The Accelerationist Phillips Curve asserts that inflation accelerates when unemployment falls below its natural rate, highlighting the dynamic relationship between wage growth and inflation expectations. This economic model suggests that attempts to maintain unemployment below the natural rate result in ever-increasing inflation, emphasizing the role of expectations in wage-setting behavior. Discover how this concept impacts monetary policy and inflation control by reading the rest of the article.

Table of Comparison

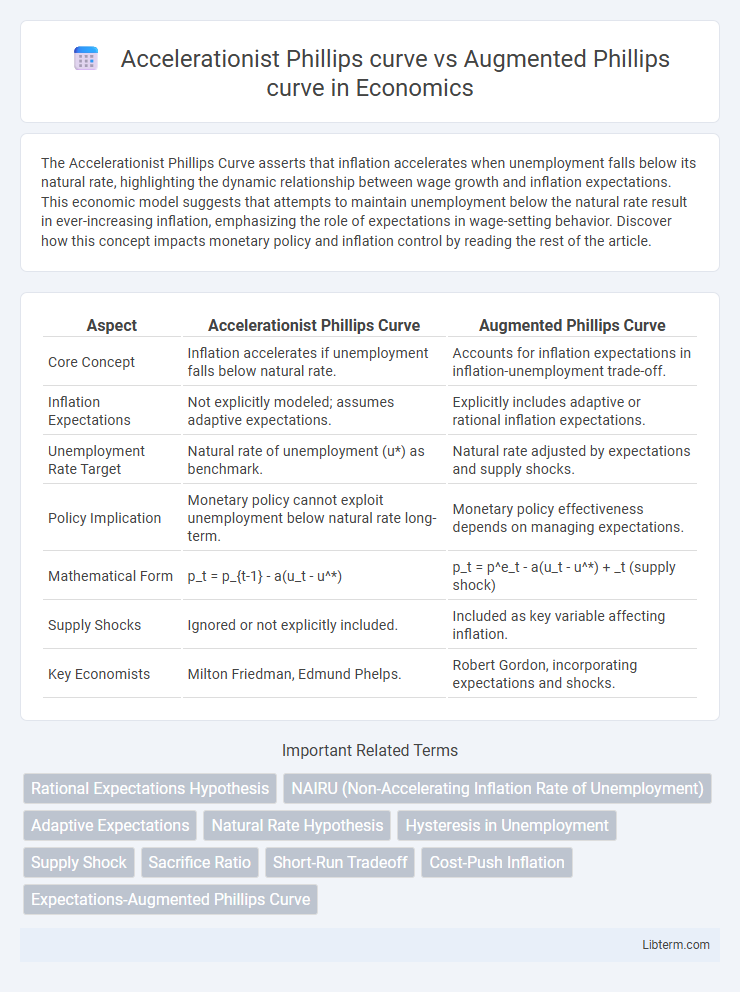

| Aspect | Accelerationist Phillips Curve | Augmented Phillips Curve |

|---|---|---|

| Core Concept | Inflation accelerates if unemployment falls below natural rate. | Accounts for inflation expectations in inflation-unemployment trade-off. |

| Inflation Expectations | Not explicitly modeled; assumes adaptive expectations. | Explicitly includes adaptive or rational inflation expectations. |

| Unemployment Rate Target | Natural rate of unemployment (u*) as benchmark. | Natural rate adjusted by expectations and supply shocks. |

| Policy Implication | Monetary policy cannot exploit unemployment below natural rate long-term. | Monetary policy effectiveness depends on managing expectations. |

| Mathematical Form | p_t = p_{t-1} - a(u_t - u^*) | p_t = p^e_t - a(u_t - u^*) + _t (supply shock) |

| Supply Shocks | Ignored or not explicitly included. | Included as key variable affecting inflation. |

| Key Economists | Milton Friedman, Edmund Phelps. | Robert Gordon, incorporating expectations and shocks. |

Introduction to the Phillips Curve Paradigm

The Phillips Curve paradigm initially illustrated an inverse relationship between unemployment and inflation, highlighting how lower unemployment rates tend to accelerate wage and price increases. The Accelerationist Phillips Curve refines this by incorporating inflation expectations, suggesting that only unexpected inflation can reduce unemployment, emphasizing a non-accelerating inflation rate of unemployment (NAIRU). In contrast, the Augmented Phillips Curve further expands the model by integrating adaptive or rational expectations, reflecting how anticipated inflation influences wage-setting behavior and stabilizes the inflation-unemployment trade-off over time.

Defining the Classical Phillips Curve

The Classical Phillips Curve illustrates an inverse relationship between unemployment and wage inflation, suggesting that lower unemployment leads to higher wages. The Accelerationist Phillips Curve refines this by incorporating expectations of inflation, indicating that only unexpected inflation can reduce unemployment in the long run. The Augmented Phillips Curve further adjusts the model by including adaptive expectations, highlighting a natural rate of unemployment at which inflation remains stable despite policy changes.

Emergence of the Augmented Phillips Curve

The Augmented Phillips Curve emerged to address limitations of the Accelerationist Phillips Curve by incorporating expectations of inflation as a key determinant of wage and price-setting behavior. Unlike the Accelerationist version, which posits a direct trade-off between inflation and unemployment only when inflation expectations are static, the Augmented Phillips Curve integrates adaptive or rational expectations, explaining the persistence of inflation even during periods of high unemployment. This shift reflects the influence of economists like Friedman and Phelps, who emphasized the role of inflation expectations in shaping the long-term relationship between inflation and unemployment.

Understanding Accelerationism in Economics

The Accelerationist Phillips curve emphasizes that inflation accelerates when unemployment falls below the natural rate, highlighting expectations' dynamic adjustment over time. In contrast, the Augmented Phillips curve incorporates adaptive expectations, suggesting a trade-off between inflation and unemployment only in the short run. Understanding accelerationism in economics involves recognizing how persistent inflation expectations drive accelerating inflation without a long-term benefit to unemployment levels.

Theoretical Foundations: Accelerationist Phillips Curve

The Accelerationist Phillips Curve theory posits inflation acceleration depends on the divergence between actual unemployment and the natural rate, emphasizing expectations' role in wage-setting behavior. This model integrates adaptive expectations, suggesting that persistent unemployment below the natural rate drives progressively faster inflation. It contrasts with the Augmented Phillips Curve, which incorporates explicit inflation expectations as a determinant of inflation dynamics alongside unemployment gaps.

Key Assumptions: Augmented vs. Accelerationist Approaches

The Accelerationist Phillips curve assumes that inflation expectations adjust fully and instantaneously, leading to a direct relationship between unemployment and the change in inflation rather than its level, emphasizing the role of expected inflation in wage-setting. In contrast, the Augmented Phillips curve incorporates adaptive or rational expectations, suggesting that both expected inflation and supply shocks influence the inflation-unemployment trade-off, allowing for short-run deviations but no long-run trade-off. Key differences lie in how inflation expectations are modeled--fixed and backward-looking in accelerationist frameworks versus forward-looking or adaptive in augmented models--affecting predictions about inflation persistence and policy effectiveness.

Inflation Expectations and Policy Implications

The Accelerationist Phillips curve emphasizes that inflation expectations adjust rapidly, causing a persistent trade-off between inflation and unemployment only when expectations are static, which implies that stabilizing inflation requires proactive monetary policy to anchor expectations. The Augmented Phillips curve incorporates adaptive inflation expectations and supply shocks, highlighting that policymakers must consider both backward-looking inflation dynamics and external factors to avoid destabilizing output. Effective inflation targeting under these models demands credible commitment to transparency and forward guidance to manage expectations and mitigate inflation volatility.

Empirical Evidence: Comparing Both Curves

Empirical evidence indicates the Augmented Phillips Curve, incorporating expectations of inflation and supply shocks, better explains real-world inflation-unemployment dynamics compared to the Accelerationist Phillips Curve, which emphasizes only the inflation rate's acceleration. Studies analyzing post-1970s data highlight the Augmented model's ability to account for stagflation periods and shifting natural rates of unemployment, making it more robust for policy analysis. Cross-country regressions consistently reveal that adaptive or rational expectations embedded in the Augmented Phillips Curve yield superior predictive accuracy over the traditional Accelerationist framework.

Criticisms and Debates in Modern Macroeconomics

The Accelerationist Phillips curve faces criticism for its reliance on expectations, as it assumes inflation accelerates with unemployment below the natural rate, potentially oversimplifying dynamic labor markets. The Augmented Phillips curve incorporates expectations and supply shocks, but debates persist regarding its predictive accuracy during stagflation and periods of anchored inflation expectations. Modern macroeconomics debates emphasize the challenges in estimating the natural rate of unemployment and the role of forward-looking behavior, questioning the empirical validity of both models in capturing real-world inflation-unemployment trade-offs.

Conclusion: Policy Lessons and Future Research

The Accelerationist Phillips curve highlights the importance of inflation expectations in shaping long-term unemployment and inflation dynamics, suggesting that policymakers should focus on managing expectations to avoid accelerating inflation without gains in employment. The Augmented Phillips curve incorporates supply shocks and varying inflation expectations, emphasizing the need for flexible policy tools that can address both demand and supply-side factors. Future research should explore nonlinear dynamics and the role of global factors in inflation-unemployment trade-offs to better inform adaptive monetary policies.

Accelerationist Phillips curve Infographic

libterm.com

libterm.com