The primary market is where new securities are issued and sold for the first time, allowing companies to raise capital directly from investors. This market plays a crucial role in facilitating economic growth by enabling businesses to expand operations and fund new projects. Explore the rest of the article to understand how the primary market impacts your investment opportunities and financial strategies.

Table of Comparison

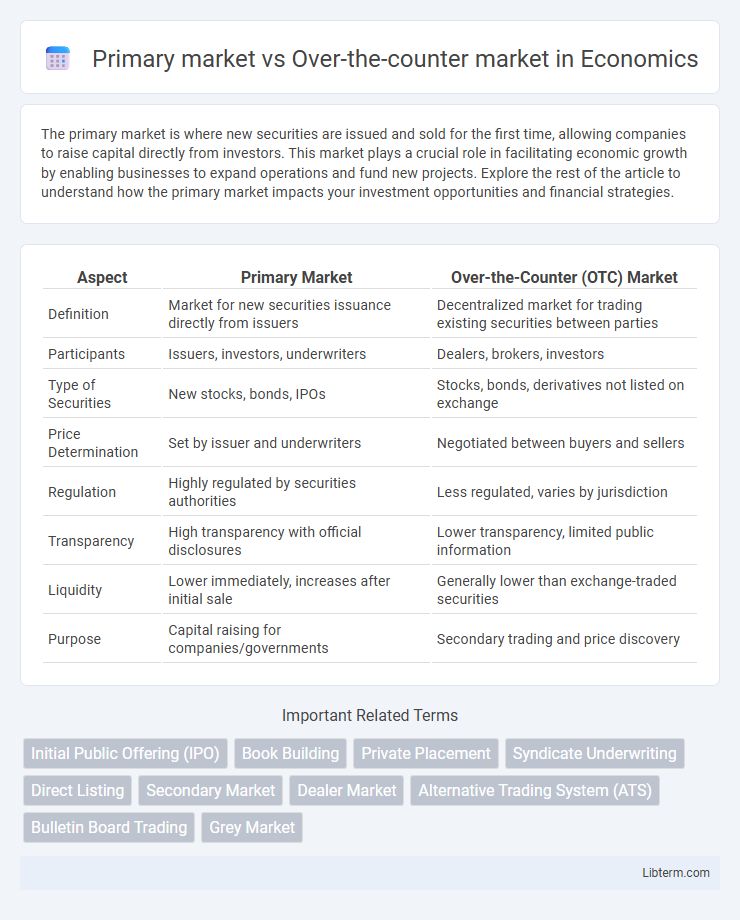

| Aspect | Primary Market | Over-the-Counter (OTC) Market |

|---|---|---|

| Definition | Market for new securities issuance directly from issuers | Decentralized market for trading existing securities between parties |

| Participants | Issuers, investors, underwriters | Dealers, brokers, investors |

| Type of Securities | New stocks, bonds, IPOs | Stocks, bonds, derivatives not listed on exchange |

| Price Determination | Set by issuer and underwriters | Negotiated between buyers and sellers |

| Regulation | Highly regulated by securities authorities | Less regulated, varies by jurisdiction |

| Transparency | High transparency with official disclosures | Lower transparency, limited public information |

| Liquidity | Lower immediately, increases after initial sale | Generally lower than exchange-traded securities |

| Purpose | Capital raising for companies/governments | Secondary trading and price discovery |

Introduction to Primary Market and Over-the-Counter (OTC) Market

The primary market facilitates the initial issuance of securities directly from companies to investors, enabling capital formation and funding for business expansion. The Over-the-Counter (OTC) market operates as a decentralized platform where securities not listed on formal exchanges are traded through broker-dealer networks, providing liquidity and price discovery for less regulated or smaller company stocks. Both markets play critical roles in the overall financial ecosystem by addressing distinct investor needs and security types.

Key Definitions: Primary Market vs OTC Market

The primary market is where new securities are issued directly by companies to investors, enabling capital formation through initial public offerings (IPOs) or private placements. The Over-the-Counter (OTC) market involves trading of securities directly between parties without a centralized exchange, often including derivatives, bonds, and smaller company stocks. Key differences include issuance of new securities in the primary market versus secondary, decentralized trading in the OTC market.

Structure and Mechanism of the Primary Market

The primary market operates through an organized framework where new securities are issued directly by corporations to investors via initial public offerings (IPOs) or private placements, establishing a direct capital-raising mechanism. Underwriters, typically investment banks, play a critical role by pricing, distributing, and guaranteeing the sale of these securities, ensuring efficient capital allocation. This structured environment contrasts with the over-the-counter market, where trading occurs directly between parties without a centralized exchange, primarily involving existing securities.

Structure and Mechanism of the OTC Market

The OTC market operates through a decentralized network of dealers who negotiate directly without a centralized exchange, enabling the trading of securities not listed on formal exchanges. This structure involves a broker-dealer system where prices are determined by supply and demand dynamics, offering greater flexibility and access to a wider range of financial instruments. The OTC mechanism facilitates quotation and trade execution via electronic platforms or over the phone, supporting less liquid and more customized securities compared to the primary market's issuance of new securities directly from issuers to investors.

Instruments Traded in Primary Market vs OTC Market

The primary market predominantly deals with new securities such as initial public offerings (IPOs), bonds, and government securities being issued directly by corporations or governments to investors. In contrast, the over-the-counter (OTC) market facilitates trading of a wide range of instruments including stocks not listed on formal exchanges, derivatives, foreign exchange, and debt securities, allowing more flexibility and customization. The OTC market is characterized by bilateral contracts and less regulation compared to the primary market, which focuses on new issuance and capital raising.

Participants: Who Buys and Sells in Each Market?

Primary market participants mainly include issuing companies, underwriters, and institutional investors purchasing newly issued securities during initial public offerings (IPOs). In the over-the-counter (OTC) market, a diverse range of investors such as retail traders, institutional investors, and broker-dealers engage in buying and selling securities not listed on formal exchanges. Market makers and dealers play a crucial role in the OTC market by facilitating liquidity and price negotiation between buyers and sellers.

Regulation and Transparency: Primary Market vs OTC Market

The primary market is highly regulated by governmental authorities such as the SEC, ensuring stringent disclosure requirements and transparency to protect investors during initial securities offerings. The over-the-counter (OTC) market operates with less regulatory oversight, leading to lower transparency as transactions occur directly between parties without a centralized exchange or mandatory public disclosures. This regulatory disparity results in higher disclosure standards in the primary market, while OTC trading often involves higher risks due to limited investor protection and informational asymmetry.

Advantages and Disadvantages of the Primary Market

The primary market enables companies to raise capital directly by issuing new securities, offering advantages such as immediate access to funds and price determination through underwriting. It provides transparency and regulatory oversight, enhancing investor confidence and reducing fraud risks. However, disadvantages include high issuance costs, lengthy regulatory approval processes, and the potential for market volatility affecting initial pricing.

Advantages and Disadvantages of the OTC Market

The Over-the-Counter (OTC) market offers advantages such as greater flexibility in trading securities not listed on formal exchanges and lower costs due to fewer regulations. However, disadvantages include reduced transparency, higher counterparty risk, and less liquidity compared to primary markets or centralized exchanges. Investors must carefully weigh the benefits of accessing unique, less-regulated assets against the potential risks of limited oversight and price discovery in the OTC market.

Key Differences Between Primary and Over-the-Counter Markets

The primary market facilitates the initial issuance of securities directly from issuers to investors, enabling companies to raise capital through IPOs and bond offerings. The over-the-counter (OTC) market involves trading securities directly between parties without a centralized exchange, often including stocks, derivatives, and bonds with less stringent regulatory oversight. Key differences include the primary market's role in capital formation versus the OTC market's focus on secondary trading, the presence of public disclosure requirements in the primary market compared to OTC's less transparent transactions, and varying liquidity levels with OTC markets typically exhibiting lower liquidity.

Primary market Infographic

libterm.com

libterm.com