Ricardian equivalence suggests that government debt issuance does not affect overall demand because individuals anticipate future taxes and adjust their savings accordingly. This theory implies that fiscal policy through borrowing may be neutral in stimulating the economy. Explore the full article to understand how Ricardian equivalence impacts economic policy and your financial decisions.

Table of Comparison

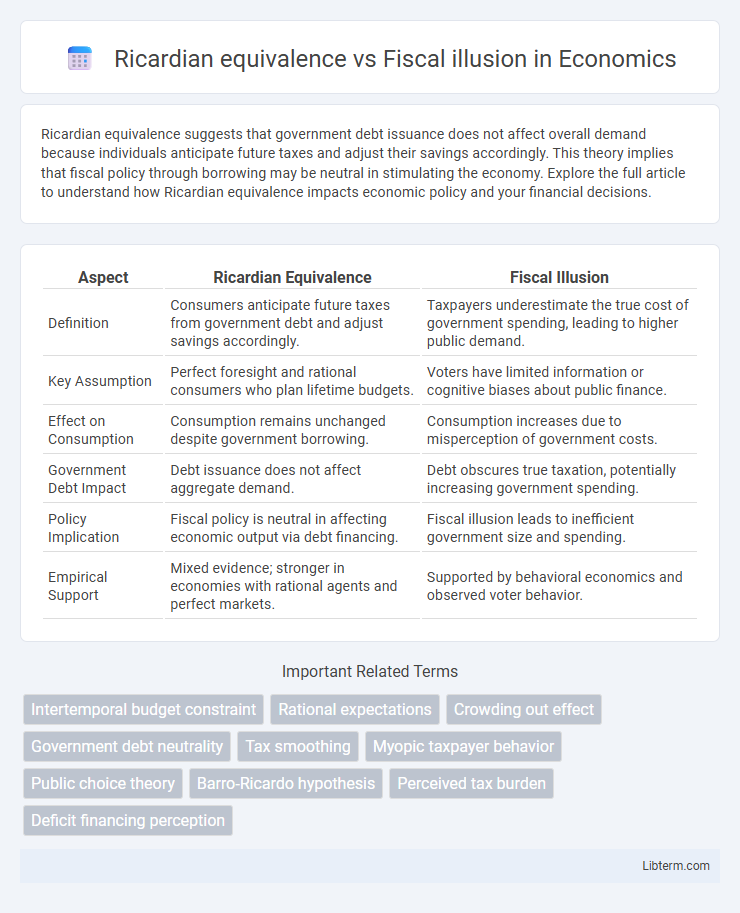

| Aspect | Ricardian Equivalence | Fiscal Illusion |

|---|---|---|

| Definition | Consumers anticipate future taxes from government debt and adjust savings accordingly. | Taxpayers underestimate the true cost of government spending, leading to higher public demand. |

| Key Assumption | Perfect foresight and rational consumers who plan lifetime budgets. | Voters have limited information or cognitive biases about public finance. |

| Effect on Consumption | Consumption remains unchanged despite government borrowing. | Consumption increases due to misperception of government costs. |

| Government Debt Impact | Debt issuance does not affect aggregate demand. | Debt obscures true taxation, potentially increasing government spending. |

| Policy Implication | Fiscal policy is neutral in affecting economic output via debt financing. | Fiscal illusion leads to inefficient government size and spending. |

| Empirical Support | Mixed evidence; stronger in economies with rational agents and perfect markets. | Supported by behavioral economics and observed voter behavior. |

Introduction to Ricardian Equivalence and Fiscal Illusion

Ricardian equivalence posits that consumers anticipate future taxes linked to government borrowing, leading them to increase savings and offset fiscal deficits, thereby neutralizing the effect of government debt on aggregate demand. In contrast, fiscal illusion occurs when taxpayers underestimate the true cost of government spending due to complex tax systems or lack of transparency, causing them to support higher government expenditures than they would if fully informed. Understanding these concepts is crucial for analyzing how public perception and behavior influence fiscal policy effectiveness and government budget constraints.

Historical Development of the Theories

Ricardian equivalence, introduced by economist David Ricardo in the early 19th century and formalized by Robert Barro in the 1970s, posits that government debt issuance does not affect overall demand because rational agents anticipate future taxes required to repay debt. Fiscal illusion, developed by economist James M. Buchanan in the 1960s, argues that taxpayers underestimate the true cost of government spending due to complex tax systems and lack of transparency, leading to increased public expenditure. The historical evolution of these theories highlights contrasting views on taxpayer behavior and government financing's impact on economic activity.

Core Principles of Ricardian Equivalence

Ricardian equivalence posits that government borrowing does not affect overall demand because individuals anticipate future taxes to repay debt and therefore increase their savings. The core principle hinges on forward-looking behavior where households internalize government budget constraints, leading to neutral fiscal policy effects. This contrasts with fiscal illusion, where taxpayers underestimate government debt and perceive deficits as expansions in disposable income, resulting in increased consumption.

Fundamental Concepts of Fiscal Illusion

Fiscal illusion occurs when taxpayers misperceive the true cost of government spending, often underestimating tax burdens or government debt implications. Unlike Ricardian equivalence, which assumes individuals fully anticipate future taxes and adjust savings accordingly, fiscal illusion highlights cognitive biases and information asymmetries that distort public perception. Fundamental concepts of fiscal illusion include complexity in tax systems, debt monetization, and the separation of benefits from costs, leading to higher demand for government services.

Key Assumptions Underlying Both Theories

Ricardian equivalence assumes that consumers have perfect foresight and fully rational expectations, leading them to anticipate future taxes resulting from government debt and thus save accordingly. Fiscal illusion theory presumes that individuals have limited information and cognitive biases, causing them to underestimate the true cost of government borrowing and overspend. Both theories hinge on contrasting assumptions about consumer behavior and information processing regarding public finance.

Real-World Evidence and Empirical Studies

Empirical studies on Ricardian equivalence reveal mixed outcomes, with evidence from advanced economies like the United States and Europe showing limited support due to liquidity constraints and myopic consumer behavior. In contrast, fiscal illusion theory gains support from real-world data where individuals underestimate tax burdens linked to public debt, as observed in developing countries with less transparent fiscal systems. Comprehensive analyses suggest that while Ricardian equivalence holds under stringent assumptions, fiscal illusion more accurately explains observed discrepancies in consumer responses to government borrowing and taxation.

Policy Implications and Economic Outcomes

Ricardian equivalence suggests that government debt does not affect overall demand because individuals anticipate future taxes and adjust their savings accordingly, which implies that fiscal policy changes may be ineffective in stimulating the economy. In contrast, fiscal illusion arises when taxpayers underestimate future tax liabilities associated with government borrowing, leading to increased consumption and potentially larger deficits, impacting economic growth and debt sustainability. Policymakers must consider these differing behavioral responses when designing budgetary strategies to avoid unintended economic consequences such as crowding out private investment or persistent budget deficits.

Contrasts and Overlaps Between the Two Theories

Ricardian equivalence posits that consumers anticipate future taxes resulting from government debt, leading them to save rather than increase spending, thus neutralizing fiscal policy effects. Fiscal illusion theory argues that taxpayers underestimate the true cost of government spending due to opaque fiscal practices, causing them to favor higher deficits and spending. Both theories address consumer perceptions of government finance but contrast in whether individuals fully internalize government budget constraints or are misled by fiscal complexity.

Criticisms and Limitations

Ricardian equivalence faces criticism for assuming perfect rationality and intergenerational altruism, which rarely hold true in real economies, limiting its practical applicability. Fiscal illusion is challenged for oversimplifying taxpayer behavior, as it underestimates the complexity of public perception and the varied responses to government financing methods. Both theories struggle with empirical validation due to heterogeneous consumer behaviors and institutional differences, restricting their predictive power in fiscal policy analysis.

Conclusion: Relevance in Modern Fiscal Policy

Ricardian equivalence posits that rational consumers anticipate future taxation and adjust their savings accordingly, implying limited effectiveness of deficit-financed fiscal policy in stimulating demand. Fiscal illusion suggests that governments can exploit voters' misperceptions about budget constraints to increase spending without immediate political cost, leading to potentially higher deficits. Modern fiscal policy must balance these theories by recognizing that while some consumers internalize future tax burdens, others exhibit bounded rationality, making transparency and credibility crucial for sustainable fiscal management.

Ricardian equivalence Infographic

libterm.com

libterm.com