The equity tranche represents the highest-risk portion of a structured finance deal, absorbing the first losses before other tranches incur any damage. It offers potentially higher returns to investors who are willing to take on this elevated risk. Explore the article to understand how the equity tranche influences overall portfolio performance and risk management.

Table of Comparison

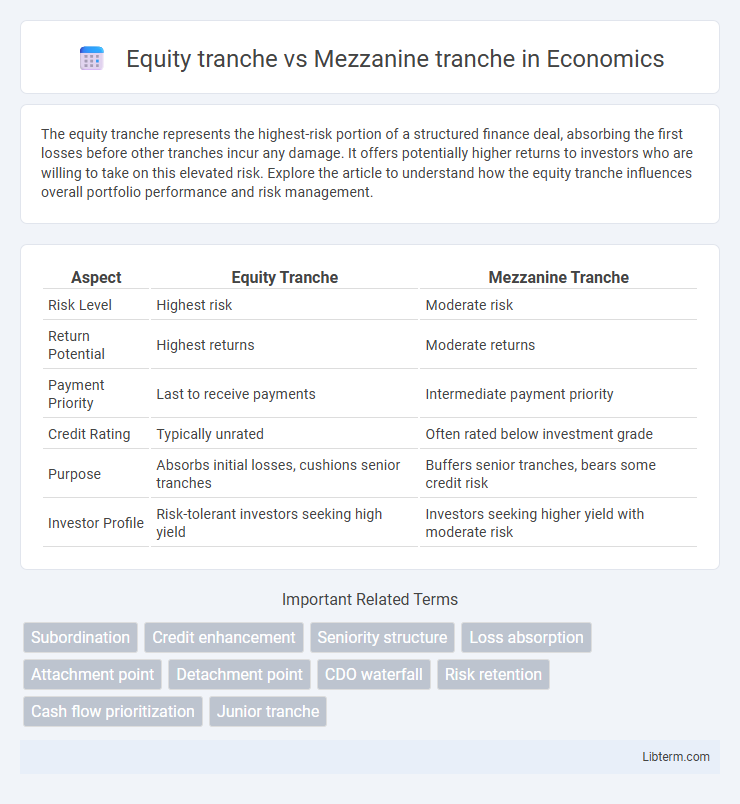

| Aspect | Equity Tranche | Mezzanine Tranche |

|---|---|---|

| Risk Level | Highest risk | Moderate risk |

| Return Potential | Highest returns | Moderate returns |

| Payment Priority | Last to receive payments | Intermediate payment priority |

| Credit Rating | Typically unrated | Often rated below investment grade |

| Purpose | Absorbs initial losses, cushions senior tranches | Buffers senior tranches, bears some credit risk |

| Investor Profile | Risk-tolerant investors seeking high yield | Investors seeking higher yield with moderate risk |

Introduction to Credit Tranches

Equity tranche represents the highest risk and highest potential return segment in a structured finance deal, absorbing the first losses and providing a buffer for senior tranches. Mezzanine tranche sits below the senior tranches but above the equity tranche, balancing moderate risk and yield by absorbing losses after the equity tranche is exhausted. Credit tranches categorize debt in securitized products based on risk, priority of payment, and exposure to default, facilitating tailored investment strategies and risk management.

What is an Equity Tranche?

An Equity Tranche represents the riskiest layer in a structured finance deal, absorbing first losses and offering the highest potential returns. It holds the lowest credit rating or often remains unrated due to its subordinated position relative to mezzanine and senior tranches. Investors in the Equity Tranche benefit from residual cash flows after all higher-priority tranches, such as Mezzanine Tranches, are paid, making it crucial for risk-tolerant portfolios seeking enhanced yield.

What is a Mezzanine Tranche?

A mezzanine tranche is a mid-level investment layer in structured finance, positioned between the equity tranche and senior debt, carrying moderate risk and return profiles. It absorbs losses after the equity tranche but before senior tranches, providing higher yields compared to senior debt due to increased credit risk. Mezzanine tranches typically appeal to investors seeking a balance between risk and reward within collateralized debt obligations (CDOs) or mortgage-backed securities (MBS).

Key Differences Between Equity and Mezzanine Tranches

Equity tranche represents the highest-risk, highest-reward segment of a structured finance deal, absorbing initial losses before mezzanine and senior tranches incur losses. Mezzanine tranche carries moderate risk and offers fixed income returns with priority over the equity tranche but subordinate to senior debt, bridging the gap between high-risk equity and lower-risk senior tranches. Key differences include risk exposure, payment priority, and return profiles, with equity tranches having residual claims and potential for higher returns, while mezzanine tranches provide more predictable income with moderate credit risk.

Risk and Return Profile Comparison

The equity tranche carries the highest risk and offers the potential for the highest returns due to its position as the first to absorb losses in a securitization structure. The mezzanine tranche presents moderate risk and return, subordinated to senior tranches but senior to the equity tranche, providing balance between protection and yield. Investors typically demand higher yields on equity tranches for increased risk, while mezzanine tranches offer a middle ground with elevated but less volatile returns.

Role in Structured Finance and Securitization

The equity tranche in structured finance absorbs the highest risk and serves as the first-loss buffer, absorbing initial defaults and protecting senior tranches. The mezzanine tranche carries moderate risk and provides a cushion between the equity and senior tranches, often offering higher yields to compensate for increased risk exposure. Both tranches play critical roles in credit enhancement and risk distribution within securitized products such as collateralized debt obligations (CDOs) and mortgage-backed securities (MBS).

Investor Suitability and Participation

Equity tranches attract high-risk-tolerant investors seeking maximum returns through first-loss exposure in structured finance deals, often participating actively in monitoring asset performance. Mezzanine tranches appeal to moderate risk investors aiming for higher yields than senior debt, with subordinated but more secured claims than equity, ensuring a balance between risk and steady income. Both tranches differ significantly in risk profile and expected recovery, shaping their suitability for distinct investor strategies within collateralized debt obligations (CDOs) or mortgage-backed securities (MBS).

Performance in Market Downturns

Equity tranches typically absorb the first losses in structured finance deals, resulting in higher volatility and poor performance during market downturns. Mezzanine tranches, positioned between equity and senior tranches, offer moderate risk with more stable returns, as they have some protection against initial losses but still face significant credit risk. In stressed market conditions, mezzanine tranches outperform equity tranches by preserving more principal while providing higher yields compared to senior tranches.

Real-World Examples and Case Studies

Equity tranches in structured finance absorb the first losses, reflecting the highest risk and yielding the highest returns, as seen in the 2008 Bear Stearns ABS deals where equity investors faced substantial losses. Mezzanine tranches, positioned between equity and senior tranches, provide moderate risk and return, exemplified by Lehman Brothers' mortgage-backed securities, where mezzanine investors incurred significant but not total losses during the financial crisis. Case studies from real estate CMBS transactions illustrate mezzanine tranches stabilizing returns through partial credit support, while equity tranches remain highly sensitive to property devaluation.

Conclusion: Choosing Between Equity and Mezzanine Tranches

Equity tranches offer higher risk and potential for greater returns but lack guaranteed principal repayment, making them suitable for investors with strong risk tolerance seeking maximum upside. Mezzanine tranches provide moderate risk with priority over equity in payment waterfalls and typically offer fixed interest payments, appealing to investors desiring a balance between risk and steady income. Selecting between equity and mezzanine tranches depends on the investor's risk appetite, return expectations, and cash flow requirements within structured finance transactions.

Equity tranche Infographic

libterm.com

libterm.com