The political business cycle refers to the phenomenon where government policies are influenced by election timing, leading to short-term economic fluctuations aimed at boosting voter support. These policy manipulations often result in inflation, altered interest rates, and economic instability around election periods. Explore how these cycles impact your economy and political landscape in the rest of this article.

Table of Comparison

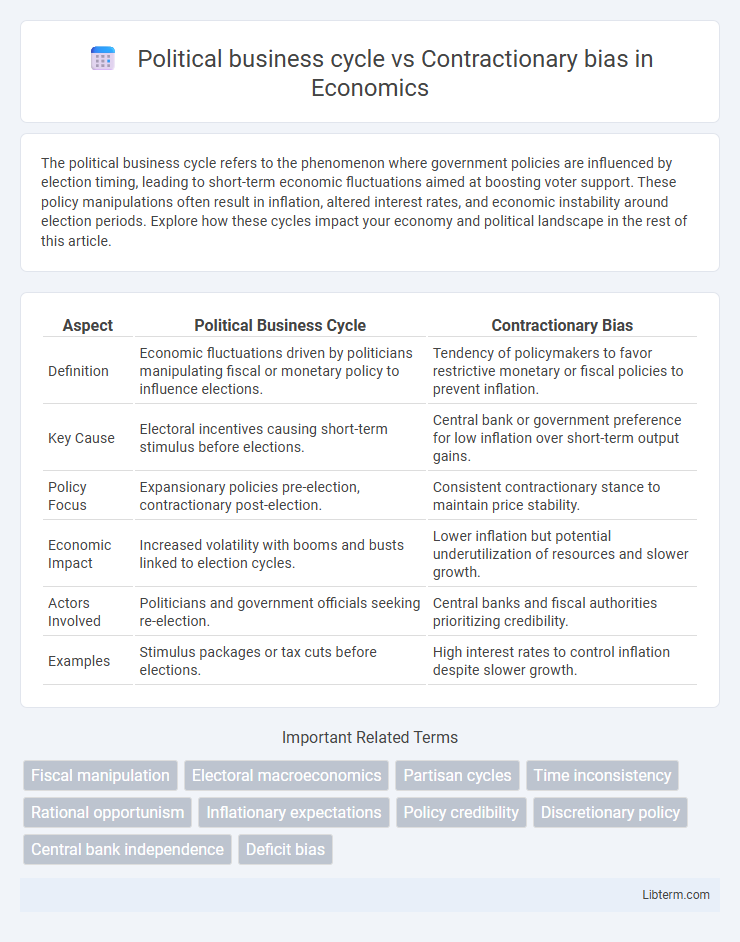

| Aspect | Political Business Cycle | Contractionary Bias |

|---|---|---|

| Definition | Economic fluctuations driven by politicians manipulating fiscal or monetary policy to influence elections. | Tendency of policymakers to favor restrictive monetary or fiscal policies to prevent inflation. |

| Key Cause | Electoral incentives causing short-term stimulus before elections. | Central bank or government preference for low inflation over short-term output gains. |

| Policy Focus | Expansionary policies pre-election, contractionary post-election. | Consistent contractionary stance to maintain price stability. |

| Economic Impact | Increased volatility with booms and busts linked to election cycles. | Lower inflation but potential underutilization of resources and slower growth. |

| Actors Involved | Politicians and government officials seeking re-election. | Central banks and fiscal authorities prioritizing credibility. |

| Examples | Stimulus packages or tax cuts before elections. | High interest rates to control inflation despite slower growth. |

Introduction: Defining Political Business Cycle and Contractionary Bias

Political business cycle refers to economic fluctuations driven by politicians manipulating fiscal or monetary policies to influence election outcomes, often leading to short-term growth followed by downturns. Contractionary bias describes central banks' tendency to pursue tighter monetary policies to prevent inflation, sometimes at the cost of higher unemployment or slower growth. Both concepts highlight the complex interaction between political motives and economic policy decisions.

Historical Evolution of Political Business Cycles

The historical evolution of political business cycles reveals patterns where incumbent politicians manipulate fiscal and monetary policies to stimulate the economy before elections, aiming to increase their chances of reelection. Early models by economists such as William Nordhaus in the 1970s highlighted how election timing influences macroeconomic policy adjustments, creating systematic cyclical fluctuations in output and inflation. Over time, the literature expanded to contrast these cycles with contractionary bias theories, which suggest policymakers may favor restrictive policies to maintain credibility and control inflation, often at the expense of short-term economic growth.

Theoretical Foundations of Contractionary Bias

Contractionary bias arises when policymakers prioritize low inflation over output stabilization, influenced by time-inconsistent preferences and the desire to maintain credibility in monetary policy. Unlike the political business cycle, which amplifies economic fluctuations through opportunistic policy manipulation during election periods, contractionary bias reflects a systematic preference for restrictive policies to anchor inflation expectations. Theoretical foundations emphasize the role of central bank independence and reputation mechanisms in sustaining commitment to tight monetary policy despite potential output costs.

Key Differences between Political Business Cycle and Contractionary Bias

Political business cycle refers to the manipulation of fiscal or monetary policy by politicians to influence election outcomes, often leading to short-term economic booms followed by downturns. Contractionary bias occurs when policymakers, particularly central banks, favor tightening monetary policy to control inflation, which can delay economic recovery and growth. The key difference lies in motivation and outcome: political business cycles are driven by electoral incentives causing fluctuating economic policies, whereas contractionary bias reflects a preference for inflation control, resulting in consistently tighter monetary measures.

Political Influence on Macroeconomic Policy Decisions

Political business cycles occur when policymakers manipulate fiscal or monetary policies to influence election outcomes, often leading to short-term economic expansions followed by contractions. Contractionary bias arises when governments prioritize inflation control over growth, often due to political pressures from conservative institutions or anti-inflation mandates. Political influence on macroeconomic policy decisions shapes the timing and intensity of stimulus or austerity measures, affecting economic stability and long-term growth trajectories.

Central Bank Independence and Its Role

Central Bank Independence (CBI) serves as a critical safeguard against the Political Business Cycle by insulating monetary policy from short-term political pressures that often lead to cyclic economic fluctuations. CBI reduces the risk of Contractionary Bias, which occurs when central banks deliberately tighten policies to maintain long-term price stability, by balancing the need for credible inflation control with economic growth considerations. Empirical studies demonstrate that countries with higher levels of CBI experience more stable inflation rates and reduced political manipulation of monetary policy, thereby enhancing overall macroeconomic stability.

Economic Outcomes: Inflation and Unemployment Perspectives

Political business cycles often trigger short-term increases in inflation as governments implement expansionary policies to boost employment before elections, resulting in higher inflation expectations and wage demands. Contractionary bias, characterized by policymakers prioritizing inflation control over output stabilization, typically leads to lower inflation but persistent unemployment due to restrictive monetary policies. These contrasting approaches influence economic outcomes distinctly: political cycles increase inflation volatility and reduce unemployment temporarily, while contractionary bias stabilizes inflation at the cost of higher and prolonged unemployment rates.

Policy Implications for Fiscal and Monetary Management

Political business cycles often lead to short-term fiscal expansions and monetary easing before elections, causing macroeconomic volatility and inflationary pressures. Contractionary bias, characterized by persistent austerity and tight monetary policies, aims to ensure long-term fiscal discipline but risks slowing economic growth and increasing unemployment. Policymakers must balance these tendencies by implementing credible fiscal rules and independent monetary authorities to stabilize economic cycles while avoiding pro-cyclical policy extremes.

Case Studies: Real-World Examples of Both Phenomena

The 2008 U.S. presidential election highlighted the political business cycle as economic policies favored short-term growth to boost voter support before the polls, contrasting with Germany's persistent contractionary bias due to its strict fiscal rules aiming to reduce deficits despite economic slowdowns. In Brazil, repeated expansionary fiscal policies prior to elections demonstrate political business cycles, whereas Japan's longstanding deflation and conservative monetary approach exemplify contractionary bias driven by risk aversion and institutional constraints. These case studies reveal how different political and economic structures influence the prevalence of cyclical policy manipulations or prolonged austerity tendencies.

Conclusion: Balancing Political Incentives and Economic Stability

Political business cycles often reflect short-term electoral motivations that can destabilize economic policy, whereas contractionary bias prioritizes long-term inflation control, sometimes at the cost of higher unemployment. Effective economic governance requires balancing these political incentives with the need for macroeconomic stability to prevent volatility and maintain investor confidence. Achieving this balance involves designing institutional frameworks that limit opportunistic policymaking while supporting credible, rules-based fiscal and monetary strategies.

Political business cycle Infographic

libterm.com

libterm.com