Austrian Economics emphasizes individual choice, spontaneous order, and the limits of central planning in markets. It argues that free markets and entrepreneurship drive innovation and economic growth without government interference. Discover how this school of thought challenges mainstream economics and its relevance to Your financial decisions by reading the full article.

Table of Comparison

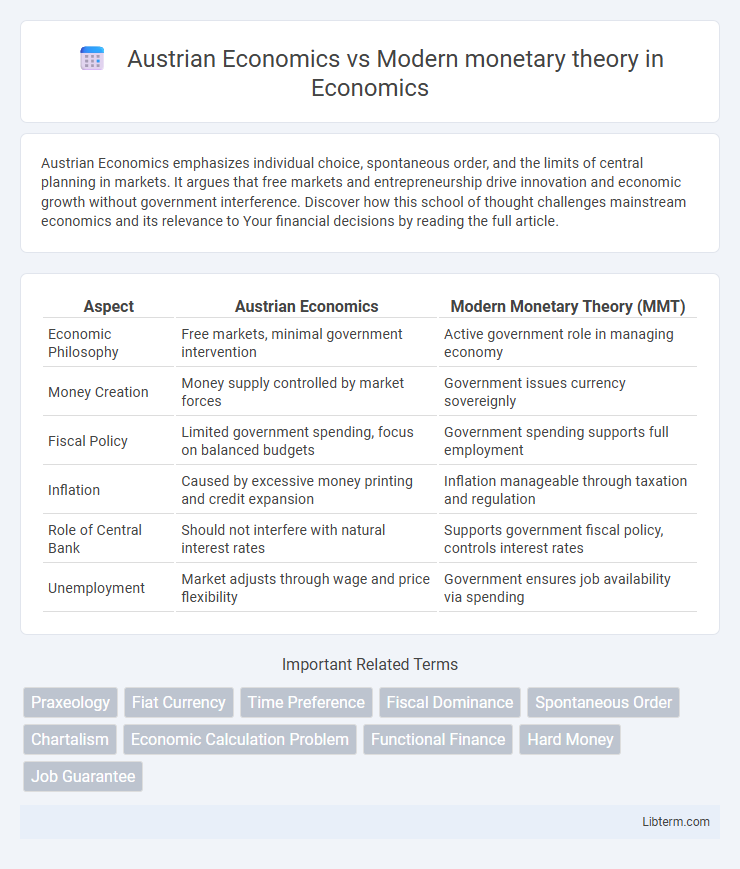

| Aspect | Austrian Economics | Modern Monetary Theory (MMT) |

|---|---|---|

| Economic Philosophy | Free markets, minimal government intervention | Active government role in managing economy |

| Money Creation | Money supply controlled by market forces | Government issues currency sovereignly |

| Fiscal Policy | Limited government spending, focus on balanced budgets | Government spending supports full employment |

| Inflation | Caused by excessive money printing and credit expansion | Inflation manageable through taxation and regulation |

| Role of Central Bank | Should not interfere with natural interest rates | Supports government fiscal policy, controls interest rates |

| Unemployment | Market adjusts through wage and price flexibility | Government ensures job availability via spending |

Introduction to Austrian Economics and Modern Monetary Theory

Austrian Economics emphasizes individual choice, limited government intervention, and the importance of spontaneous order in markets, rooted in the works of Ludwig von Mises and Friedrich Hayek. Modern Monetary Theory (MMT) centers on the role of sovereign currency issuers, asserting that governments with fiat currency can finance deficits without traditional constraints, as explained by economists like Stephanie Kelton and Warren Mosler. Both frameworks offer divergent views on fiscal policy, monetary sovereignty, and the dynamics of inflation and unemployment.

Core Principles of Austrian Economics

Austrian Economics centers on the principles of individual choice, spontaneous order, and the importance of market-driven price signals, emphasizing that economic value emerges from subjective preferences rather than objective measures. It advocates for minimal government intervention, stressing that free markets are self-regulating through entrepreneurs' discovery processes and time preferences of consumers. In contrast to Modern Monetary Theory, which supports active fiscal policy and government spending to manage economic cycles, Austrian Economics warns that artificial manipulation of money supply and interest rates leads to malinvestment and economic distortions.

Fundamental Concepts of Modern Monetary Theory

Modern Monetary Theory (MMT) fundamentally asserts that sovereign governments with fiat currencies can create money to finance public spending without the risk of default, as long as inflation remains controlled. It emphasizes functional finance, where government fiscal policy focuses on achieving full employment and price stability rather than balancing budgets. Unlike Austrian Economics, which warns against inflation and prioritizes limited government intervention, MMT advocates for active fiscal policy to manage economic demand and resource utilization.

Historical Backgrounds and Influential Thinkers

Austrian Economics, rooted in the late 19th century with key figures like Carl Menger and Ludwig von Mises, emphasizes individual choice, market processes, and the dangers of government intervention. Modern Monetary Theory (MMT), developed in the late 20th and early 21st centuries by economists such as Warren Mosler and Stephanie Kelton, focuses on sovereign currency issuance and fiscal policy as tools for managing economic stability and employment. The contrasting historical backgrounds reflect Austrian Economics' foundation in classical liberalism and MMT's evolution amid mainstream Keynesian debates on monetary sovereignty.

Views on Money Creation and Banking

Austrian Economics asserts that money creation should be tightly regulated, emphasizing the role of sound money and opposing central bank interventions that lead to artificial credit expansion and economic cycles. Modern Monetary Theory (MMT) supports sovereign currency issuers' ability to create money to finance government spending without relying on taxes or borrowing, viewing money creation as a tool to achieve full employment and economic stability. Regarding banking, Austrian Economics advocates for free banking and limited fractional reserve practices, whereas MMT considers banks as intermediaries influenced by central bank policies and government fiscal actions.

Approaches to Inflation and Price Stability

Austrian Economics views inflation as primarily caused by excessive money supply growth leading to malinvestment and economic distortions, emphasizing sound money and minimal government intervention to maintain price stability. Modern Monetary Theory (MMT) sees inflation as a risk mainly when aggregate demand outpaces productive capacity, advocating for strategic fiscal policy and government spending to manage inflation without strict reliance on monetary control. While Austrian economists prioritize limiting credit expansion to prevent price instability, MMT proponents focus on using taxation and public sector adjustments to regulate inflationary pressures.

Government Intervention: Contrasts and Critiques

Austrian Economics vehemently opposes government intervention, arguing it distorts market signals and leads to inefficient resource allocation, emphasizing that only free markets can achieve sustainable economic equilibrium. In contrast, Modern Monetary Theory (MMT) supports active government spending and fiscal intervention, positing that sovereign currency issuers can finance deficits without incurring insolvency, as long as inflation remains controlled. Critics of Austrian Economics cite its rejection of macroeconomic stabilization tools as overly rigid, while critics of MMT warn that excessive government intervention risks runaway inflation and undermines market discipline.

Business Cycles and Economic Fluctuations

Austrian Economics attributes business cycles to excessive credit expansion by central banks, causing artificial booms followed by inevitable busts and economic fluctuations. Modern Monetary Theory (MMT) argues that government fiscal policy can effectively manage economic fluctuations through strategic spending and taxation, minimizing recessions and promoting stable growth. Austrian economists emphasize market-driven corrections, while MMT advocates for active fiscal intervention to smooth out business cycles.

Policy Implications and Real-World Applications

Austrian Economics emphasizes limited government intervention, advocating for free markets and sound money to prevent inflation and ensure long-term economic stability. Modern Monetary Theory (MMT) supports expansive fiscal policy financed by sovereign currency issuance, prioritizing full employment and social investment without immediate concern for deficits. Policy implications highlight Austrian skepticism toward central banking and deficit spending, whereas MMT influences contemporary debates on government spending, social programs, and inflation management strategies.

Strengths, Weaknesses, and Ongoing Debates

Austrian Economics emphasizes individual choice, market self-regulation, and the dangers of government intervention, providing robust insights into economic cycles and the importance of sound money but is criticized for its lack of empirical testing and practical policy guidance. Modern Monetary Theory (MMT) highlights the sovereign capacity of governments to create currency, advocating for fiscal policies aimed at full employment and social investment, yet it faces skepticism regarding inflation risks and long-term debt sustainability. The ongoing debate centers on the balance between fiscal responsibility and economic flexibility, questioning whether monetary sovereignty or market discipline offers a more effective framework for stable, inclusive growth.

Austrian Economics Infographic

libterm.com

libterm.com