Exchange rate regimes determine how a country manages its currency's value relative to others, influencing economic stability and international trade. Options range from fixed and floating to pegged systems, each with unique benefits and risks tailored to different economic goals. Explore the rest of the article to understand how your choice of exchange rate regime affects global market dynamics and financial planning.

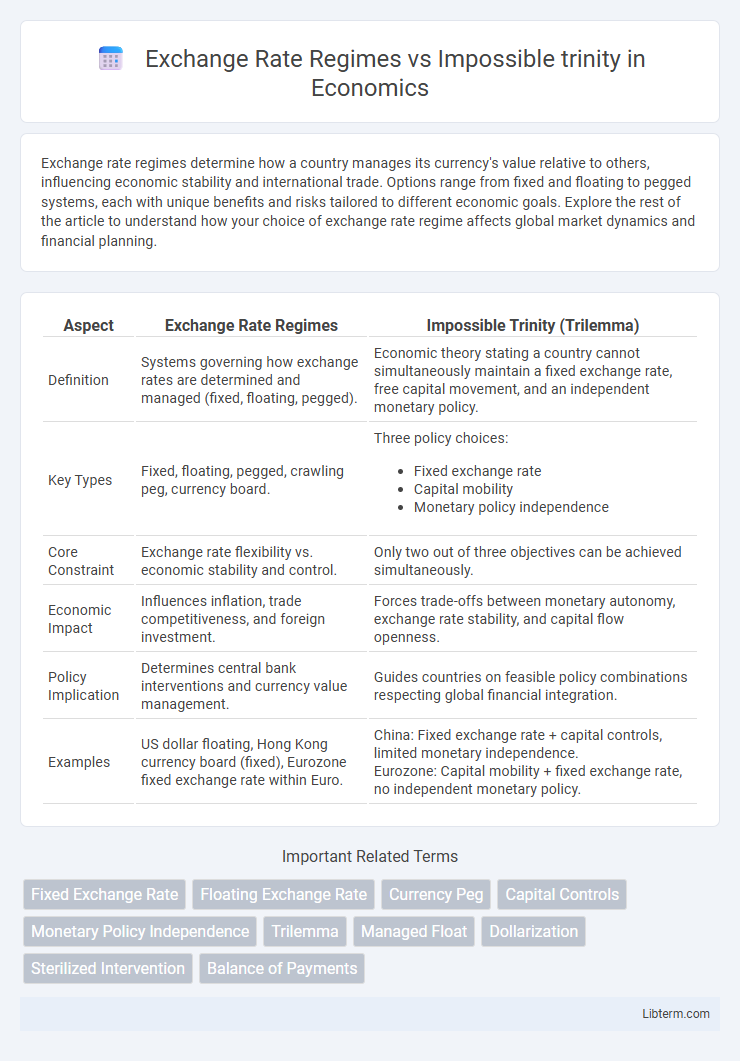

Table of Comparison

| Aspect | Exchange Rate Regimes | Impossible Trinity (Trilemma) |

|---|---|---|

| Definition | Systems governing how exchange rates are determined and managed (fixed, floating, pegged). | Economic theory stating a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. |

| Key Types | Fixed, floating, pegged, crawling peg, currency board. | Three policy choices:

|

| Core Constraint | Exchange rate flexibility vs. economic stability and control. | Only two out of three objectives can be achieved simultaneously. |

| Economic Impact | Influences inflation, trade competitiveness, and foreign investment. | Forces trade-offs between monetary autonomy, exchange rate stability, and capital flow openness. |

| Policy Implication | Determines central bank interventions and currency value management. | Guides countries on feasible policy combinations respecting global financial integration. |

| Examples | US dollar floating, Hong Kong currency board (fixed), Eurozone fixed exchange rate within Euro. | China: Fixed exchange rate + capital controls, limited monetary independence. Eurozone: Capital mobility + fixed exchange rate, no independent monetary policy. |

Introduction to Exchange Rate Regimes

Exchange rate regimes define how a country manages its currency in foreign exchange markets, ranging from fixed to floating systems. These regimes influence monetary policy autonomy and capital mobility, key components of the impossible trinity trade-off. Understanding exchange rate regimes is essential to navigate the challenges posed by the impossible trinity, which states a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and independent monetary policy.

Understanding the Impossible Trinity (Trilemma)

The Impossible Trinity, or Trilemma, highlights that countries cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. Exchange rate regimes must prioritize two out of these three objectives, forcing policymakers to balance economic stability and sovereignty. Understanding this trade-off is essential for designing effective monetary and fiscal strategies in an interconnected global economy.

Types of Exchange Rate Regimes

Fixed, floating, and hybrid exchange rate regimes represent the primary types within the framework of international finance, each balancing monetary policy autonomy, exchange rate stability, and capital mobility as outlined by the impossible trinity. Fixed regimes, such as currency pegs or currency boards, prioritize exchange rate stability but limit independent monetary policy and capital flow flexibility. Floating regimes allow full monetary policy autonomy and capital mobility but accept exchange rate volatility, while hybrid regimes, like adjustable pegs or managed floats, attempt intermediate trade-offs among these three incompatible policy goals.

The Core Principles of the Impossible Trinity

The core principles of the Impossible Trinity, also known as the trilemma, state that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. Policymakers must choose two out of these three objectives, which directly influences the choice of exchange rate regimes. For example, a fixed exchange rate combined with free capital flow requires sacrificing monetary policy autonomy, illustrating the trade-offs central to the Impossible Trinity.

Exchange Rate Regimes: Fixed vs Floating

Exchange rate regimes, including fixed and floating systems, play a crucial role in managing national monetary policy under the constraints of the impossible trinity, which states that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. Fixed exchange rate regimes anchor a currency's value to another currency or basket of currencies, providing stability but limiting monetary policy flexibility. Floating exchange rate regimes allow currency values to fluctuate according to market forces, granting monetary policy autonomy but introducing exchange rate volatility.

Policy Trade-Offs in the Impossible Trinity

Exchange rate regimes embody choices among fixed, floating, and hybrid systems, each reflecting distinct policy trade-offs within the impossible trinity framework. The trilemma dictates that a country cannot simultaneously achieve exchange rate stability, monetary policy autonomy, and free capital movement, forcing policymakers to prioritize two objectives at the expense of the third. For instance, adopting a fixed exchange rate regime under capital mobility sacrifices independent monetary control, while a floating exchange rate with open capital markets preserves monetary autonomy but introduces exchange rate volatility.

Real-World Examples of Exchange Rate Choices

Countries with fixed exchange rate regimes, such as Hong Kong's dollar peg to the US dollar, prioritize exchange rate stability but sacrifice full monetary policy independence, illustrating the trade-offs described in the Impossible Trinity framework. Emerging economies like Brazil often adopt floating exchange rates, allowing monetary autonomy and capital mobility but accepting exchange rate volatility. Germany's experience within the Eurozone demonstrates the choice of relinquishing independent monetary policy under a fixed exchange rate system to maintain capital mobility and economic integration.

How Countries Navigate the Trilemma

Countries navigate the impossible trinity by strategically selecting exchange rate regimes that balance monetary policy independence, exchange rate stability, and capital mobility. Fixed exchange rate regimes often sacrifice monetary policy autonomy to maintain exchange rate stability and capital flow openness. Conversely, countries adopting floating exchange rates prioritize monetary policy independence and capital mobility at the cost of exchange rate volatility.

Economic Impacts of Exchange Rate Regimes

Exchange rate regimes significantly influence a country's ability to maintain monetary policy autonomy, exchange rate stability, and free capital movement, as outlined by the Impossible Trinity framework. Fixed exchange rate regimes promote exchange rate stability but limit monetary policy independence, potentially causing challenges in responding to economic shocks. Conversely, flexible exchange rate regimes allow monetary policy autonomy and capital mobility but can introduce exchange rate volatility, impacting trade balances and inflation rates.

Conclusion: Balancing Exchange Rate Policies and the Impossible Trinity

Balancing exchange rate policies requires carefully navigating the impossible trinity, which states that a country cannot simultaneously achieve fixed exchange rates, free capital mobility, and an independent monetary policy. Policymakers must prioritize two out of these three goals, often choosing between exchange rate stability and monetary policy autonomy while managing capital flows. Effective exchange rate regimes align with a nation's economic priorities and structural conditions, recognizing that trade-offs in the impossible trinity are inevitable and must be strategically managed to maintain macroeconomic stability.

Exchange Rate Regimes Infographic

libterm.com

libterm.com