A Pigovian tax is designed to correct negative externalities by imposing a cost on activities that generate social harm, such as pollution. This economic tool incentivizes producers and consumers to reduce harmful behaviors, aligning private costs with societal costs and promoting sustainable practices. Discover how implementing a Pigovian tax can make a difference in economic policy and environmental protection by reading the full article.

Table of Comparison

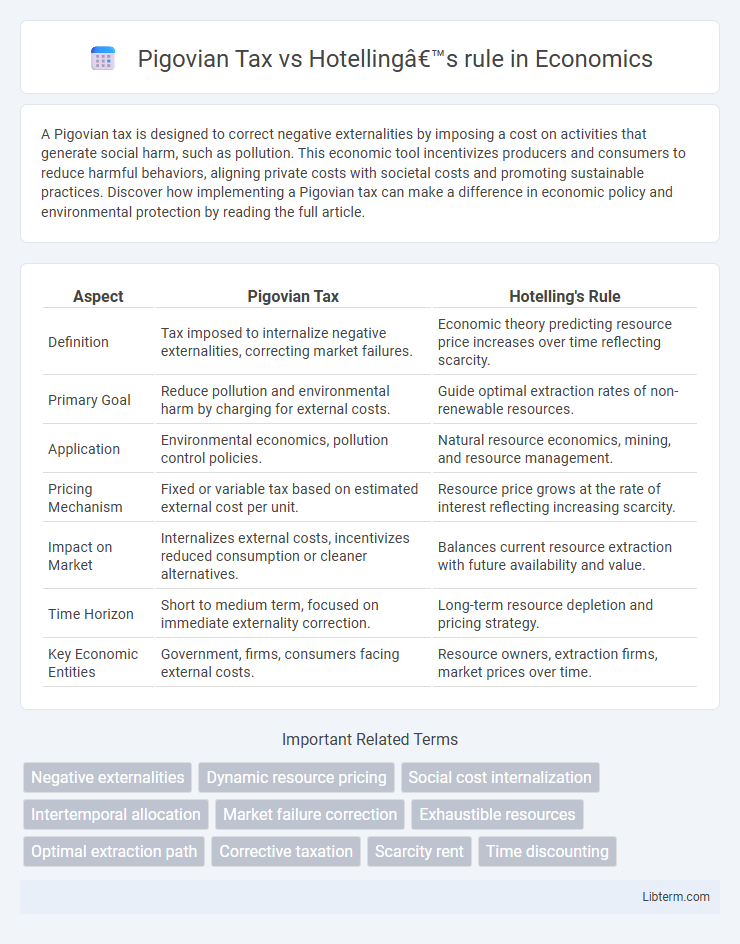

| Aspect | Pigovian Tax | Hotelling's Rule |

|---|---|---|

| Definition | Tax imposed to internalize negative externalities, correcting market failures. | Economic theory predicting resource price increases over time reflecting scarcity. |

| Primary Goal | Reduce pollution and environmental harm by charging for external costs. | Guide optimal extraction rates of non-renewable resources. |

| Application | Environmental economics, pollution control policies. | Natural resource economics, mining, and resource management. |

| Pricing Mechanism | Fixed or variable tax based on estimated external cost per unit. | Resource price grows at the rate of interest reflecting increasing scarcity. |

| Impact on Market | Internalizes external costs, incentivizes reduced consumption or cleaner alternatives. | Balances current resource extraction with future availability and value. |

| Time Horizon | Short to medium term, focused on immediate externality correction. | Long-term resource depletion and pricing strategy. |

| Key Economic Entities | Government, firms, consumers facing external costs. | Resource owners, extraction firms, market prices over time. |

Introduction to Pigovian Tax and Hotelling’s Rule

Pigovian Tax is an economic tool designed to correct negative externalities by imposing a tax equal to the marginal social cost of an activity, incentivizing producers to reduce harmful effects such as pollution. Hotelling's Rule governs the optimal extraction rate of non-renewable resources, stating that resource owners should increase prices at the rate of interest over time to maximize profit from finite reserves. Both concepts address resource management and environmental economics but focus on different mechanisms for achieving economic efficiency and sustainability.

Defining Pigovian Taxes: Purpose and Mechanism

Pigovian taxes are designed to correct negative externalities by imposing a cost equal to the external damage caused by an economic activity, effectively internalizing social costs. The mechanism involves levying taxes on activities like pollution to incentivize producers or consumers to reduce harmful behaviors and allocate resources more efficiently. This contrasts with Hotelling's rule, which addresses the optimal depletion rate of non-renewable resources based on their scarcity and price trajectory.

Explaining Hotelling’s Rule: Resource Extraction Economics

Hotelling's Rule explains the economics of non-renewable resource extraction by stating that the net price of a resource should increase at the rate of interest over time to maximize the resource owner's profit. This implies that resource owners balance current extraction against future scarcity, ensuring optimal depletion paths that reflect scarcity rent growth. The rule provides a framework for valuing exhaustible resources by considering extraction costs, market demand, and the opportunity cost of leaving resources in the ground.

Key Economic Principles Behind Both Approaches

Pigovian Tax targets externalities by levying a tax equivalent to the social cost of pollution, incentivizing producers to reduce harmful emissions and internalize environmental costs. Hotelling's rule governs non-renewable resource extraction, dictating that resource owners maximize value by setting extraction rates based on the resource's scarcity and the interest rate over time. Both approaches rely on economic principles of optimizing social welfare: Pigovian Tax aligns private costs with social costs, while Hotelling's rule balances intertemporal resource allocation to prevent premature depletion.

Environmental Impact: Pigovian Tax vs. Hotelling’s Rule

Pigovian tax directly internalizes the environmental externality by imposing a cost equivalent to the damage caused, incentivizing firms and consumers to reduce pollution and resource depletion. Hotelling's rule focuses on the optimal extraction rate of non-renewable resources by balancing current extraction benefits against future scarcity value, indirectly influencing environmental impact through resource conservation. Whereas Pigovian tax actively reduces harmful emissions and pollution by targeting external costs, Hotelling's rule primarily guides resource depletion timing to maximize economic value without explicitly accounting for environmental damages.

Market Incentives and Behavioral Responses

Pigovian tax imposes a cost on negative externalities, aligning private incentives with social costs to reduce harmful behavior through market-based price signals. Hotelling's rule governs non-renewable resource extraction by assuming rational agents maximize discounted profits, creating intertemporal incentives that influence resource depletion rates based on scarcity and interest rates. Behavioral responses differ as Pigovian taxes directly alter consumption and production decisions, while Hotelling's rule shapes extraction timing, both leveraging economic incentives to achieve efficient resource allocation.

Case Studies: Pigovian Taxes in Practice

Pigovian taxes have been effectively implemented in various countries to address negative externalities such as pollution, exemplified by Sweden's carbon tax which has significantly reduced greenhouse gas emissions since its introduction in 1991. In contrast, Hotelling's rule, a theoretical framework for non-renewable resource extraction, is less directly observed in policy but influences resource management strategies by predicting price and extraction rate trajectories over time. The practical application of Pigovian taxes demonstrates tangible environmental and economic benefits by internalizing external costs, whereas Hotelling's rule primarily guides long-term resource valuation and depletion considerations.

Case Studies: Applying Hotelling’s Rule

Case studies applying Hotelling's Rule demonstrate its effectiveness in managing non-renewable resource extraction by predicting optimal depletion paths based on resource scarcity and price dynamics. Unlike Pigovian taxes that directly impose externality costs to correct market failures, Hotelling's Rule emphasizes time-consistent pricing strategies to maximize economic rents over the resource lifespan. Empirical evidence from oil and mineral markets reveals how Hotelling's Rule guides extraction rates and informs reserves management, ensuring sustainable resource use aligned with market scarcity signals.

Comparative Effectiveness: Addressing Market Failures

Pigovian tax effectively corrects externalities by imposing a cost equal to the social damage of pollution, incentivizing producers to reduce harmful emissions and improve resource allocation. Hotelling's rule guides optimal extraction of non-renewable resources by balancing present and future scarcity values, preventing over-exploitation and ensuring sustainable depletion rates. Comparative effectiveness depends on the market failure type; Pigovian taxes address external costs in pollution markets, while Hotelling's rule manages intertemporal allocation of finite resources, both enhancing economic efficiency through targeted incentives.

Policy Implications and Future Directions

Pigovian tax effectively internalizes external environmental costs, incentivizing reduced pollution and resource overuse, while Hotelling's rule guides optimal non-renewable resource depletion by balancing extraction rates with future value appreciation. Policy implications of Pigovian taxes emphasize correcting market failures and promoting sustainable consumption through targeted fiscal measures, whereas Hotelling's rule informs regulatory frameworks on resource conservation and economic rent maximization over time. Future directions involve integrating dynamic models combining both approaches to enhance environmental taxation policies, aligning resource management with climate goals and technological advancements in renewable alternatives.

Pigovian Tax Infographic

libterm.com

libterm.com