The Beveridge curve illustrates the relationship between job vacancies and unemployment, revealing insights into labor market efficiency and economic health. Shifts in the curve can indicate changes in matching efficiency between job seekers and employers, impacting your understanding of employment trends. Explore the rest of the article to discover how this concept influences labor market policies and economic forecasting.

Table of Comparison

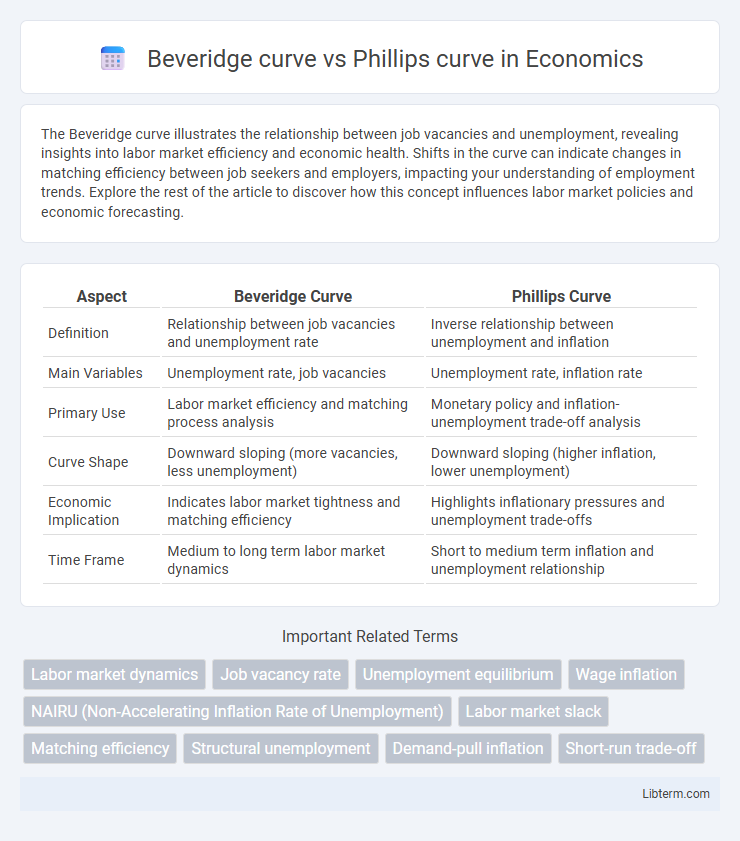

| Aspect | Beveridge Curve | Phillips Curve |

|---|---|---|

| Definition | Relationship between job vacancies and unemployment rate | Inverse relationship between unemployment and inflation |

| Main Variables | Unemployment rate, job vacancies | Unemployment rate, inflation rate |

| Primary Use | Labor market efficiency and matching process analysis | Monetary policy and inflation-unemployment trade-off analysis |

| Curve Shape | Downward sloping (more vacancies, less unemployment) | Downward sloping (higher inflation, lower unemployment) |

| Economic Implication | Indicates labor market tightness and matching efficiency | Highlights inflationary pressures and unemployment trade-offs |

| Time Frame | Medium to long term labor market dynamics | Short to medium term inflation and unemployment relationship |

Introduction to the Beveridge Curve and Phillips Curve

The Beveridge Curve illustrates the inverse relationship between job vacancies and unemployment, highlighting labor market efficiency and matching dynamics. The Phillips Curve depicts the trade-off between inflation and unemployment, suggesting that lower unemployment often accompanies higher inflation rates. Understanding both curves provides crucial insights into macroeconomic policy and labor market behavior.

Historical Background of Both Economic Curves

The Beveridge curve, developed by economist Christopher Beveridge in the 1950s, illustrates the inverse relationship between job vacancies and unemployment, highlighting labor market matching efficiency. The Phillips curve, introduced by A.W. Phillips in 1958, shows the historical inverse correlation between unemployment rates and wage inflation, later extended to price inflation and unemployment. Both curves have significantly influenced macroeconomic policy and labor market analysis, reflecting changing economic conditions over decades.

Defining the Beveridge Curve: Vacancy and Unemployment Relationship

The Beveridge Curve illustrates the inverse relationship between job vacancies and unemployment, highlighting labor market efficiency in matching job seekers with available positions. It captures how higher vacancy rates generally correspond to lower unemployment rates, reflecting the dynamic flow between job creation and job destruction. This curve serves as a crucial tool for analyzing structural changes in the labor market and assessing the impact of frictional unemployment.

Understanding the Phillips Curve: Inflation and Unemployment Trade-off

The Phillips Curve illustrates the inverse relationship between inflation and unemployment, suggesting that lower unemployment rates tend to coincide with higher inflation due to increased demand for labor. In contrast, the Beveridge Curve depicts the relationship between job vacancies and unemployment, emphasizing labor market efficiency and matching dynamics. Understanding the Phillips Curve is crucial for policymakers aiming to balance inflation control with employment levels through monetary and fiscal strategies.

Mathematical Formulations of the Beveridge and Phillips Curves

The Beveridge curve is mathematically represented by the inverse relationship between the unemployment rate (u) and the job vacancy rate (v), often expressed as v = f(u), where f is a decreasing function indicating labor market tightness. The Phillips curve models the trade-off between unemployment (u) and inflation (p), generally formulated as p = pe - a(u - u*) + e, where pe denotes expected inflation, u* is the natural rate of unemployment, a > 0 measures sensitivity, and e captures supply shocks. Both curves are pivotal in macroeconomic analysis, with the Beveridge curve focusing on labor market matching efficiency and the Phillips curve illustrating inflation-unemployment dynamics.

Key Differences Between Beveridge Curve and Phillips Curve

The Beveridge curve illustrates the inverse relationship between job vacancies and unemployment rates, highlighting labor market efficiency and matching dynamics, whereas the Phillips curve depicts the trade-off between inflation and unemployment, focusing on wage inflation and price-setting behavior. Key differences include the Beveridge curve's emphasis on structural aspects of labor markets, such as vacancy-unemployment matching, while the Phillips curve centers on cyclical economic fluctuations and inflation expectations. The Beveridge curve is primarily used to analyze labor market frictions and matching efficiency, whereas the Phillips curve informs monetary policy by linking inflation dynamics to labor market tightness.

Factors Influencing the Beveridge and Phillips Curves

Labor market efficiency, job search intensity, and matching technology significantly influence the position and shape of the Beveridge curve by affecting unemployment and vacancy rates. The Phillips curve is shaped by factors such as inflation expectations, wage rigidity, and supply shocks, which determine the trade-off between unemployment and inflation. Structural changes like labor market reforms and productivity growth can shift both curves, altering their dynamics in response to economic conditions.

Shifts and Movements: Interpretation in Real-World Economies

Shifts along the Beveridge curve represent changes in the efficiency of matching unemployed workers with job vacancies, while movements along the curve indicate fluctuations in the natural rate of unemployment and vacancy rate equilibrium. In contrast, shifts in the Phillips curve reflect changes in inflation expectations or supply shocks, whereas movements along the curve denote short-run trade-offs between unemployment and inflation. Real-world economies experience concurrent shifts and movements in both curves due to labor market rigidities, policy interventions, and external shocks affecting wage-setting and price dynamics.

Policy Implications: How Economists Use Both Curves

Economists use the Beveridge curve and Phillips curve to inform monetary and labor market policies by analyzing the dynamic relationships between unemployment, job vacancies, and inflation. The Beveridge curve guides policies aimed at improving labor market efficiency and matching, helping reduce structural unemployment, while the Phillips curve influences inflation targeting and wage-setting strategies to balance inflation and unemployment trade-offs. Combining insights from both curves enables policymakers to design comprehensive interventions that address cyclical fluctuations and structural labor market challenges simultaneously.

Conclusion: Comparative Insights and Future Trends

The Beveridge curve illustrates the inverse relationship between job vacancies and unemployment, highlighting labor market efficiency, while the Phillips curve demonstrates the trade-off between inflation and unemployment, emphasizing price dynamics. Comparative analysis reveals that understanding the interactions between these curves enhances macroeconomic policy design by balancing employment growth and inflation control. Future trends suggest incorporating real-time labor market data and inflation expectations into dynamic models to improve predictive accuracy and policy responsiveness.

Beveridge curve Infographic

libterm.com

libterm.com