Debt relief offers effective solutions to reduce or eliminate your outstanding financial obligations, easing the burden of loan repayments and improving your credit score. Various strategies such as debt consolidation, settlement, and forgiveness programs can provide immediate relief and long-term financial stability. Explore the article further to discover the best debt relief options tailored to your needs.

Table of Comparison

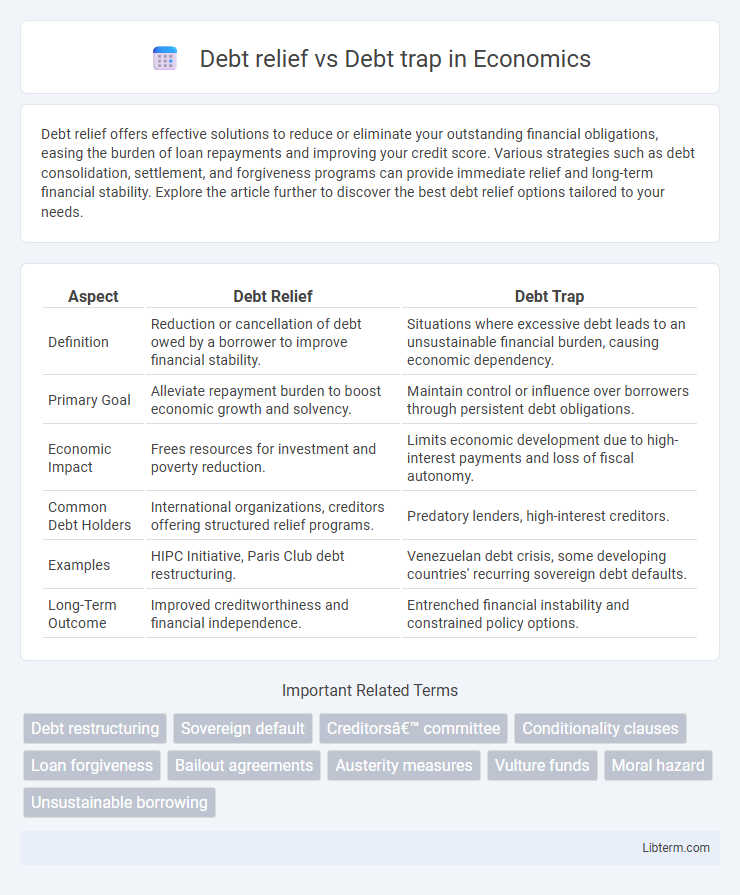

| Aspect | Debt Relief | Debt Trap |

|---|---|---|

| Definition | Reduction or cancellation of debt owed by a borrower to improve financial stability. | Situations where excessive debt leads to an unsustainable financial burden, causing economic dependency. |

| Primary Goal | Alleviate repayment burden to boost economic growth and solvency. | Maintain control or influence over borrowers through persistent debt obligations. |

| Economic Impact | Frees resources for investment and poverty reduction. | Limits economic development due to high-interest payments and loss of fiscal autonomy. |

| Common Debt Holders | International organizations, creditors offering structured relief programs. | Predatory lenders, high-interest creditors. |

| Examples | HIPC Initiative, Paris Club debt restructuring. | Venezuelan debt crisis, some developing countries' recurring sovereign debt defaults. |

| Long-Term Outcome | Improved creditworthiness and financial independence. | Entrenched financial instability and constrained policy options. |

Understanding Debt Relief: Key Concepts

Debt relief involves strategies such as debt forgiveness, restructuring, and consolidation that reduce the amount or burden of debt on borrowers, enhancing financial stability and enabling economic growth. In contrast, a debt trap occurs when creditors impose high interest rates and unfavorable terms, causing borrowers to accumulate more debt than they can repay, leading to a cycle of dependency and financial distress. Key concepts in debt relief emphasize transparency, affordability, and sustainable repayment plans to avoid the pitfalls associated with debt traps and promote long-term economic resilience.

What Is a Debt Trap? Definitions and Warning Signs

A debt trap occurs when an individual or entity continuously borrows money to repay existing debts, resulting in a cycle of increasing debt and financial strain. Warning signs of a debt trap include reliance on high-interest loans, inability to meet minimum payments, and escalating total debt despite regular payments. Recognizing these indicators early is crucial to avoid long-term financial instability and to seek effective debt relief strategies.

Types of Debt Relief Solutions

Debt relief solutions include debt consolidation, debt settlement, debt management plans, and bankruptcy, each tailored to reduce financial burdens and improve credit health. Debt consolidation combines multiple debts into a single loan with lower interest, while debt settlement negotiates reduced payoff amounts with creditors. Debt management plans coordinate payments through credit counseling agencies, and bankruptcy legally limits debt obligations but significantly impacts credit scores.

Common Causes of Falling into a Debt Trap

High-interest rates, poor financial literacy, and unexpected expenses are common causes that push individuals into a debt trap. Excessive reliance on payday loans and credit cards without proper repayment plans often worsens the cycle of accumulating debt. Insufficient income growth and lack of emergency savings further contribute to the inability to escape mounting financial obligations.

Pros and Cons of Debt Relief Programs

Debt relief programs offer significant benefits such as reducing financial burdens for struggling borrowers and preventing defaults, which can stabilize economies and improve creditworthiness. However, they often come with drawbacks including potential moral hazard, where borrowers may rely on relief repeatedly, and the risk of debt traps if restructuring leads to longer repayment periods with accumulating interest. Evaluating these programs requires balancing immediate financial relief against long-term economic sustainability and borrower responsibility.

Risks and Consequences of Debt Traps

Debt traps pose significant risks including overwhelming interest rates and compounding debt that make repayment nearly impossible, often leading to financial instability and diminished creditworthiness. Victims of debt traps may face severe consequences such as loss of assets, increased poverty, and prolonged dependence on high-cost borrowing. Unlike structured debt relief programs, debt traps perpetuate cycles of borrowing and financial distress, undermining long-term economic security.

How to Identify If You Need Debt Relief

Signs you may need debt relief include struggling to make minimum monthly payments, accumulating high-interest debt that grows despite regular payments, and experiencing constant financial stress impacting your daily life. Recognizing a debt trap involves identifying patterns like relying on payday loans or credit cards to cover existing debt, taking on more debt to pay off previous obligations, and facing escalating fees and interest rates. Early evaluation of your debt-to-income ratio and seeking professional financial advice can help differentiate between manageable debt and a dangerous debt trap requiring structured debt relief solutions.

Strategies to Escape a Debt Trap

Effective strategies to escape a debt trap include negotiating lower interest rates with creditors, consolidating high-interest debts into a single loan with better terms, and creating a strict budget to prioritize essential expenses while allocating extra funds towards debt repayment. Utilizing financial counseling services can provide personalized plans and support to manage debt systematically. Building an emergency fund helps prevent future reliance on high-interest borrowing, breaking the cycle of recurring debt traps.

Preventive Measures Against Debt Traps

Implementing strict lending criteria and promoting financial literacy are crucial preventive measures against debt traps. Governments and financial institutions can enforce transparent loan terms and encourage budgeting to help borrowers avoid unsustainable debt. Early intervention programs targeting high-risk populations reduce the likelihood of falling into cycle debt and promote long-term economic stability.

Choosing the Right Path: Debt Relief vs Debt Trap

Choosing the right path between debt relief and a debt trap hinges on understanding financial consequences and long-term impacts. Debt relief offers structured solutions such as consolidation, negotiation, or government programs to reduce or eliminate debt burdens, improving credit scores and financial stability. In contrast, falling into a debt trap involves reliance on high-interest loans or minimum payments that escalate balances and lead to worsening financial health.

Debt relief Infographic

libterm.com

libterm.com