Time consistency ensures decisions remain optimal and reliable across different time periods, preventing conflicts between short-term and long-term objectives. It plays a crucial role in economics, finance, and policy-making where future commitments must align with present actions. Discover how achieving time consistency can enhance your strategic planning by exploring the full article.

Table of Comparison

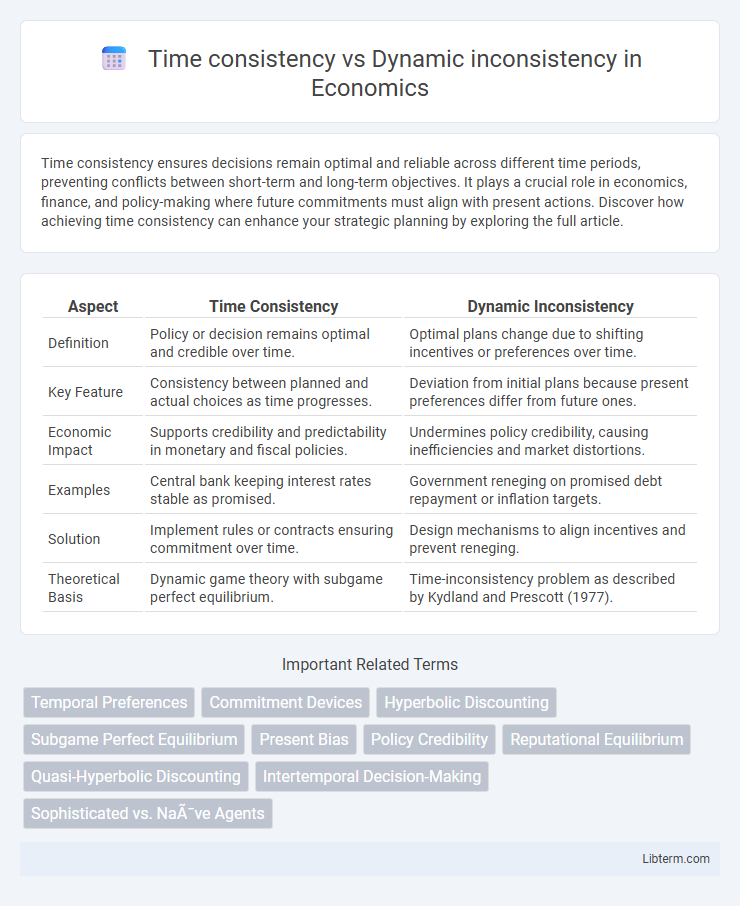

| Aspect | Time Consistency | Dynamic Inconsistency |

|---|---|---|

| Definition | Policy or decision remains optimal and credible over time. | Optimal plans change due to shifting incentives or preferences over time. |

| Key Feature | Consistency between planned and actual choices as time progresses. | Deviation from initial plans because present preferences differ from future ones. |

| Economic Impact | Supports credibility and predictability in monetary and fiscal policies. | Undermines policy credibility, causing inefficiencies and market distortions. |

| Examples | Central bank keeping interest rates stable as promised. | Government reneging on promised debt repayment or inflation targets. |

| Solution | Implement rules or contracts ensuring commitment over time. | Design mechanisms to align incentives and prevent reneging. |

| Theoretical Basis | Dynamic game theory with subgame perfect equilibrium. | Time-inconsistency problem as described by Kydland and Prescott (1977). |

Understanding Time Consistency and Dynamic Inconsistency

Time consistency refers to a decision-making process where preferences remain stable over time, ensuring that plans made today are adhered to in the future. Dynamic inconsistency occurs when preferences shift over time, causing individuals to deviate from their initial plans and resulting in choices that contradict earlier intentions. Understanding these concepts is crucial for modeling rational behavior in economics and addressing challenges in commitment and self-control.

Theoretical Foundations of Time Consistency

Time consistency in decision theory ensures that preferences and plans remain stable over time, aligning with the principle of dynamic optimality established in dynamic programming and Bellman's principle. Theoretical foundations rely on recursive utility models and the Bellman equation, which formalize how future choices should be planned today to avoid contradictions in later decisions. In contrast, dynamic inconsistency arises when preferences change over time due to non-exponential discounting, leading to time-inconsistent plans that violate the Bellman principle and challenge standard rational choice models.

What Causes Dynamic Inconsistency?

Dynamic inconsistency arises when preferences change over time due to shifting incentives or new information, causing decisions that seemed optimal initially to become suboptimal later. This phenomenon is often driven by time-inconsistent discounting, such as hyperbolic discounting, where individuals disproportionately value immediate rewards over future benefits. Behavioral economics highlights that changing foresight and self-control problems contribute significantly to dynamic inconsistency in decision-making processes.

Psychological Drivers Behind Inconsistent Decisions

Time consistency refers to making decisions that remain stable over time, while dynamic inconsistency occurs when preferences change, leading to contradictory choices. Psychological drivers such as present bias, where immediate rewards are overvalued compared to future benefits, and hyperbolic discounting underlie these inconsistent decisions. Cognitive factors like impulsivity, self-control failures, and shifting perceptions of value further exacerbate the inability to maintain consistent preferences across time.

Economic Implications of Time-Inconsistent Behavior

Time inconsistency in economic behavior occurs when preferences change over time, leading individuals or policymakers to deviate from previously planned actions. Dynamic inconsistency undermines long-term commitments, causing inefficiencies such as underinvestment in savings or overconsumption that impact economic growth and fiscal stability. Understanding these behaviors is crucial for designing credible policies and commitment devices that promote consistent decision-making and optimal economic outcomes.

Real-World Examples of Dynamic Inconsistency

Dynamic inconsistency occurs when individuals or policymakers change their preferences over time, leading to decisions that contradict earlier plans. Real-world examples include procrastination in personal finance, where people plan to save but later choose immediate spending, and monetary policy, where central banks promise low inflation but later pursue higher inflation to stimulate growth. These behaviors highlight the challenge of maintaining time consistency in both individual decision-making and economic policy.

Policymaking: Ensuring Time-Consistent Strategies

Time consistency in policymaking ensures that strategies set today remain optimal and credible for the future, preventing shifts that undermine long-term goals. Dynamic inconsistency arises when policymakers have incentives to deviate from initial plans, eroding public trust and economic stability. Effective mechanisms such as commitment devices, credible institutions, and transparent frameworks help maintain time-consistent policies, reinforcing predictable and stable economic environments.

Behavioral Interventions for Dynamic Inconsistency

Behavioral interventions for dynamic inconsistency target improving time consistency by leveraging commitment devices and framing techniques that align short-term actions with long-term goals. Tools like self-imposed deadlines, automatic savings plans, and implementation intentions help mitigate preference reversals that undermine consistent behavior over time. These interventions capitalize on insights from behavioral economics to overcome impulsivity and procrastination inherent in dynamic inconsistency.

Tools for Monitoring and Improving Time Consistency

Time consistency in decision-making can be enhanced using commitment devices and pre-commitment strategies that align future actions with current plans. Tools such as automatic savings plans, self-imposed deadlines, and real-time feedback systems help reduce dynamic inconsistency by minimizing temptation and reinforcing long-term goals. Behavioral interventions combined with monitoring technologies ensure adherence to intended choices, improving overall time-consistent behavior.

Future Directions in Research on Decision Consistency

Future research on decision consistency should explore integrating adaptive models that account for evolving preferences over time to address dynamic inconsistency effectively. Investigating the impact of cognitive biases and behavioral factors on time inconsistency can enhance predictive accuracy in economic and psychological decision-making frameworks. Advanced computational techniques, such as machine learning and real-time data analysis, may offer novel approaches to modeling and mitigating decision inconsistencies in dynamic environments.

Time consistency Infographic

libterm.com

libterm.com