Blue bonds are innovative financial instruments designed to fund projects that protect and sustainably manage ocean and water resources. These bonds support marine conservation, fisheries management, and climate resilience initiatives, driving positive environmental and economic outcomes. Discover how blue bonds can impact your investments and contribute to a healthier planet by reading the full article.

Table of Comparison

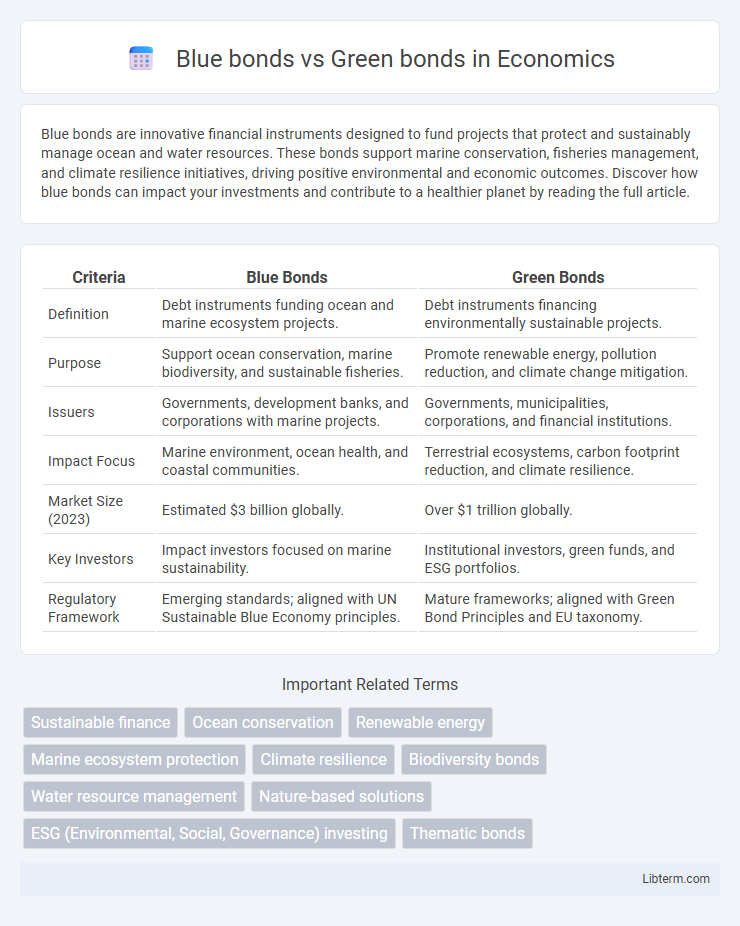

| Criteria | Blue Bonds | Green Bonds |

|---|---|---|

| Definition | Debt instruments funding ocean and marine ecosystem projects. | Debt instruments financing environmentally sustainable projects. |

| Purpose | Support ocean conservation, marine biodiversity, and sustainable fisheries. | Promote renewable energy, pollution reduction, and climate change mitigation. |

| Issuers | Governments, development banks, and corporations with marine projects. | Governments, municipalities, corporations, and financial institutions. |

| Impact Focus | Marine environment, ocean health, and coastal communities. | Terrestrial ecosystems, carbon footprint reduction, and climate resilience. |

| Market Size (2023) | Estimated $3 billion globally. | Over $1 trillion globally. |

| Key Investors | Impact investors focused on marine sustainability. | Institutional investors, green funds, and ESG portfolios. |

| Regulatory Framework | Emerging standards; aligned with UN Sustainable Blue Economy principles. | Mature frameworks; aligned with Green Bond Principles and EU taxonomy. |

Introduction to Blue Bonds and Green Bonds

Blue bonds finance marine and ocean-based projects aimed at sustainable water resource management, conservation, and climate resilience. Green bonds support environmentally friendly initiatives focused on renewable energy, pollution reduction, and ecosystem restoration. Both instruments attract investors committed to sustainable development but differ primarily in their environmental focus areas.

Defining Blue Bonds: Purpose and Scope

Blue bonds specifically target financing projects aimed at ocean and water resource sustainability, addressing marine conservation, fisheries management, and pollution reduction. Unlike green bonds, which broadly fund environmental initiatives including renewable energy and climate mitigation, blue bonds concentrate on preserving aquatic ecosystems and enhancing water security. Their scope includes protection of coastal habitats, restoration of marine biodiversity, and sustainable use of ocean resources to support economic development and climate resilience.

Understanding Green Bonds: Key Features

Green bonds are debt securities specifically issued to finance projects with positive environmental benefits, such as renewable energy, energy efficiency, and sustainable waste management. Their key features include transparency through rigorous reporting standards, third-party verification, and compliance with frameworks like the Green Bond Principles, ensuring funds are allocated to environmentally friendly initiatives. These bonds attract investors focused on sustainability and contribute significantly to global efforts in combating climate change by driving capital towards green infrastructure.

Environmental Impact: Blue Bonds vs Green Bonds

Blue bonds specifically fund projects aimed at preserving ocean health, such as marine conservation and sustainable fisheries, directly addressing marine environmental challenges. Green bonds support a broader range of environmental projects including renewable energy, pollution reduction, and climate change mitigation, impacting terrestrial and atmospheric ecosystems. The targeted environmental impact of blue bonds enhances marine biodiversity and resilience, while green bonds contribute to overall sustainability and carbon footprint reduction across multiple ecosystems.

Major Sectors Funded by Blue and Green Bonds

Blue bonds primarily finance marine conservation, sustainable fisheries, and ocean ecosystem restoration projects, addressing critical challenges such as coral reef degradation and overfishing. Green bonds focus largely on renewable energy, energy efficiency, sustainable agriculture, and clean transportation initiatives to combat climate change and reduce carbon emissions. Both types of bonds support infrastructure and resilience-building efforts, but blue bonds target ocean health while green bonds broadly advance environmental sustainability across terrestrial and atmospheric systems.

Issuers and Investors: Who Participates?

Blue bonds primarily attract issuers such as governments and corporations involved in ocean conservation and sustainable marine projects, while investors include impact-driven funds and development banks focusing on ocean health. Green bonds have a broader range of issuers, including municipalities, corporations, and financial institutions financing a wide array of environmental projects, with investors spanning ESG funds, pension funds, and private investors seeking climate-positive outcomes. Both bond types engage participants aligned with sustainability goals, but blue bonds target ocean-specific initiatives, narrowing their issuer and investor base compared to the more diverse green bond market.

Financial Performance and Risks Compared

Blue bonds typically finance ocean-related projects and show steady financial performance with moderate risk due to the niche environmental focus, whereas green bonds fund broader environmental initiatives covering energy, water, and climate, often offering higher diversification and slightly lower risk profiles. Studies indicate green bonds can deliver comparable or slightly improved yields relative to traditional bonds, while blue bonds may face sector-specific risks like regulatory changes in marine policies or climate impacts. Investors aiming for sustainable portfolios weigh the balanced risk-return characteristics of green bonds against the targeted ecological impact and specialized risk factors inherent in blue bonds.

Regulatory Frameworks and Standards

Blue bonds and green bonds operate under distinct regulatory frameworks tailored to their environmental objectives. Blue bonds focus on marine and water-related projects and often adhere to standards set by initiatives such as the Blue Bond Principles, while green bonds primarily target climate-friendly projects and follow guidelines like the Green Bond Principles established by ICMA. Regulatory bodies in various regions, including the EU's Sustainable Finance Disclosure Regulation (SFDR) for green bonds and emerging frameworks for blue bonds, ensure transparency and environmental impact reporting to attract sustainable investment.

Global Trends and Market Growth

Blue bonds, dedicated to marine and ocean conservation projects, have seen rapid growth as global awareness of oceanic environmental challenges rises. Green bonds, which fund broader environmental initiatives like renewable energy and climate change mitigation, dominate the sustainable finance market but face increasing competition from specialized instruments such as blue bonds. Market analysis shows a surge in blue bond issuances, particularly from countries with extensive coastlines and marine economies, reflecting growing investor interest in financing ocean sustainability alongside the broader green finance movement.

Future Outlook: Blue Bonds vs Green Bonds

The future outlook for blue bonds centers on financing ocean and marine conservation projects, addressing climate resilience and sustainable fisheries with rising investor interest in blue economy initiatives. Green bonds continue to dominate sustainable finance, funding renewable energy, clean transportation, and carbon reduction projects, backed by strong regulatory frameworks and growing corporate commitments to net-zero targets. Both bond types are poised for growth, with blue bonds expanding niche markets while green bonds lead broad decarbonization efforts worldwide.

Blue bonds Infographic

libterm.com

libterm.com