Central banks play a pivotal role in stabilizing the economy by regulating money supply, setting interest rates, and controlling inflation. Understanding how these institutions influence financial markets and monetary policy can help you make better-informed decisions. Explore the rest of this article to learn how central banks impact your financial future.

Table of Comparison

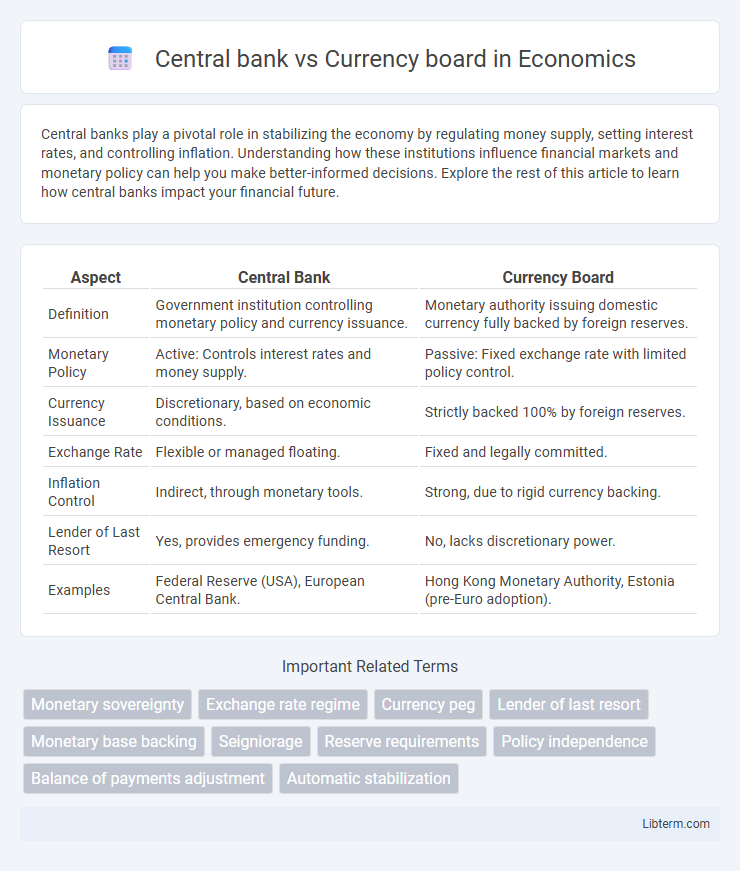

| Aspect | Central Bank | Currency Board |

|---|---|---|

| Definition | Government institution controlling monetary policy and currency issuance. | Monetary authority issuing domestic currency fully backed by foreign reserves. |

| Monetary Policy | Active: Controls interest rates and money supply. | Passive: Fixed exchange rate with limited policy control. |

| Currency Issuance | Discretionary, based on economic conditions. | Strictly backed 100% by foreign reserves. |

| Exchange Rate | Flexible or managed floating. | Fixed and legally committed. |

| Inflation Control | Indirect, through monetary tools. | Strong, due to rigid currency backing. |

| Lender of Last Resort | Yes, provides emergency funding. | No, lacks discretionary power. |

| Examples | Federal Reserve (USA), European Central Bank. | Hong Kong Monetary Authority, Estonia (pre-Euro adoption). |

Introduction to Central Banks and Currency Boards

Central banks serve as the primary monetary authority in a country, regulating money supply, controlling inflation, and overseeing financial stability through monetary policy tools like interest rates and open market operations. Currency boards maintain a fixed exchange rate by backing the domestic currency with foreign reserves, ensuring currency stability and preventing inflation through strict monetary discipline. While central banks have discretionary powers to influence the economy, currency boards operate under predetermined rules that limit monetary policy flexibility.

Historical Background and Evolution

Currency boards emerged in the 19th century as rigid monetary institutions designed to maintain fixed exchange rates by fully backing the local currency with foreign reserves, gaining prominence in British colonies to ensure currency stability. Central banks evolved from early public banks in the 17th century, such as the Bank of England, expanding their roles to include monetary policy regulation, lender of last resort functions, and economic stabilization. Over time, central banks shifted from strict currency pegs towards flexible monetary frameworks, contrasting with currency boards' continued emphasis on fixed exchange regimes.

Core Functions and Mandate Differences

Central banks primarily manage monetary policy by controlling interest rates and regulating money supply to ensure economic stability, while currency boards strictly maintain a fixed exchange rate by issuing domestic currency fully backed by foreign reserves. Central banks serve as lenders of last resort and oversee the banking system, whereas currency boards have limited roles, focusing mainly on maintaining currency convertibility and fiscal discipline. The mandate of central banks includes promoting price stability and economic growth, contrasting with currency boards that prioritize exchange rate stability without discretionary monetary policy.

Monetary Policy Tools and Flexibility

Central banks possess a wide range of monetary policy tools such as open market operations, reserve requirements, and interest rate adjustments to influence domestic economic conditions flexibly. In contrast, currency boards maintain a fixed exchange rate by strictly backing the domestic currency with foreign reserves, limiting their ability to independently use monetary policy instruments. This structural difference results in currency boards having minimal monetary policy flexibility, as their primary focus is on maintaining currency stability rather than targeting domestic economic objectives.

Exchange Rate Management and Stability

Central banks actively manage exchange rates through monetary policy tools such as interest rate adjustments and foreign exchange interventions, aiming to stabilize the currency and control inflation. Currency boards maintain fixed exchange rates by backing the domestic currency fully with foreign reserves, limiting monetary policy flexibility but ensuring exchange rate stability and confidence. The currency board's rigid structure reduces exchange rate volatility, while central banks may face challenges in sustaining stability during economic shocks.

Impact on Inflation and Price Stability

Central banks influence inflation and price stability through monetary policy tools like interest rate adjustments and open market operations, allowing for flexible responses to economic fluctuations. Currency boards maintain strict currency issuance tied to foreign reserves, limiting monetary policy flexibility but ensuring strong price stability by preventing excessive inflation. The rigid framework of currency boards often results in lower and more stable inflation rates compared to central banks, which may face trade-offs between inflation control and economic growth.

Crisis Management and Lender of Last Resort Role

Central banks play a crucial role in crisis management by providing liquidity to financial institutions during periods of economic distress, acting as lenders of last resort to stabilize the banking system and prevent systemic collapse. Currency boards, with their strict foreign reserve backing and fixed exchange rate regime, lack discretionary monetary policy tools, limiting their ability to intervene directly in banking crises or provide emergency liquidity. The rigid structure of currency boards often forces reliance on external support or fiscal adjustments during crises, whereas central banks can leverage monetary policy flexibility to restore confidence and financial stability.

Case Studies: Countries Using Central Banks vs Currency Boards

Countries like the United States, Japan, and the United Kingdom use central banks that manage monetary policy through interest rate adjustments and open market operations to influence economic growth and inflation. In contrast, Hong Kong and Estonia employ currency boards that maintain fixed exchange rates by holding foreign currency reserves equal to the domestic currency in circulation, ensuring greater currency stability and investor confidence. These contrasting frameworks demonstrate how central banks prioritize economic flexibility, while currency boards emphasize strict monetary discipline and reduced risk of currency crises.

Economic Growth and Financial System Implications

A central bank controls monetary policy, influencing economic growth through interest rates and inflation management, supporting financial system stability via lender-of-last-resort functions and regulatory oversight. Currency boards, by pegging domestic currency to a foreign reserve currency, provide exchange rate stability and limit monetary policy flexibility, which can reduce inflation but may constrain economic growth during external shocks. The choice between a central bank and currency board significantly affects financial system resilience and the country's ability to respond to economic fluctuations.

Conclusion: Choosing the Right Monetary Authority

Selecting the appropriate monetary authority depends on a country's economic stability and policy goals, where central banks offer greater flexibility in managing inflation and economic growth, while currency boards provide stronger currency stability by strictly backing the local currency with foreign reserves. Central banks enable proactive monetary interventions and lender-of-last-resort functions, making them suitable for economies requiring dynamic financial control. Currency boards, with their fixed exchange rate systems, are preferable for economies seeking to anchor inflation expectations and build investor confidence through automatic monetary discipline.

Central bank Infographic

libterm.com

libterm.com