The Rational Expectations Hypothesis asserts that individuals use all available information efficiently to forecast future economic variables, minimizing systematic errors. This theory challenges traditional models by suggesting that people do not consistently make biased predictions, influencing policy effectiveness. Explore the article to understand how this hypothesis impacts economic decision-making and policy outcomes.

Table of Comparison

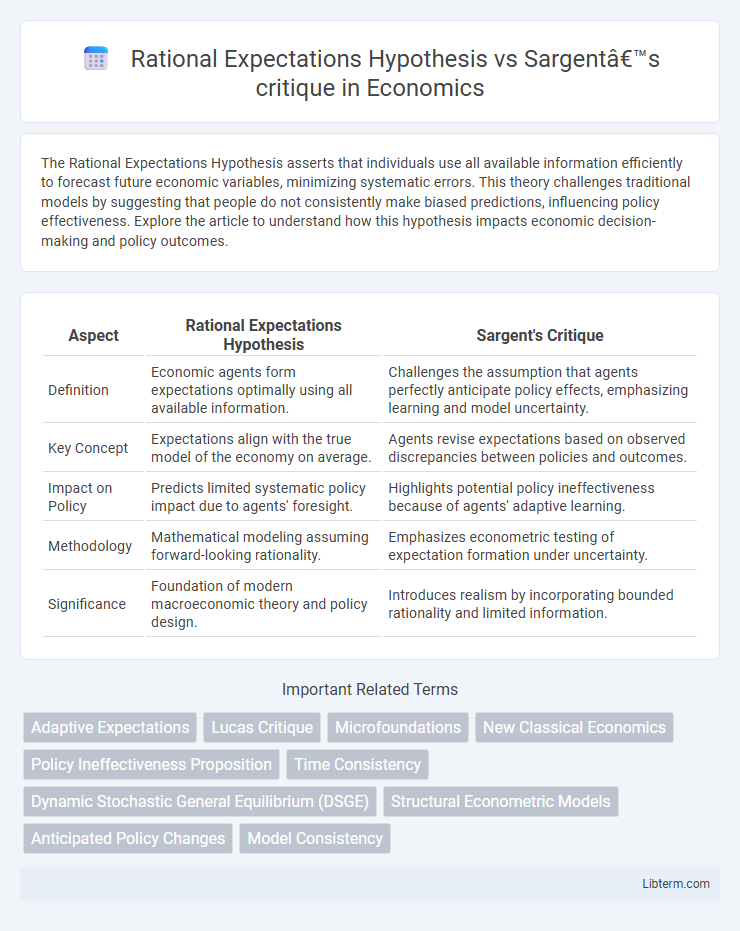

| Aspect | Rational Expectations Hypothesis | Sargent's Critique |

|---|---|---|

| Definition | Economic agents form expectations optimally using all available information. | Challenges the assumption that agents perfectly anticipate policy effects, emphasizing learning and model uncertainty. |

| Key Concept | Expectations align with the true model of the economy on average. | Agents revise expectations based on observed discrepancies between policies and outcomes. |

| Impact on Policy | Predicts limited systematic policy impact due to agents' foresight. | Highlights potential policy ineffectiveness because of agents' adaptive learning. |

| Methodology | Mathematical modeling assuming forward-looking rationality. | Emphasizes econometric testing of expectation formation under uncertainty. |

| Significance | Foundation of modern macroeconomic theory and policy design. | Introduces realism by incorporating bounded rationality and limited information. |

Introduction to Rational Expectations Hypothesis

The Rational Expectations Hypothesis posits that economic agents form forecasts of future variables based on all available information and the underlying economic model, leading their predictions to be, on average, accurate and unbiased. This framework assumes individuals use the true probability distribution of future events when making decisions, thereby eliminating systematic errors in expectation formation. Sargent's critique challenges this assumption by arguing that the model's reliance on common knowledge and perfect information is unrealistic, highlighting the difficulties in identifying true rational expectations in practice.

Core Principles of the Rational Expectations Hypothesis

The Rational Expectations Hypothesis (REH) posits that economic agents form forecasts about the future based on all available information and unbiased, model-consistent predictions, ensuring that on average, expected values match actual outcomes. Core principles include the assumption that agents use the correct economic model, incorporate policy changes into expectations immediately, and avoid systematic errors in forecasting economic variables like inflation and interest rates. Sargent's critique challenges the REH by emphasizing that agents may not have perfect model knowledge and that learning dynamics and structural changes can lead to persistent forecast errors and policy ineffectiveness.

Historical Context: Emergence of Rational Expectations

The Rational Expectations Hypothesis emerged in the 1970s amid growing dissatisfaction with traditional Keynesian economics, emphasizing that individuals and firms utilize all available information to forecast future economic variables accurately. This development occurred during a period marked by stagflation and unexpected inflation, which challenged the effectiveness of policy interventions based on adaptive expectations. Sargent's critique highlighted the limitations of the hypothesis by underscoring that agents' learning processes and model uncertainty complicate the assumption that expectations are always rational and fully informed.

Sargent’s Critique: An Overview

Sargent's critique of the Rational Expectations Hypothesis emphasizes the limitations of assuming agents possess perfect foresight and complete model knowledge, arguing that real-world expectations formation involves learning and adaptation. He highlights how deviations from rational expectations can persist due to model misspecification and information constraints faced by economic agents. This critique underscores the importance of incorporating bounded rationality and learning dynamics in macroeconomic modeling to better explain observed economic behavior.

Major Points of Divergence

The Rational Expectations Hypothesis posits that individuals form forecasts about the future based on all available information, leading to policy ineffectiveness in systematically manipulating economic outcomes. Sargent's critique challenges this by emphasizing that agents' learning processes and model uncertainty cause deviations from fully rational expectations, resulting in persistent policy impacts and potential economic inefficiencies. Key divergences include assumptions about information availability, agents' model consistency, and the adaptive nature of expectations formation under stochastic environments.

Policy Implications: Classical vs. Sargent’s Perspective

The Rational Expectations Hypothesis asserts that economic agents anticipate the effects of policy changes, rendering systematic monetary and fiscal interventions ineffective in influencing real variables like output and employment. Sargent's critique emphasizes that while classical models predict policy ineffectiveness, unexpected or unanticipated policies can temporarily impact the economy before agents adjust their expectations, highlighting the importance of credible policy commitment. Consequently, classical views downplay the role of active stabilization policies, whereas Sargent's perspective underscores policy design and communication to manage expectations and enhance policy efficacy.

Empirical Evidence and Real-World Applications

Empirical evidence challenges the Rational Expectations Hypothesis by highlighting systematic forecast errors and deviations from model predictions in financial markets and inflation rates. Sargent's critique emphasizes the limitations of rational expectations in capturing agents' learning processes and adaptive behaviors in real-world economic environments. Real-world applications reveal that rigid rational expectations models often fail to predict economic crises, leading to the development of alternative frameworks incorporating bounded rationality and behavioral insights.

Impact on Macroeconomic Modeling

The Rational Expectations Hypothesis fundamentally transformed macroeconomic modeling by assuming agents use all available information efficiently, leading to models where policy effects are anticipated and often neutralized. Sargent's critique emphasized the limitations of rational expectations in real-world scenarios, highlighting issues such as model misspecification, adaptive learning, and the role of structural changes in the economy. This critique spurred the development of more robust macroeconomic models that incorporate expectations formation processes and account for policy ineffectiveness under certain conditions.

Ongoing Debates and Theoretical Advancements

The Rational Expectations Hypothesis asserts that economic agents use all available information to forecast future variables accurately, influencing market outcomes and policy effectiveness. Sargent's critique highlights limitations in this hypothesis by emphasizing the role of learning, model uncertainty, and the persistence of systematic forecasting errors, challenging the assumption of perfect foresight. Ongoing debates focus on integrating bounded rationality, adaptive learning frameworks, and heterogeneous agent models to refine theoretical advancements and better explain observed macroeconomic dynamics.

Conclusion: Weighing Rational Expectations vs. Sargent’s Critique

The Rational Expectations Hypothesis asserts that economic agents make forecasts grounded in all available information, leading to model-consistent expectations that effectively neutralize systematic policy impacts. Sargent's critique emphasizes the limitations of this hypothesis by highlighting real-world deviations due to information imperfections and adaptive learning, which can cause policy ineffectiveness or unintended consequences. Weighing these perspectives reveals that while rational expectations provide a robust theoretical framework, incorporating Sargent's insights is essential for realistic policy design acknowledging agents' bounded rationality and dynamic adaptation.

Rational Expectations Hypothesis Infographic

libterm.com

libterm.com