite losses. This transition highlights the challenges faced by centrally planned economies, as soft budget constraints led to inefficiencies and moral hazard, influencing economic reforms aimed at introducing market mechanisms and hardening budget constraints. Understanding this evolution is crucial for analyzing fiscal policies and enterprise behavior in different economic systems.

Key Features of Soft Budget Constraints

Soft budget constraints occur when organizations or entities expect financial support or bailouts despite budget overruns, reducing the incentive for cost control and efficiency. Key features include reliance on external subsidies, lack of financial discipline, and persistent deficits due to anticipated rescues. This often leads to inefficient resource allocation and chronic financial imbalance in enterprises or governmental units.

Defining Characteristics of Hard Budget Constraints

Hard budget constraints are defined by strict financial limits that require organizations or individuals to operate within available resources without external bailouts. These constraints enforce accountability by ensuring expenditures do not exceed income or allocated funds, fostering efficient resource management and fiscal discipline. Unlike soft budget constraints, hard budget constraints prevent reliance on external support when financial shortfalls occur, promoting sustainability and self-reliance in economic decision-making.

Economic Implications of Soft Budget Constraints

Soft budget constraints lead to inefficiencies by encouraging firms or organizations to overspend, expecting financial bailouts from external sources such as governments or parent companies. This behavior distorts resource allocation, reduces incentives for cost control and innovation, and often results in persistent deficits or financial instability. Economic implications include increased fiscal burdens on public budgets, distorted market competition, and weakened overall economic productivity.

Role in Public and Private Sector Organizations

Soft budget constraints frequently characterize public sector organizations, where funding often exceeds initial limits due to political and social objectives, reducing financial discipline and efficiency. Hard budget constraints dominate private sector firms, enforcing strict financial limits that enhance resource allocation, cost control, and profitability. This distinction shapes operational behavior, with public entities relying on external bailouts while private firms prioritize sustainable financial management.

Consequences for Financial Discipline

Soft budget constraints often lead to inefficient resource allocation and reduced financial discipline due to the expectation of external bailouts or financial support, encouraging overspending and lack of accountability. Hard budget constraints enforce strict financial discipline by requiring entities to operate within their means, promoting cost control, efficiency, and sustainable financial management. Organizations facing hard budget constraints tend to have stronger incentives for innovation and performance improvement to maintain solvency without external assistance.

Case Studies: Examples from Different Economies

Soft budget constraints often appear in state-owned enterprises in socialist economies, such as China's SOEs, where government bailouts reduce financial discipline and lead to inefficiency. In contrast, hard budget constraints characterize market economies like the United States, where bankruptcy laws enforce strict financial accountability, exemplified by the automotive industry's restructuring during the 2008 financial crisis. Case studies reveal that economies with hard budget constraints typically foster competitive markets and sustainable growth, while soft constraints may perpetuate resource misallocation and fiscal deficits.

Policy Measures to Enforce Hard Budget Constraints

Policy measures to enforce hard budget constraints include strict financial auditing, performance-based funding, and legal repercussions for overspending. Governments and organizations implement transparent accounting systems and impose penalties or sanctions to ensure compliance with budget limits. Encouraging market discipline through competitive pressures also helps in reducing the soft budget constraint problem by promoting fiscal responsibility.

Balancing Flexibility and Fiscal Responsibility

Soft budget constraints allow organizations or governments greater flexibility to manage finances by permitting overspending and external bailouts, which can encourage innovation but risk fiscal irresponsibility. Hard budget constraints enforce strict expenditure limits without external financial support, ensuring discipline and sustainability but potentially stifling adaptive responses to unforeseen challenges. Balancing flexibility and fiscal responsibility requires calibrating budget policies to foster efficient resource allocation while maintaining accountability and minimizing moral hazard.

Soft budget constraint Infographic

libterm.com

libterm.com