Fiscal stimulus boosts economic activity by increasing government spending or cutting taxes to encourage consumer and business spending. It plays a crucial role in mitigating recessions and accelerating recovery by injecting demand into the economy. Discover how fiscal stimulus can impact your financial future and the broader market by reading the full article.

Table of Comparison

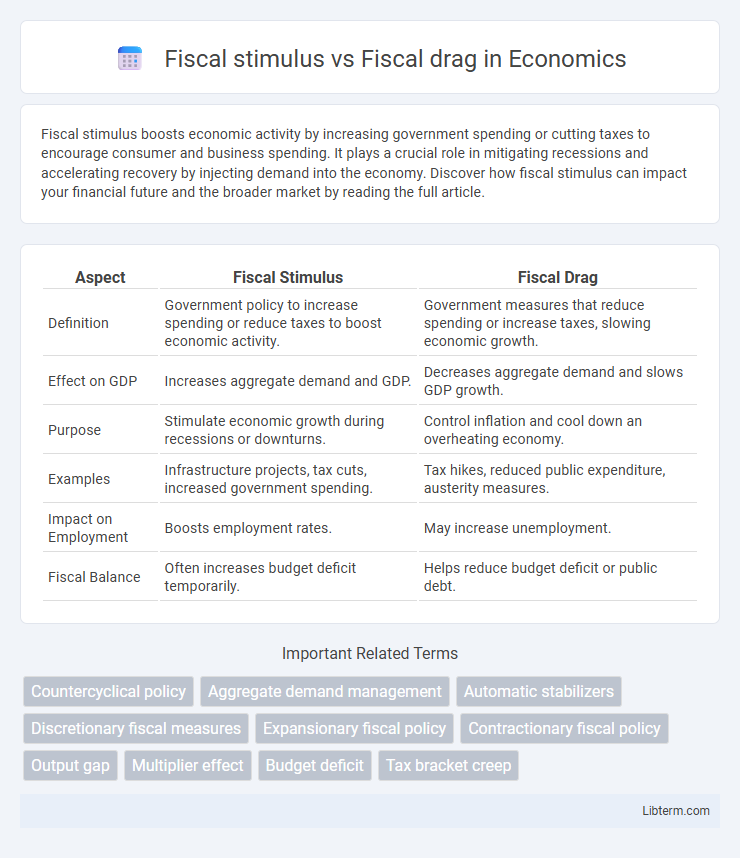

| Aspect | Fiscal Stimulus | Fiscal Drag |

|---|---|---|

| Definition | Government policy to increase spending or reduce taxes to boost economic activity. | Government measures that reduce spending or increase taxes, slowing economic growth. |

| Effect on GDP | Increases aggregate demand and GDP. | Decreases aggregate demand and slows GDP growth. |

| Purpose | Stimulate economic growth during recessions or downturns. | Control inflation and cool down an overheating economy. |

| Examples | Infrastructure projects, tax cuts, increased government spending. | Tax hikes, reduced public expenditure, austerity measures. |

| Impact on Employment | Boosts employment rates. | May increase unemployment. |

| Fiscal Balance | Often increases budget deficit temporarily. | Helps reduce budget deficit or public debt. |

Understanding Fiscal Stimulus and Fiscal Drag

Fiscal stimulus involves government policies such as increased public spending and tax cuts aimed at boosting economic growth by increasing aggregate demand. Fiscal drag occurs when rising incomes push taxpayers into higher tax brackets, reducing disposable income and slowing economic expansion. Understanding these concepts is essential for analyzing how fiscal policy influences economic cycles and overall market stability.

Key Differences Between Fiscal Stimulus and Fiscal Drag

Fiscal stimulus involves increased government spending or tax cuts aimed at boosting economic activity, while fiscal drag occurs when higher taxes or reduced spending slow down economic growth. The key difference lies in their effects on aggregate demand: fiscal stimulus raises it, promoting expansion, whereas fiscal drag decreases it, leading to contraction. Understanding these effects is crucial for policymakers to balance economic growth and inflation control.

How Fiscal Stimulus Boosts Economic Growth

Fiscal stimulus boosts economic growth by increasing government spending and lowering taxes, which raises overall demand and encourages higher consumption and investment. This heightened economic activity leads to job creation, increased business revenues, and improved consumer confidence, fueling further expansion. The multiplier effect of fiscal stimulus amplifies its impact, accelerating GDP growth and reducing unemployment during economic downturns.

The Mechanics of Fiscal Drag on Economies

Fiscal drag occurs when rising incomes push taxpayers into higher tax brackets, increasing average tax rates and reducing disposable income, which suppresses consumer spending and slows economic growth. This mechanism contracts aggregate demand by increasing the tax burden without explicit policy changes, leading to lower private sector consumption and investment. Fiscal drag can act as an automatic stabilizer but also risk deepening recessions during economic downturns by restricting fiscal flexibility.

Real-World Examples of Fiscal Stimulus

Fiscal stimulus involves government measures such as increased public spending or tax cuts to boost economic activity, exemplified by the 2009 American Recovery and Reinvestment Act which injected $831 billion into the U.S. economy during the Great Recession. Other real-world examples include China's 2008-2009 stimulus plan worth approximately 4 trillion yuan aimed at infrastructure investment to counteract global downturns. These interventions contrast with fiscal drag, where rising taxes and reduced government spending slow economic growth during recovery phases.

Indicators of Fiscal Drag in an Economy

Fiscal drag occurs when rising incomes push taxpayers into higher tax brackets, increasing overall tax revenues without legislative changes, which dampens consumer spending and economic growth. Key indicators of fiscal drag include an increasing average tax rate, a shrinking disposable income despite rising gross income, and a reduction in aggregate demand due to higher personal tax burdens. Monitoring these indicators helps policymakers assess the contractionary effects of fiscal drag on the economy.

Fiscal Tools: Policy Approaches in Practice

Fiscal stimulus involves government policies such as increased public spending and tax cuts to boost aggregate demand and economic growth during downturns. Fiscal drag occurs when rising taxes and reduced government expenditure slow economic activity, typically during periods of inflation or economic overheating. Policymakers balance these fiscal tools by adjusting budget deficits or surpluses to stabilize output and control inflation, using countercyclical measures tailored to the business cycle.

Impacts on Employment and Consumer Spending

Fiscal stimulus increases government spending or cuts taxes to boost aggregate demand, leading to higher employment and increased consumer spending by putting more disposable income into households. Fiscal drag occurs when rising tax revenues or reduced government spending cool economic activity, resulting in slower job growth and decreased consumer spending as households face tighter budgets. The contrasting effects on employment and consumer spending highlight the role of fiscal policy in managing economic cycles and stabilizing growth.

Fiscal Stimulus vs Fiscal Drag: Policy Challenges

Fiscal stimulus involves increased government spending or tax cuts aimed at boosting economic growth and reducing unemployment. Fiscal drag occurs when rising incomes push taxpayers into higher tax brackets, reducing disposable income and slowing economic activity. Policymakers face challenges in balancing stimulus efforts to prevent overheating while managing fiscal drag effects that can dampen economic expansion during recovery phases.

Strategic Balancing for Sustainable Economic Growth

Fiscal stimulus injects public funds into the economy to boost demand and accelerate growth during downturns, whereas fiscal drag occurs when rising tax revenues or reduced government spending slow economic expansion by restraining consumer and business activity. Strategic balancing involves calibrating fiscal policies to stimulate growth without triggering overheating or inflation, ensuring public debt remains sustainable while supporting employment and investment. Achieving this balance fosters stable, long-term economic growth by mitigating cyclical fluctuations and maintaining fiscal health.

Fiscal stimulus Infographic

libterm.com

libterm.com