Social insurance provides financial protection by covering risks such as unemployment, disability, and retirement, ensuring stability for individuals and families. Programs like Social Security and unemployment benefits play a crucial role in safeguarding your income during unforeseen circumstances. Explore the rest of the article to understand how social insurance can secure your financial future.

Table of Comparison

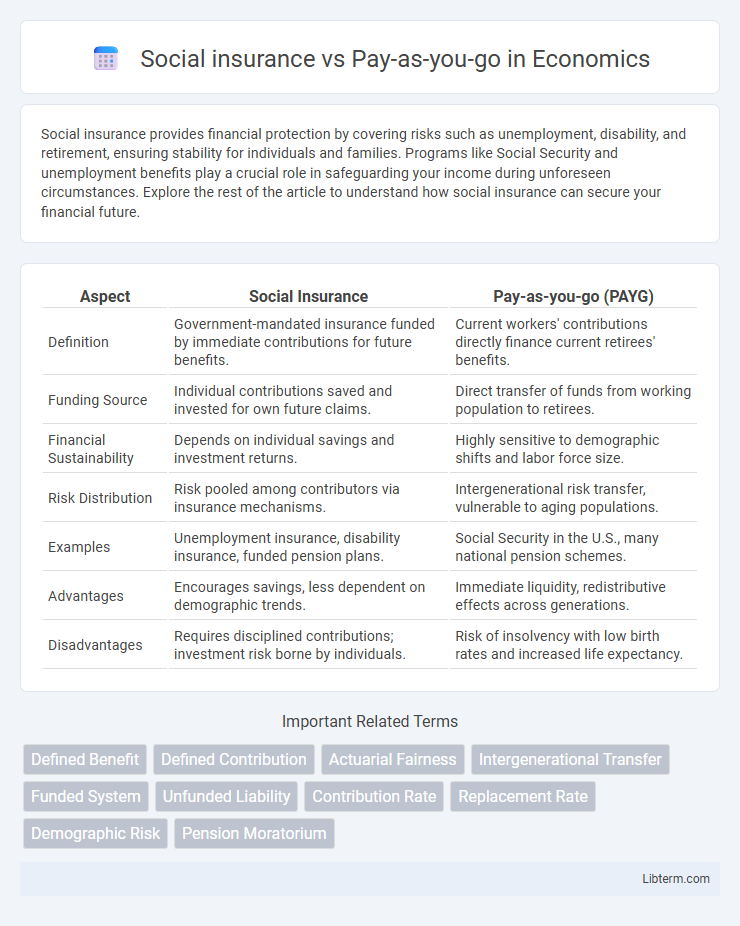

| Aspect | Social Insurance | Pay-as-you-go (PAYG) |

|---|---|---|

| Definition | Government-mandated insurance funded by immediate contributions for future benefits. | Current workers' contributions directly finance current retirees' benefits. |

| Funding Source | Individual contributions saved and invested for own future claims. | Direct transfer of funds from working population to retirees. |

| Financial Sustainability | Depends on individual savings and investment returns. | Highly sensitive to demographic shifts and labor force size. |

| Risk Distribution | Risk pooled among contributors via insurance mechanisms. | Intergenerational risk transfer, vulnerable to aging populations. |

| Examples | Unemployment insurance, disability insurance, funded pension plans. | Social Security in the U.S., many national pension schemes. |

| Advantages | Encourages savings, less dependent on demographic trends. | Immediate liquidity, redistributive effects across generations. |

| Disadvantages | Requires disciplined contributions; investment risk borne by individuals. | Risk of insolvency with low birth rates and increased life expectancy. |

Introduction to Social Insurance and Pay-as-you-go Systems

Social insurance systems provide financial protection through mandatory contributions, offering benefits such as retirement, disability, and unemployment payments based on predefined eligibility criteria. Pay-as-you-go (PAYG) systems finance current benefits directly from the contributions of current workers, creating an intergenerational transfer of funds rather than individual savings accumulation. Understanding the structure and funding mechanisms of social insurance versus PAYG is essential for assessing pension sustainability and economic impact.

Definition of Social Insurance

Social insurance is a government-run program that provides economic support during unemployment, disability, retirement, or illness through mandatory contributions from workers and employers. It operates on the principle of risk pooling, ensuring individuals receive benefits based on their contribution history and eligibility criteria. Unlike pay-as-you-go systems, where current workers' contributions fund current beneficiaries, social insurance often accumulates reserves to sustain long-term benefits.

Understanding Pay-as-you-go (PAYG) Models

Pay-as-you-go (PAYG) models in social insurance rely on current workers' contributions to fund existing beneficiaries' benefits rather than accumulating funds in advance. This system requires a steady or growing workforce to sustain payouts, making demographic shifts like aging populations a critical challenge. Understanding the PAYG structure is essential for evaluating its sustainability and designing reforms in public pension or healthcare systems.

Key Differences Between Social Insurance and PAYG

Social insurance requires participants to make contributions during their working years, which are then invested to fund their future benefits, creating a pre-funded system. PAYG systems rely on current workers' contributions to directly finance the benefits of current retirees, making it a pay-as-you-go financing method with no accumulation of funds. Social insurance typically offers more sustainability and security through reserves, while PAYG systems are sensitive to demographic changes such as aging populations and workforce size fluctuations.

Funding Mechanisms: Contributions and Sustainability

Social insurance systems rely on dedicated contributions from workers and employers to fund current and future benefits, creating a reserve that enhances long-term sustainability. Pay-as-you-go (PAYG) schemes operate by using current workers' contributions to immediately pay retirees, which can lead to funding imbalances as demographic shifts occur. The sustainability of social insurance depends on contribution rates and reserve management, whereas PAYG systems are more vulnerable to population aging and workforce size fluctuations.

Benefits Coverage: Who Qualifies and What Is Included

Social insurance programs typically ensure broad benefits coverage by mandating participation for eligible workers based on employment status, including retirement, disability, and survivor benefits under schemes like Social Security in the U.S. Pay-as-you-go (PAYG) systems finance current beneficiaries through current workers' contributions, often covering a wide population but sometimes excluding informal sectors depending on national regulations. Qualification criteria under social insurance are strictly defined by work history and contribution requirements, whereas PAYG systems focus on demographic sustainability, with benefits generally including pensions and sometimes health care or unemployment support.

Impact on Beneficiaries and Employers

Social insurance systems provide beneficiaries with predictable, legally guaranteed benefits funded through employer and employee contributions, enhancing financial security during retirement, disability, or unemployment. Pay-as-you-go (PAYG) schemes depend on current workers' contributions to finance retirees' benefits, potentially leading to sustainability challenges during demographic shifts, which can increase financial strain on both employers and employees. Employers in social insurance frameworks face stable contribution rates, whereas in PAYG systems, contribution requirements may fluctuate, impacting workforce costs and long-term business planning.

Financial Risks and System Stability

Social insurance systems pool financial risks across a broad population to provide stable benefits despite individual uncertainties, reducing the impact of income volatility, unemployment, and health expenses. Pay-as-you-go (PAYG) systems rely on current workers' contributions to finance retirees' benefits, making them vulnerable to demographic shifts like aging populations and declining birth rates, which strain system stability. Financial risks in PAYG models include funding shortfalls and escalating costs, whereas social insurance often incorporates reserves and actuarial management to enhance long-term sustainability.

Global Examples: Social Insurance vs PAYG in Practice

Social insurance systems like Germany's social security provide funded benefits based on accumulated contributions, ensuring long-term sustainability through individual accounts. In contrast, pay-as-you-go (PAYG) models, used in countries such as the United States and Japan, rely on current workers' contributions to pay retirees, making them sensitive to demographic shifts like aging populations. Scandinavian countries blend these approaches, combining funded social insurance with PAYG elements to balance fiscal stability and intergenerational equity.

Future Outlook: Reforming Social Protection Systems

Reforming social protection systems involves transitioning from pay-as-you-go (PAYG) models to sustainable social insurance schemes that ensure long-term financial stability amid demographic shifts such as aging populations and shrinking workforces. Future outlooks emphasize integrating automated data analytics and digital contributions tracking to enhance transparency, efficiency, and adaptability. Policymakers prioritize diversifying funding sources and incorporating private savings incentives to reinforce resilience against economic volatility and fiscal pressures.

Social insurance Infographic

libterm.com

libterm.com