Bond prices fluctuate based on interest rates, credit risk, and market demand, directly impacting your investment returns. When interest rates rise, bond prices typically fall, and vice versa, creating opportunities and risks for investors. Explore the rest of the article to understand how bond pricing affects your portfolio and strategies to optimize your investments.

Table of Comparison

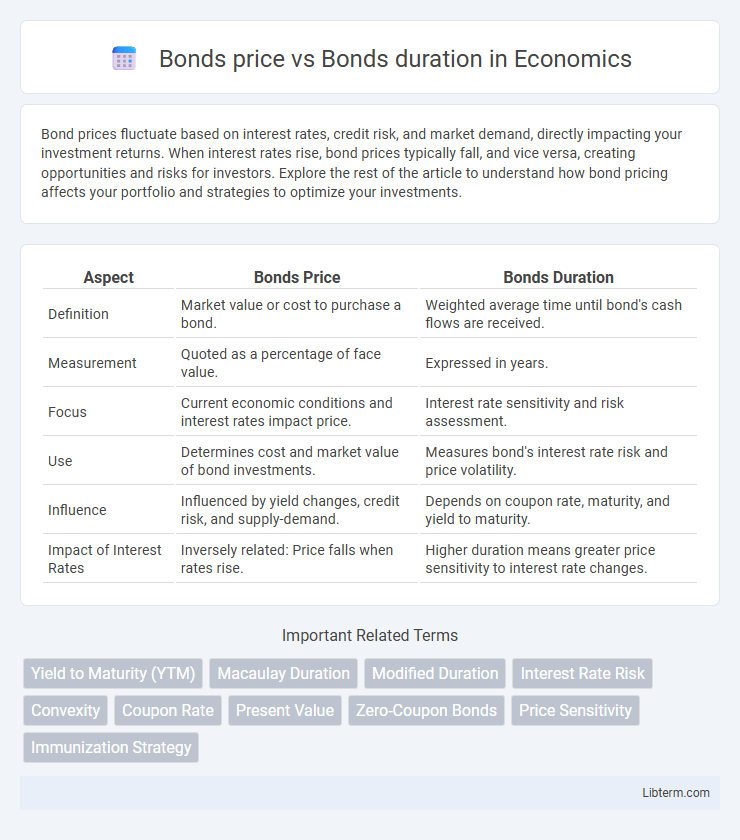

| Aspect | Bonds Price | Bonds Duration |

|---|---|---|

| Definition | Market value or cost to purchase a bond. | Weighted average time until bond's cash flows are received. |

| Measurement | Quoted as a percentage of face value. | Expressed in years. |

| Focus | Current economic conditions and interest rates impact price. | Interest rate sensitivity and risk assessment. |

| Use | Determines cost and market value of bond investments. | Measures bond's interest rate risk and price volatility. |

| Influence | Influenced by yield changes, credit risk, and supply-demand. | Depends on coupon rate, maturity, and yield to maturity. |

| Impact of Interest Rates | Inversely related: Price falls when rates rise. | Higher duration means greater price sensitivity to interest rate changes. |

Introduction to Bonds: Price and Duration

Bond price inversely correlates with interest rates, causing prices to fall when rates rise and rise when rates fall. Duration measures a bond's sensitivity to interest rate changes, quantifying the weighted average time to receive cash flows and thus the price volatility. Understanding bond price and duration is essential for investors assessing interest rate risk and portfolio management strategies.

Understanding Bond Prices

Bond prices and bond duration are intrinsically linked, where bond price reflects the present value of future cash flows discounted at prevailing interest rates, and duration measures the sensitivity of a bond's price to interest rate changes. Longer duration indicates higher price volatility due to interest rate fluctuations, making bond duration a crucial metric for assessing interest rate risk. Understanding bond prices involves analyzing factors such as coupon rates, yield to maturity, and duration to predict how price will react under varying market conditions.

What Is Bond Duration?

Bond duration measures the sensitivity of a bond's price to changes in interest rates, expressed in years. It indicates how much a bond's price will fluctuate when interest rates move by 1%, providing investors a gauge of interest rate risk. Unlike maturity, duration accounts for coupon payments and price, offering a more accurate risk assessment for bond valuation.

Price vs Duration: Key Differences

Bond price reflects the current market value of a bond, influenced by interest rates, credit risk, and time to maturity, whereas bond duration measures the sensitivity of the bond's price to changes in interest rates. Duration quantifies the weighted average time until cash flows are received and serves as a key risk metric, indicating how much the bond price will fluctuate with interest rate movements. Price changes inversely with yield, while duration provides a direct estimate of the magnitude of these price changes relative to interest rate shifts.

How Interest Rates Affect Bond Prices

Bond prices and bond duration share a critical relationship influenced by interest rate fluctuations; as interest rates rise, bond prices typically fall, with longer-duration bonds experiencing greater sensitivity to these changes. This inverse correlation stems from the fixed coupon payments of bonds becoming less attractive compared to new issues offering higher yields, causing a decline in older bond prices. Understanding that bond duration measures interest rate risk helps investors gauge potential price volatility and make informed decisions in varying interest rate environments.

The Role of Duration in Bond Investing

Duration measures a bond's sensitivity to interest rate changes, quantifying the percentage price change for a 1% change in yields. Bonds with longer durations exhibit greater price volatility when interest rates fluctuate, making duration a critical factor for risk assessment in bond investing. Investors use duration to align bond portfolio risk with market interest rate expectations, optimizing returns while managing exposure to rate movements.

Calculating Duration: Macaulay and Modified

Bond price sensitivity to interest rate changes is measured using duration, with Macaulay duration representing the weighted average time until cash flows are received, calculated by summing the present value of each cash flow multiplied by its time period, divided by the current bond price. Modified duration refines this by adjusting Macaulay duration for yield to maturity, providing a direct estimate of the percentage price change in response to a 1% change in interest rates, computed as Macaulay duration divided by (1 + yield per period). These duration measures are critical for bond investors to assess interest rate risk and price volatility effectively.

Duration’s Impact on Bond Price Volatility

Bond duration measures the sensitivity of a bond's price to changes in interest rates, with higher duration indicating greater price volatility. As duration increases, the bond's price experiences larger fluctuations for each basis point change in yield, reflecting higher interest rate risk. Investors use duration to assess and manage potential price volatility when interest rates shift, making it a critical metric for fixed-income portfolio strategies.

Managing Bond Portfolio Risk with Duration

Managing bond portfolio risk requires a strong understanding of the inverse relationship between bond prices and bond duration. Longer-duration bonds experience greater price volatility in response to changes in interest rates compared to shorter-duration bonds, increasing interest rate risk. Investors can reduce exposure to interest rate fluctuations by shortening the portfolio's average duration, thereby stabilizing bond prices and enhancing risk management.

Practical Examples: Bonds Price vs Duration

A bond with a 10-year duration will experience larger price fluctuations than a bond with a 3-year duration when interest rates change. For example, if interest rates rise by 1%, a bond priced at $1,000 with a 10-year duration might decrease in value by approximately $100, whereas a 3-year duration bond may only drop by around $30. Investors use duration to estimate the sensitivity of bond prices to interest rate changes, helping manage risk in fixed-income portfolios.

Bonds price Infographic

libterm.com

libterm.com