Total liabilities represent the sum of all financial obligations a company owes to external parties, including loans, accounts payable, and other debts. Accurately understanding total liabilities is crucial for assessing a company's financial health and risk level. Explore the rest of the article to learn how managing total liabilities impacts your business success.

Table of Comparison

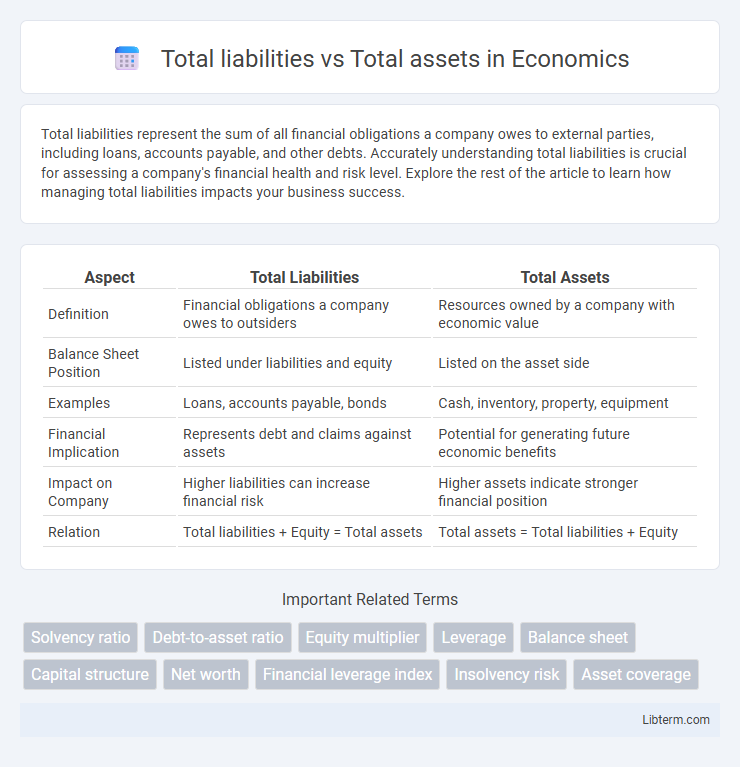

| Aspect | Total Liabilities | Total Assets |

|---|---|---|

| Definition | Financial obligations a company owes to outsiders | Resources owned by a company with economic value |

| Balance Sheet Position | Listed under liabilities and equity | Listed on the asset side |

| Examples | Loans, accounts payable, bonds | Cash, inventory, property, equipment |

| Financial Implication | Represents debt and claims against assets | Potential for generating future economic benefits |

| Impact on Company | Higher liabilities can increase financial risk | Higher assets indicate stronger financial position |

| Relation | Total liabilities + Equity = Total assets | Total assets = Total liabilities + Equity |

Understanding Total Liabilities

Total liabilities represent all financial obligations a company owes to external parties, including loans, accounts payable, and accrued expenses. Understanding total liabilities is crucial for assessing a company's financial health, as it indicates the extent of debt that must be managed or repaid. Comparing total liabilities to total assets reveals the company's leverage and solvency, with a lower ratio suggesting a stronger balance sheet and greater financial stability.

Defining Total Assets

Total assets represent the complete value of everything a company owns, including cash, inventory, property, and accounts receivable. These assets are categorized as current assets, fixed assets, and intangible assets, reflecting the company's financial strength and operational capacity. Understanding total assets is essential for evaluating a firm's ability to cover its total liabilities and maintain financial stability.

Key Differences Between Total Liabilities and Total Assets

Total liabilities represent the company's financial obligations and debts owed to external parties, while total assets encompass everything of value owned by the company, including cash, inventory, property, and receivables. A key difference lies in the balance sheet equation: Total Assets = Total Liabilities + Shareholders' Equity, highlighting that assets are financed through liabilities and equity. Understanding this distinction is crucial for assessing a company's financial health, liquidity, and solvency.

The Role of Liabilities in Business Finance

Total liabilities represent a company's financial obligations owed to external parties, including loans, accounts payable, and other debts, while total assets encompass resources owned such as cash, inventory, and property. Liabilities play a crucial role in business finance by enabling companies to leverage borrowed funds for growth opportunities, operational expenses, and capital investments without diluting ownership. Effective management of liabilities impacts a firm's liquidity, solvency, and overall financial stability, directly influencing creditworthiness and long-term profitability.

The Importance of Assets in Financial Health

Total assets represent the economic resources owned by a company, serving as a foundation for generating revenue and supporting operations, while total liabilities reflect the company's financial obligations. A higher asset base compared to liabilities indicates stronger financial health, as it signifies the company's capacity to cover debts and invest in growth opportunities. Maintaining a balanced ratio between total liabilities and total assets is crucial for stability, creditworthiness, and long-term sustainability.

Calculating Total Liabilities and Total Assets

Calculating total liabilities involves summing all financial obligations such as short-term debt, long-term debt, accounts payable, and other accrued expenses recorded on the balance sheet. Total assets calculation includes adding current assets like cash, inventory, and receivables to long-term assets such as property, plant, equipment, and intangible assets. Accurate measurement of total liabilities and total assets is essential for determining company solvency, financial health, and preparing the balance sheet equation where assets equal liabilities plus equity.

Liabilities-to-Assets Ratio Explained

The Liabilities-to-Assets Ratio measures the proportion of a company's total liabilities to its total assets, indicating financial leverage and risk level. A higher ratio suggests greater reliance on debt financing, potentially increasing insolvency risks, while a lower ratio signifies more asset backing and financial stability. Investors and creditors use this ratio to assess a firm's ability to cover obligations and maintain long-term solvency.

Impact on Balance Sheet and Financial Statements

Total liabilities represent obligations a company must settle, directly reducing net equity on the balance sheet, while total assets indicate economic resources owned. A higher ratio of total liabilities to total assets signals increased financial leverage and potential solvency risk, impacting investor perception and credit ratings. Accurate reporting of both ensures transparent financial statements, crucial for assessing liquidity, operational efficiency, and overall financial health.

Strategies for Managing Liabilities vs. Assets

Effective strategies for managing total liabilities versus total assets involve maintaining a balanced debt-to-asset ratio to ensure financial stability and optimize leverage. Companies should prioritize reducing high-interest liabilities while strategically investing in assets that generate consistent cash flows and appreciate over time. Regularly analyzing asset performance against outstanding liabilities enables informed decisions to improve liquidity and enhance overall financial health.

Total Liabilities vs Total Assets: Implications for Investors

Total liabilities compared to total assets reveal a company's financial leverage and risk level, with a higher liabilities-to-assets ratio indicating greater financial obligations and potential solvency issues. Investors analyze this ratio to assess credit risk, liquidity, and the company's ability to meet long-term debt, impacting investment decisions and valuation. A balanced or low liability-to-asset ratio typically signals financial stability and attracts investor confidence by demonstrating prudent management and reduced default risk.

Total liabilities Infographic

libterm.com

libterm.com