Deflation refers to a sustained decrease in the general price level of goods and services, which can increase the real value of money over time. It often signals reduced consumer demand and can lead to slowed economic growth or increased unemployment. Discover how deflation impacts your finances and the broader economy by reading the rest of the article.

Table of Comparison

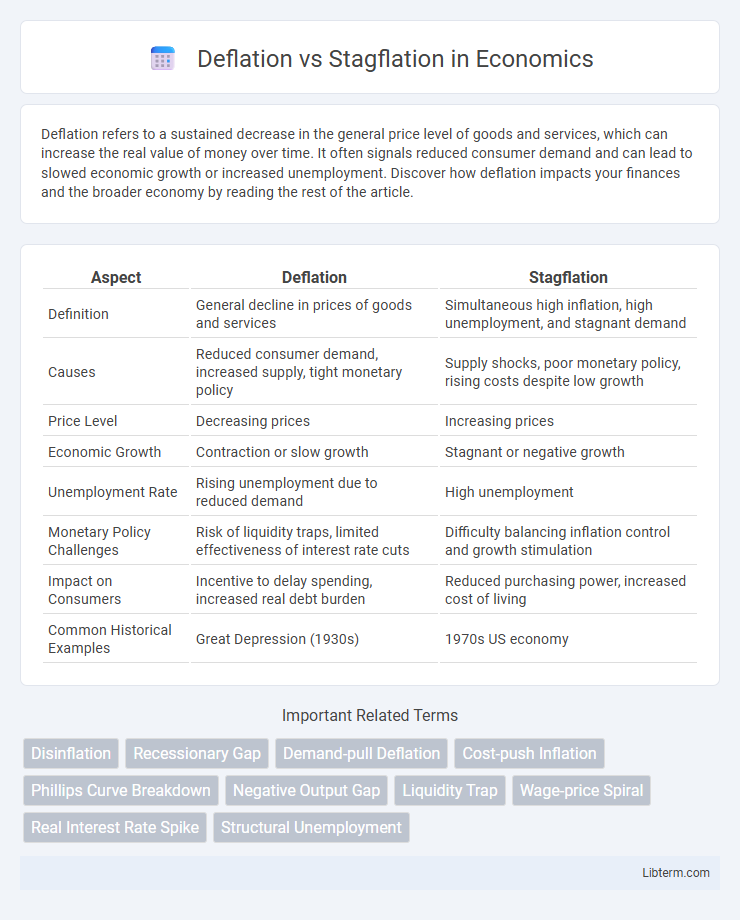

| Aspect | Deflation | Stagflation |

|---|---|---|

| Definition | General decline in prices of goods and services | Simultaneous high inflation, high unemployment, and stagnant demand |

| Causes | Reduced consumer demand, increased supply, tight monetary policy | Supply shocks, poor monetary policy, rising costs despite low growth |

| Price Level | Decreasing prices | Increasing prices |

| Economic Growth | Contraction or slow growth | Stagnant or negative growth |

| Unemployment Rate | Rising unemployment due to reduced demand | High unemployment |

| Monetary Policy Challenges | Risk of liquidity traps, limited effectiveness of interest rate cuts | Difficulty balancing inflation control and growth stimulation |

| Impact on Consumers | Incentive to delay spending, increased real debt burden | Reduced purchasing power, increased cost of living |

| Common Historical Examples | Great Depression (1930s) | 1970s US economy |

Introduction to Deflation and Stagflation

Deflation refers to a sustained decrease in the general price level of goods and services, often leading to reduced consumer spending and increased unemployment. Stagflation is characterized by the simultaneous occurrence of high inflation, stagnant economic growth, and rising unemployment, creating a challenging environment for policymakers. Understanding the contrasting economic conditions of deflation and stagflation is essential for analyzing their distinct impacts on markets and fiscal strategies.

Defining Deflation: Causes and Effects

Deflation is a decline in the general price level of goods and services, driven by factors such as reduced consumer demand, excess supply, or technological advancements that lower production costs. It often results in decreased business revenues, lower wages, and increased unemployment, leading to a slowdown in economic growth. Persistent deflation can create a deflationary spiral where consumers delay purchases, exacerbating economic contraction and financial instability.

Understanding Stagflation: Core Characteristics

Stagflation is characterized by the unusual combination of stagnant economic growth, high unemployment, and persistent inflation, posing challenges for policymakers. Unlike deflation, where prices decline and economic activity slows, stagflation involves rising prices despite economic stagnation. Key indicators include elevated inflation rates above 5%, unemployment rates exceeding 6%, and gross domestic product (GDP) growth near zero or negative.

Key Differences Between Deflation and Stagflation

Deflation is characterized by a general decline in prices and reduced consumer spending, often leading to decreased economic output and rising unemployment. Stagflation, however, combines stagnant economic growth, high unemployment, and persistent inflation, creating a challenging environment for policymakers. The key difference lies in price trends: deflation features falling prices, while stagflation involves inflation despite weak economic conditions.

Historical Examples of Deflation and Stagflation

The Great Depression of the 1930s is a key historical example of deflation, characterized by plummeting prices, high unemployment, and reduced consumer spending. Stagflation famously occurred during the 1970s, particularly in the United States, when rising inflation coincided with stagnant economic growth and soaring unemployment rates, largely due to oil price shocks and monetary policy challenges. These contrasting economic conditions demonstrate how deflation and stagflation impact market stability, consumer behavior, and fiscal policy responses.

Economic Indicators to Identify Deflation vs Stagflation

Deflation is characterized by a sustained decrease in the general price level, with key economic indicators including falling consumer prices, negative inflation rates, and declining demand, often accompanied by rising unemployment and reduced industrial production. Stagflation, on the other hand, combines stagnant economic growth, high unemployment, and persistent inflation, evidenced by slow GDP growth, elevated inflation rates, and continued job losses. Monitoring core inflation, GDP growth rates, unemployment figures, and consumer price indexes helps distinguish deflationary conditions from stagflation scenarios.

Impact on Businesses and Consumers

Deflation leads to lower consumer prices, reducing business revenues and discouraging investment due to shrinking profit margins. Stagflation combines stagnating economic growth with high inflation, causing rising input costs for businesses while consumers face decreased purchasing power and higher living expenses. Both conditions strain financial stability, but deflation pressures businesses through reduced demand, whereas stagflation challenges them with fluctuating costs and unsold inventory.

Policy Responses to Deflation and Stagflation

Policy responses to deflation typically involve expansionary monetary policies such as lowering interest rates and quantitative easing to stimulate spending and investment. In contrast, stagflation requires a combination of tight monetary policies to control inflation and targeted fiscal interventions to support economic growth without exacerbating price pressures. Governments often implement supply-side reforms and measures to improve productivity to address the persistent coexistence of high inflation and stagnant economic growth during stagflation.

Long-Term Economic Consequences

Deflation leads to reduced consumer spending and increased real debt burdens, causing prolonged economic stagnation and higher unemployment rates. Stagflation combines stagnant growth with high inflation, resulting in eroded purchasing power and diminished business investment over time. Long-term consequences of deflation include asset price declines and financial sector instability, whereas stagflation challenges monetary policy effectiveness and can trigger persistent economic malaise.

Future Outlook: Mitigating Deflation and Stagflation Risks

Mitigating deflation and stagflation risks requires proactive monetary policies that balance inflation control with economic growth stimulation, leveraging targeted fiscal stimulus and technological innovation to enhance productivity. Central banks are increasingly adopting flexible inflation targeting and forward guidance to anchor inflation expectations while supporting employment. Investments in green technologies and digital infrastructure are poised to create new economic opportunities, reducing vulnerability to prolonged deflation or stagflation scenarios.

Deflation Infographic

libterm.com

libterm.com