Default spread measures the difference in yield between a corporate bond and a comparable government bond, reflecting the market's perception of the issuer's credit risk. This spread widens when investors perceive higher risk of default, directly impacting your investment decisions and portfolio management. Explore the rest of the article to understand how default spreads influence financial markets and investment strategies.

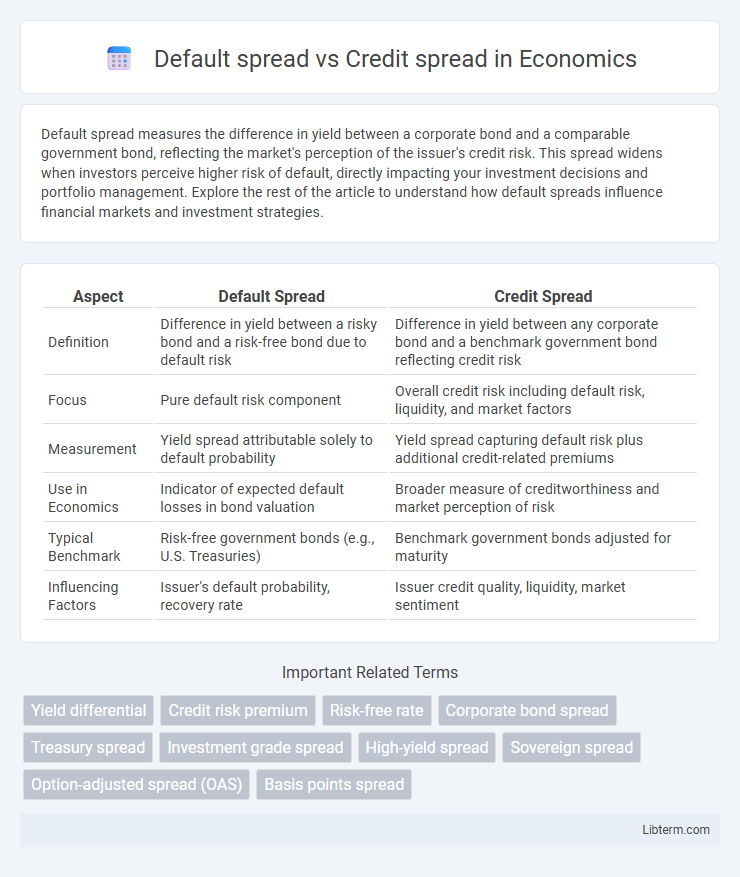

Table of Comparison

| Aspect | Default Spread | Credit Spread |

|---|---|---|

| Definition | Difference in yield between a risky bond and a risk-free bond due to default risk | Difference in yield between any corporate bond and a benchmark government bond reflecting credit risk |

| Focus | Pure default risk component | Overall credit risk including default risk, liquidity, and market factors |

| Measurement | Yield spread attributable solely to default probability | Yield spread capturing default risk plus additional credit-related premiums |

| Use in Economics | Indicator of expected default losses in bond valuation | Broader measure of creditworthiness and market perception of risk |

| Typical Benchmark | Risk-free government bonds (e.g., U.S. Treasuries) | Benchmark government bonds adjusted for maturity |

| Influencing Factors | Issuer's default probability, recovery rate | Issuer credit quality, liquidity, market sentiment |

Introduction to Default Spread and Credit Spread

Default spread and credit spread both represent the risk premium investors demand for bearing credit risk, but they focus on different aspects of that risk. Default spread specifically measures the yield difference between a corporate bond and a risk-free government bond due to the issuer's likelihood of default, while credit spread more broadly encompasses the compensation for various credit risks, including default risk, liquidity risk, and market risk. Understanding default spread provides insight into default probability, whereas credit spread reflects the overall credit risk premium embedded in bond prices.

Definition of Default Spread

Default spread refers to the difference in yield between a corporate bond and a risk-free government bond of similar maturity, reflecting the additional compensation investors require for the risk of borrower default. It measures the credit risk premium embedded in bond pricing, indicating the market's assessment of the likelihood of default. Default spread is a key component in credit spread analysis, directly quantifying default risk separate from other factors like liquidity or tax considerations.

Definition of Credit Spread

Credit spread refers to the difference in yield between a corporate bond and a comparable maturity government bond, reflecting the additional risk premium investors demand for credit risk. It captures the compensation required for the possibility of issuer default and other credit-related uncertainties. Default spread, a component of credit spread, specifically denotes the yield difference due to the probability of default, while credit spread also includes liquidity and other market risk factors.

Key Differences Between Default Spread and Credit Spread

Default spread represents the yield difference between a corporate bond and a risk-free Treasury bond of the same maturity, directly reflecting the issuer's default risk. Credit spread broadens this concept by encompassing all risks affecting the bond's yield, including default risk, liquidity risk, and market sentiment, thus providing a more comprehensive measure of credit risk premium. The key difference lies in default spread solely quantifying default risk, whereas credit spread captures a wider array of factors influencing bond prices and yields.

Calculation Methods for Default Spread and Credit Spread

Default spread calculation typically involves measuring the difference between the yield on a corporate bond and a risk-free government bond of the same maturity to quantify the premium investors demand for default risk. Credit spread calculation, on the other hand, accounts for the difference between the yields of bonds with similar maturities and credit ratings, incorporating factors such as liquidity, tax treatment, and market conditions. Advanced models like structural and reduced-form frameworks use firm-specific financial data and market information to estimate default probabilities and recoveries, refining both default and credit spread estimations.

Importance in Fixed Income Markets

Default spread and credit spread are critical metrics in fixed income markets, reflecting the additional yield investors demand for bearing credit risk over risk-free securities. The default spread specifically measures the yield difference attributable to the issuer's probability of default, while the credit spread encompasses overall credit risk, including liquidity and market perception. Understanding these spreads enables investors to evaluate risk premiums, price bonds accurately, and make informed investment decisions in corporate and sovereign debt instruments.

Factors Influencing Default and Credit Spreads

Default spreads and credit spreads are influenced by factors such as the issuer's creditworthiness, macroeconomic conditions, and market liquidity. Credit spreads also reflect investors' risk premiums for bearing credit risk, including the issuer's probability of default and recovery rates. Additionally, changes in interest rates, sector-specific risks, and overall market sentiment play significant roles in determining these spreads.

Default Spread vs Credit Spread: Use Cases

Default spread measures the yield difference between a corporate bond and a risk-free government bond of similar maturity, primarily reflecting the issuer's credit risk and likelihood of default. Credit spread encompasses a broader risk premium, including liquidity risk, tax considerations, and market sentiment in addition to default risk, making it useful for comprehensive bond valuation and portfolio management. Investors use default spread for assessing pure default risk, while credit spread aids in evaluating overall compensation for credit and non-credit-related risks.

Implications for Investors and Portfolio Management

Default spread measures the yield difference between corporate bonds and risk-free government bonds of similar maturity, reflecting the credit risk premium investors demand. Credit spread encompasses the broader risk factors including liquidity, market conditions, and investor sentiment, influencing the overall yield above risk-free rates. Investors use default and credit spread analysis for portfolio diversification, risk assessment, and optimizing returns, adjusting bond allocations to manage exposure to credit risk and potential default losses.

Conclusion: Choosing the Right Metric

Choosing the right metric between default spread and credit spread depends on the specific risk assessment needs; default spread isolates the risk of default by comparing yields on corporate bonds to risk-free securities, making it ideal for evaluating credit risk alone. Credit spread, encompassing both default risk and other factors like liquidity and market risk, offers a more comprehensive view of total credit market risk. Investors focusing on pure default risk should prioritize default spread, while those requiring broader market insights should consider credit spread for investment decisions.

Default spread Infographic

libterm.com

libterm.com