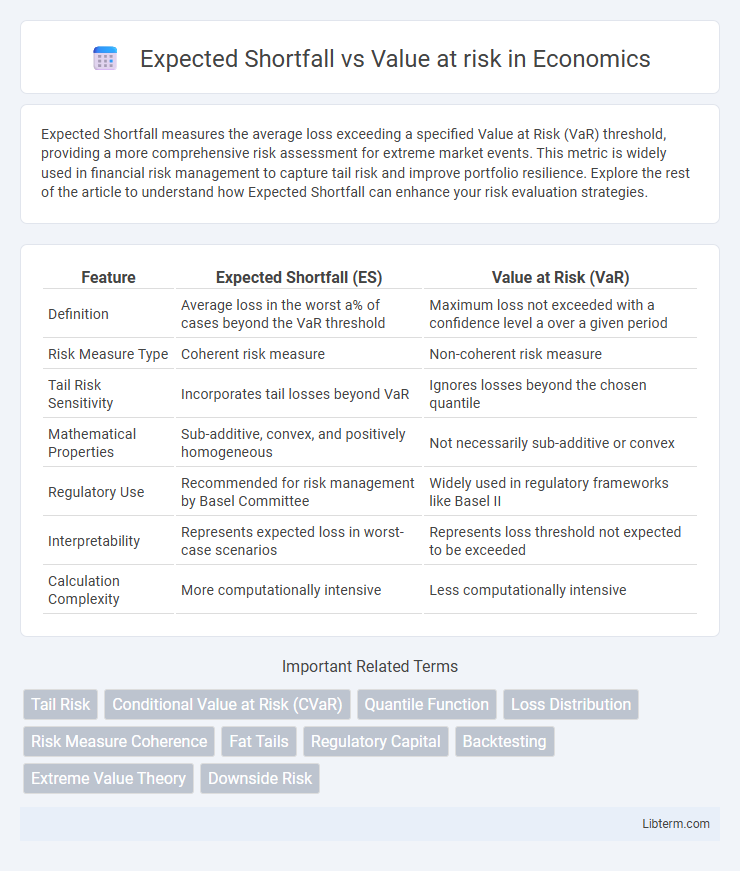

Expected Shortfall measures the average loss exceeding a specified Value at Risk (VaR) threshold, providing a more comprehensive risk assessment for extreme market events. This metric is widely used in financial risk management to capture tail risk and improve portfolio resilience. Explore the rest of the article to understand how Expected Shortfall can enhance your risk evaluation strategies.

Table of Comparison

| Feature | Expected Shortfall (ES) | Value at Risk (VaR) |

|---|---|---|

| Definition | Average loss in the worst a% of cases beyond the VaR threshold | Maximum loss not exceeded with a confidence level a over a given period |

| Risk Measure Type | Coherent risk measure | Non-coherent risk measure |

| Tail Risk Sensitivity | Incorporates tail losses beyond VaR | Ignores losses beyond the chosen quantile |

| Mathematical Properties | Sub-additive, convex, and positively homogeneous | Not necessarily sub-additive or convex |

| Regulatory Use | Recommended for risk management by Basel Committee | Widely used in regulatory frameworks like Basel II |

| Interpretability | Represents expected loss in worst-case scenarios | Represents loss threshold not expected to be exceeded |

| Calculation Complexity | More computationally intensive | Less computationally intensive |

Introduction to Risk Measures

Expected Shortfall (ES) and Value at Risk (VaR) are fundamental risk measures used in financial risk management to quantify potential losses. VaR estimates the maximum potential loss over a specified time horizon at a given confidence level, but it does not account for the severity of losses beyond this threshold. Expected Shortfall addresses this limitation by calculating the average loss exceeding the VaR, providing a more comprehensive assessment of tail risk.

Defining Value at Risk (VaR)

Value at Risk (VaR) quantifies the maximum potential loss in portfolio value over a specified time horizon at a given confidence level, typically expressed as a percentile of the loss distribution. VaR is widely used in risk management to assess market risk by estimating the threshold loss that will not be exceeded with a certain probability, such as 95% or 99%. Unlike Expected Shortfall, which measures the average loss beyond the VaR threshold, VaR provides a single loss figure that acts as a risk limit indicator.

Understanding Expected Shortfall (ES)

Expected Shortfall (ES) measures the average loss in the worst-case percentile of a portfolio's loss distribution, providing a more comprehensive assessment of tail risk compared to Value at Risk (VaR). ES captures the magnitude of extreme losses beyond the VaR threshold, making it a coherent risk measure favored in financial risk management and regulatory frameworks like Basel III. This focus on tail risk sensitivity ensures better capital allocation and stress testing in volatile market conditions.

Key Differences Between VaR and ES

Value at Risk (VaR) quantifies the maximum potential loss over a specified time horizon at a given confidence level, but it does not account for losses beyond that threshold. Expected Shortfall (ES), also known as Conditional VaR, provides the average loss exceeding the VaR threshold, offering a more comprehensive risk measure by capturing tail risk. Unlike VaR, ES satisfies subadditivity and coherence properties, making it a preferred metric in risk management for assessing extreme market downturns.

Calculation Methods for VaR and ES

Value at Risk (VaR) is commonly calculated using historical simulation, variance-covariance, and Monte Carlo simulation methods, each estimating potential losses at a specified confidence level over a set time horizon. Expected Shortfall (ES), also known as Conditional VaR, involves averaging losses that exceed the VaR threshold, typically computed through Monte Carlo simulations or historical data sorting beyond the VaR cutoff. Both methods require robust statistical models, with ES providing a more coherent risk measure by capturing tail risk beyond the VaR estimate.

Advantages and Limitations of Value at Risk

Value at Risk (VaR) offers clear advantages such as simplicity and ease of interpretation, providing a single metric to quantify potential losses within a specified confidence interval and time horizon. However, its limitations include the inability to capture tail risk beyond the threshold, non-subadditivity which complicates portfolio risk aggregation, and sensitivity to model assumptions that may underestimate extreme losses. These drawbacks highlight why financial institutions often complement VaR with Expected Shortfall, which better accounts for the severity of losses in the tail of the loss distribution.

Advantages and Limitations of Expected Shortfall

Expected Shortfall (ES) provides a more coherent risk measure than Value at Risk (VaR) by capturing the average loss in the tail beyond the VaR threshold, offering better insight into extreme market risks. ES is subadditive, promoting diversification benefits, whereas VaR may underestimate risk aggregation due to its lack of subadditivity. However, Expected Shortfall is computationally intensive and can be sensitive to the choice of confidence level, posing challenges in practical implementation and interpretation.

Regulatory Perspectives: VaR vs ES

Regulatory frameworks such as Basel III emphasize Expected Shortfall (ES) over Value at Risk (VaR) due to ES's ability to capture tail risk and provide a more coherent risk measure during extreme market events. While VaR measures the maximum potential loss at a given confidence level, it often underestimates risks beyond the cutoff, leading to possible capital inadequacy during financial crises. ES addresses these shortcomings by averaging losses in the tail beyond the VaR threshold, ensuring more robust capital requirements and improved financial stability oversight by regulators.

Practical Applications in Financial Risk Management

Expected Shortfall (ES) offers a more comprehensive risk assessment than Value at Risk (VaR) by measuring the average loss beyond the VaR threshold, making it particularly useful for stress testing and tail risk analysis in portfolio management. Financial institutions prefer ES in regulatory frameworks like Basel III due to its coherence and sensitivity to extreme market movements, enhancing capital allocation strategies. In practice, ES supports risk managers in identifying potential losses during financial crises, improving decision-making in asset allocation and hedging activities.

Conclusion: Choosing Between VaR and ES

Expected Shortfall (ES) provides a more comprehensive risk measure than Value at Risk (VaR) by capturing the average loss beyond the VaR threshold, making it particularly useful for understanding tail risk in extreme market conditions. Financial institutions seeking a more robust assessment of potential losses in the tail distribution often prefer ES due to its coherence and ability to better reflect the severity of worst-case scenarios. Regulatory frameworks and risk management practices are increasingly favoring ES over VaR to enhance capital adequacy and improve financial stability.

Expected Shortfall Infographic

libterm.com

libterm.com