Rent-seeking involves individuals or businesses attempting to increase their own wealth without creating new value, often through manipulation or exploitation of the economic or political environment. This behavior can lead to inefficiencies and hinder overall economic growth by diverting resources away from productive activities. Discover how rent-seeking impacts economies and what you can do to recognize and address it in the full article.

Table of Comparison

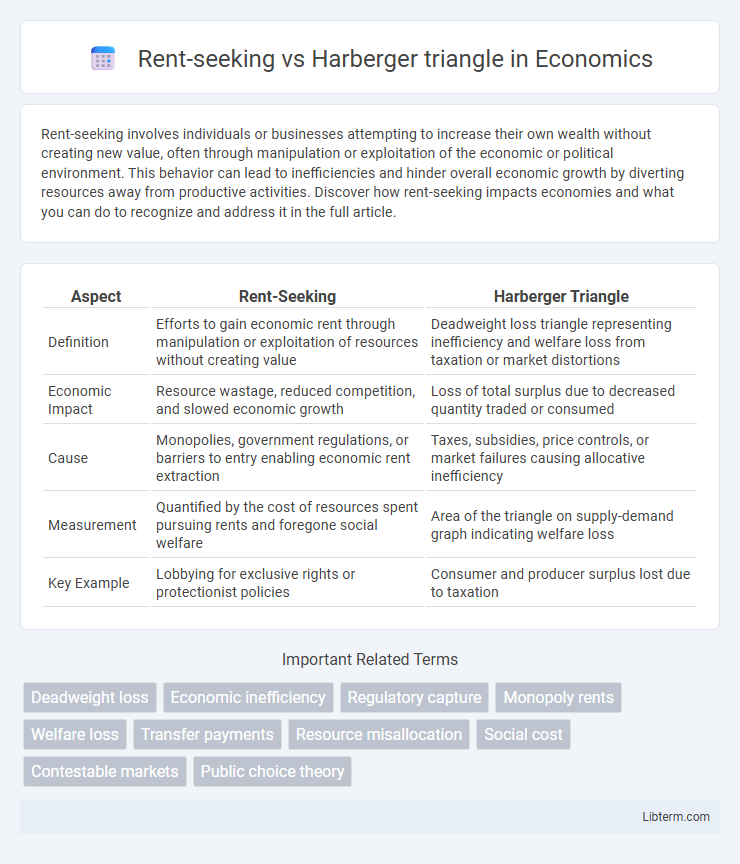

| Aspect | Rent-Seeking | Harberger Triangle |

|---|---|---|

| Definition | Efforts to gain economic rent through manipulation or exploitation of resources without creating value | Deadweight loss triangle representing inefficiency and welfare loss from taxation or market distortions |

| Economic Impact | Resource wastage, reduced competition, and slowed economic growth | Loss of total surplus due to decreased quantity traded or consumed |

| Cause | Monopolies, government regulations, or barriers to entry enabling economic rent extraction | Taxes, subsidies, price controls, or market failures causing allocative inefficiency |

| Measurement | Quantified by the cost of resources spent pursuing rents and foregone social welfare | Area of the triangle on supply-demand graph indicating welfare loss |

| Key Example | Lobbying for exclusive rights or protectionist policies | Consumer and producer surplus lost due to taxation |

Understanding Rent-Seeking: A Brief Overview

Rent-seeking involves individuals or firms attempting to gain economic benefits through manipulation or exploitation of the political or regulatory environment rather than creating new wealth. The Harberger triangle represents the deadweight loss associated with market inefficiencies, which can be exacerbated by rent-seeking activities that distort resource allocation. Understanding rent-seeking is crucial for identifying how economic inefficiencies arise from seeking unproductive gains, leading to welfare losses captured by the Harberger triangle.

Defining the Harberger Triangle in Economics

The Harberger Triangle in economics represents the deadweight loss caused by market inefficiencies such as taxes, subsidies, or monopolies, illustrating the reduction in total surplus where consumer and producer surplus are not maximized. This concept quantifies the welfare loss to society when resources are misallocated, contrasting with rent-seeking, which involves efforts to gain economic rent through non-productive activities. Understanding the Harberger Triangle helps economists measure the economic cost of distortions that prevent optimal market equilibrium.

Key Differences Between Rent-Seeking and Harberger Triangle

Rent-seeking involves efforts to increase one's share of existing wealth without creating new wealth, often through lobbying or regulatory capture, whereas the Harberger triangle represents the deadweight loss caused by market inefficiencies like taxes or monopolies. Rent-seeking typically leads to resource misallocation and lowers overall economic efficiency by diverting resources toward non-productive activities. The Harberger triangle quantifies welfare loss in terms of reduced consumer and producer surplus resulting from distorted prices or output deviations from competitive equilibrium.

Economic Impacts of Rent-Seeking Behavior

Rent-seeking behavior leads to inefficient allocation of resources by diverting efforts toward securing economic rents rather than productive activities, resulting in overall welfare loss. The Harberger triangle quantifies this deadweight loss as the area of inefficiency between supply and demand curves caused by distortions such as taxes or monopolies. Persistent rent-seeking decreases market competitiveness, reduces innovation incentives, and slows economic growth by creating barriers to entry and increasing transaction costs.

Welfare Losses Illustrated by the Harberger Triangle

The Harberger triangle quantifies welfare losses from market distortions, highlighting deadweight loss due to inefficient resource allocation caused by rent-seeking behavior. Rent-seeking leads to economic inefficiencies where resources are wasted on securing favorable policies or monopolistic rents rather than productive activities, exacerbating the Harberger triangle's illustrated social welfare loss. Empirical studies demonstrate that pervasive rent-seeking inflates the size of the Harberger triangle, signaling significant reductions in total surplus and overall economic well-being.

Real-World Examples: Rent-Seeking vs. Deadweight Loss

Rent-seeking often manifests in monopolistic practices where firms expend resources lobbying for regulations that limit competition, exemplified by large corporations influencing patent laws to extend market exclusivity, which leads to inefficient allocation of resources. The Harberger triangle, representing deadweight loss, quantifies the welfare loss from such market distortions, as seen in tariffs on imported goods that reduce consumer surplus and overall economic efficiency. Real-world examples include rent-seeking behaviors in the pharmaceutical industry's patent extensions contrasted with the deadweight loss caused by agricultural subsidies that distort market prices and production incentives.

Policy Implications for Addressing Rent-Seeking

Policies targeting rent-seeking should aim to minimize resource misallocation by reducing barriers to competition and enhancing market transparency, thus limiting the creation of economic rents that lead to deadweight losses represented by the Harberger triangle. Implementing regulatory reforms that streamline licensing, enforce anti-corruption measures, and promote open access to market information can diminish incentives for rent extraction and improve overall economic efficiency. Designing tax policies to capture excess profits while avoiding distortions encourages productive investment and mitigates welfare losses associated with rent-seeking behavior.

Mitigating Deadweight Loss in Competitive Markets

Mitigating deadweight loss in competitive markets involves reducing rent-seeking behaviors that distort resource allocation and decrease overall welfare. The Harberger triangle quantifies the inefficiency caused by taxes or market distortions, highlighting areas where intervention can improve efficiency. Implementing policies that lower barriers to competition and discourage rent-seeking can shrink the Harberger triangle, enhancing market outcomes and promoting optimal resource distribution.

Comparative Analysis: Efficiency Losses and Social Costs

Rent-seeking generates efficiency losses by diverting resources from productive activities to lobbying or other non-productive efforts, resulting in deadweight losses that exceed the Harberger triangle associated with pure taxation distortions. The Harberger triangle quantifies the social cost of taxes by measuring the reduction in consumer and producer surplus due to market distortions but does not fully capture the extra social costs imposed by rent-seeking behaviors. Comparative analysis shows that while the Harberger triangle estimates the direct efficiency loss from taxation, rent-seeking introduces additional social costs such as resource misallocation and increased inequality, amplifying overall welfare losses beyond standard deadweight losses.

Conclusions: Balancing Policies to Minimize Economic Inefficiency

Balancing policies to minimize economic inefficiency requires addressing both rent-seeking activities and the Harberger triangle deadweight loss. Effective regulation curbs rent-seeking by reducing unproductive resource expenditures aimed at securing economic rents, while optimal taxation and subsidy designs target the distortions depicted by the Harberger triangle, enhancing allocative efficiency. Policymakers must integrate strategies that simultaneously limit rent extraction and market inefficiencies to promote sustainable economic growth.

Rent-seeking Infographic

libterm.com

libterm.com