BRICS economies--Brazil, Russia, India, China, and South Africa--represent some of the fastest-growing, influential emerging markets with significant impact on global trade and investment. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--offer promising growth potential driven by young populations, strategic locations, and diverse resources. Explore the rest of this article to understand how these dynamic economies could shape your business strategies and investment opportunities.

Table of Comparison

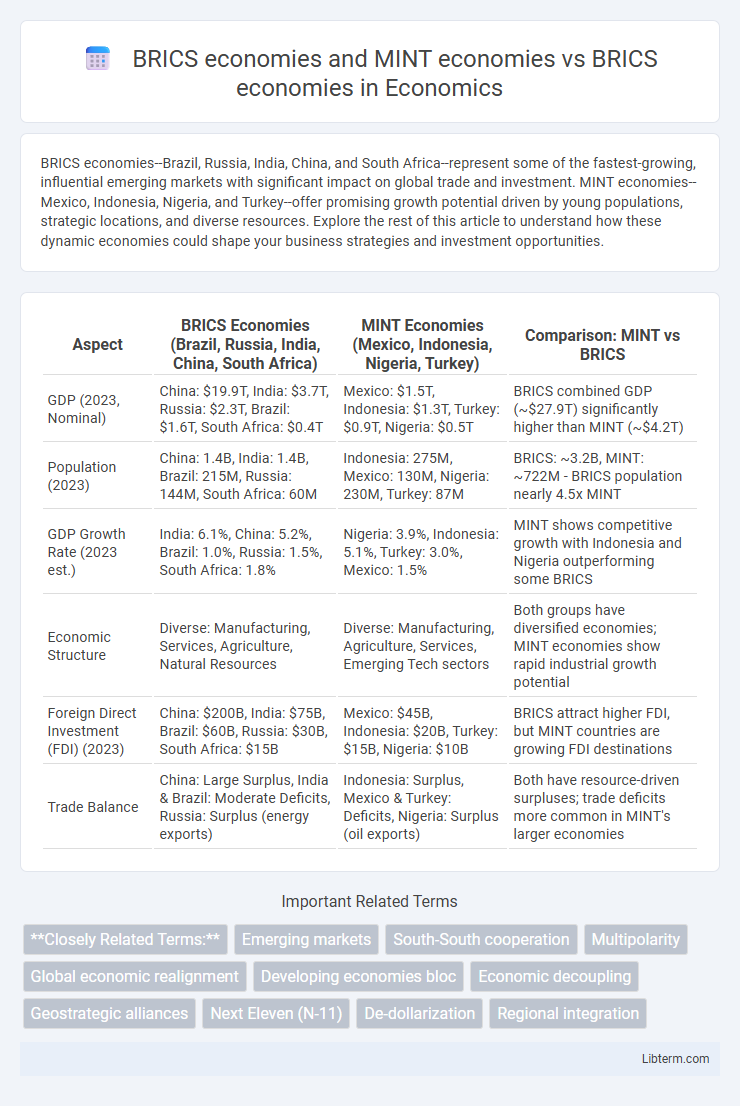

| Aspect | BRICS Economies (Brazil, Russia, India, China, South Africa) | MINT Economies (Mexico, Indonesia, Nigeria, Turkey) | Comparison: MINT vs BRICS |

|---|---|---|---|

| GDP (2023, Nominal) | China: $19.9T, India: $3.7T, Russia: $2.3T, Brazil: $1.6T, South Africa: $0.4T | Mexico: $1.5T, Indonesia: $1.3T, Turkey: $0.9T, Nigeria: $0.5T | BRICS combined GDP (~$27.9T) significantly higher than MINT (~$4.2T) |

| Population (2023) | China: 1.4B, India: 1.4B, Brazil: 215M, Russia: 144M, South Africa: 60M | Indonesia: 275M, Mexico: 130M, Nigeria: 230M, Turkey: 87M | BRICS: ~3.2B, MINT: ~722M - BRICS population nearly 4.5x MINT |

| GDP Growth Rate (2023 est.) | India: 6.1%, China: 5.2%, Brazil: 1.0%, Russia: 1.5%, South Africa: 1.8% | Nigeria: 3.9%, Indonesia: 5.1%, Turkey: 3.0%, Mexico: 1.5% | MINT shows competitive growth with Indonesia and Nigeria outperforming some BRICS |

| Economic Structure | Diverse: Manufacturing, Services, Agriculture, Natural Resources | Diverse: Manufacturing, Agriculture, Services, Emerging Tech sectors | Both groups have diversified economies; MINT economies show rapid industrial growth potential |

| Foreign Direct Investment (FDI) (2023) | China: $200B, India: $75B, Brazil: $60B, Russia: $30B, South Africa: $15B | Mexico: $45B, Indonesia: $20B, Turkey: $15B, Nigeria: $10B | BRICS attract higher FDI, but MINT countries are growing FDI destinations |

| Trade Balance | China: Large Surplus, India & Brazil: Moderate Deficits, Russia: Surplus (energy exports) | Indonesia: Surplus, Mexico & Turkey: Deficits, Nigeria: Surplus (oil exports) | Both have resource-driven surpluses; trade deficits more common in MINT's larger economies |

Introduction to BRICS and MINT Economies

BRICS economies--comprising Brazil, Russia, India, China, and South Africa--represent a significant portion of global GDP, driven by diverse natural resources, large populations, and emerging industrial sectors. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--are recognized for their strategic geographic locations, youthful demographics, and rapid urbanization fostering accelerated economic growth potential. While BRICS maintain substantial influence in global trade and finance, MINT economies are poised as next-generation emerging markets with strong investment opportunities and expanding consumer bases.

Historical Evolution: BRICS vs MINT

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, emerged in the early 2000s as influential global players through rapid industrialization and strategic economic reforms, leveraging abundant natural resources and large populations. In contrast, MINT economies--Mexico, Indonesia, Nigeria, and Turkey--gained prominence later, driven by demographic dividends, diverse economic bases, and expanding middle classes aimed at capitalizing on globalization trends. While BRICS historically prioritized heavy industries and export-led growth, MINT countries emphasize service sectors, technology adoption, and regional integration to foster sustained economic resilience.

Economic Growth Drivers: A Comparative Analysis

BRICS economies--comprising Brazil, Russia, India, China, and South Africa--drive growth primarily through large domestic markets, natural resource exports, and rapid industrialization, with China and India leading in technology and manufacturing. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--show growth potentials fueled by demographic dividends, strategic geographic locations, and expanding middle-class consumption, with strong contributions from agriculture, manufacturing, and services sectors. Compared to BRICS, MINT economies benefit from younger populations and lower labor costs, presenting competitive advantages in workforce-driven growth, though they often face infrastructural and political challenges limiting rapid industrial scale-up.

Demographic Dynamics in BRICS and MINT Nations

BRICS economies, including Brazil, Russia, India, China, and South Africa, feature diverse demographic dynamics with aging populations in Russia and China contrasting with youthful, rapidly growing populations in India and Brazil, driving varying economic growth potentials. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--exhibit younger populations with high fertility rates, presenting robust labor force expansion and consumer market growth compared to BRICS, positioning them as emerging investment hotspots. Understanding demographic trends highlights labor supply advantages and challenges such as dependency ratios, which significantly impact economic trajectories and development policies in both BRICS and MINT nations.

Trade Patterns and Foreign Investment Trends

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, dominate global trade with diversified export portfolios spanning natural resources, manufacturing, and technology sectors, attracting substantial foreign direct investment (FDI) due to their large consumer markets and industrial bases. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--exhibit emerging trade patterns focused on manufacturing, agriculture, and energy exports, benefiting from strategic geographic locations that enhance export competitiveness while showing robust growth in FDI inflows driven by improving infrastructure and market reforms. Compared to BRICS, MINT countries maintain faster trade growth rates and increasing foreign investment diversification, yet face challenges in infrastructure and political stability that influence long-term trade sustainability and capital inflows.

Technological Innovation and Industrialization

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, have demonstrated significant advancements in technological innovation and industrialization, particularly with China's leadership in 5G technology and India's growing IT sector. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--are emerging as dynamic hubs for industrialization and technology adoption, leveraging younger populations and increasing digital infrastructure investments to accelerate growth. Compared to BRICS, MINT economies show faster adaptability in technology startups and manufacturing diversification, but BRICS maintain stronger global market influence due to established industrial bases and robust R&D ecosystems.

Political Stability and Governance Structures

BRICS economies, consisting of Brazil, Russia, India, China, and South Africa, demonstrate diverse political stability levels, with India and China showing relatively stable governance structures supporting economic growth, while Brazil and South Africa face challenges related to political volatility and corruption. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--exhibit varying governance frameworks, where Indonesia's improving political stability contrasts with ongoing institutional weaknesses in Nigeria and Turkey that impact investor confidence. Comparing both groups, BRICS countries generally have more established political systems and experience higher governance effectiveness, whereas MINT economies often navigate transitional political environments that influence policy implementation and economic trajectory.

Global Influence and Geopolitical Roles

BRICS economies--Brazil, Russia, India, China, and South Africa--wield significant global influence due to their large GDPs, substantial natural resources, and strategic geopolitical positioning, shaping international trade and diplomatic alliances. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--are emerging markets with rapid economic growth, youthful populations, and increasing regional geopolitical roles, challenging established power balances in their respective continents. While BRICS nations hold established global clout through institutional participation in groups like the G20, MINT countries are becoming pivotal in future global economic shifts, leveraging demographic advantages and strategic regional partnerships.

Key Challenges Facing BRICS and MINT Economies

BRICS economies face key challenges such as political instability, infrastructure deficits, and income inequality, hindering sustainable growth and global influence. MINT economies encounter hurdles like limited industrial diversification, inadequate healthcare systems, and vulnerability to external economic shocks, slowing their development potential compared to BRICS. Both groups struggle with balancing rapid urbanization and environmental sustainability, impacting long-term economic resilience.

Future Prospects: Synergies and Divergences

BRICS economies--Brazil, Russia, India, China, and South Africa--exhibit strong synergies in natural resource wealth and large domestic markets, driving growth through industrial diversification and infrastructure investments. MINT economies--Mexico, Indonesia, Nigeria, and Turkey--show promising growth fueled by young populations, technological adoption, and strategic geographic positions, but face divergences in political stability and economic diversification. Future prospects hinge on BRICS leveraging established global influence while MINT economies capitalize on demographic dividends and innovation potential to complement global growth dynamics.

BRICS economies and MINT economies Infographic

libterm.com

libterm.com