A flat tax system applies a single constant tax rate to all taxable income, simplifying the tax code and reducing administrative costs. This approach can increase transparency and predictability for taxpayers, but critics argue it may disproportionately affect lower-income individuals. Discover how a flat tax system could impact your finances and the broader economy in the rest of this article.

Table of Comparison

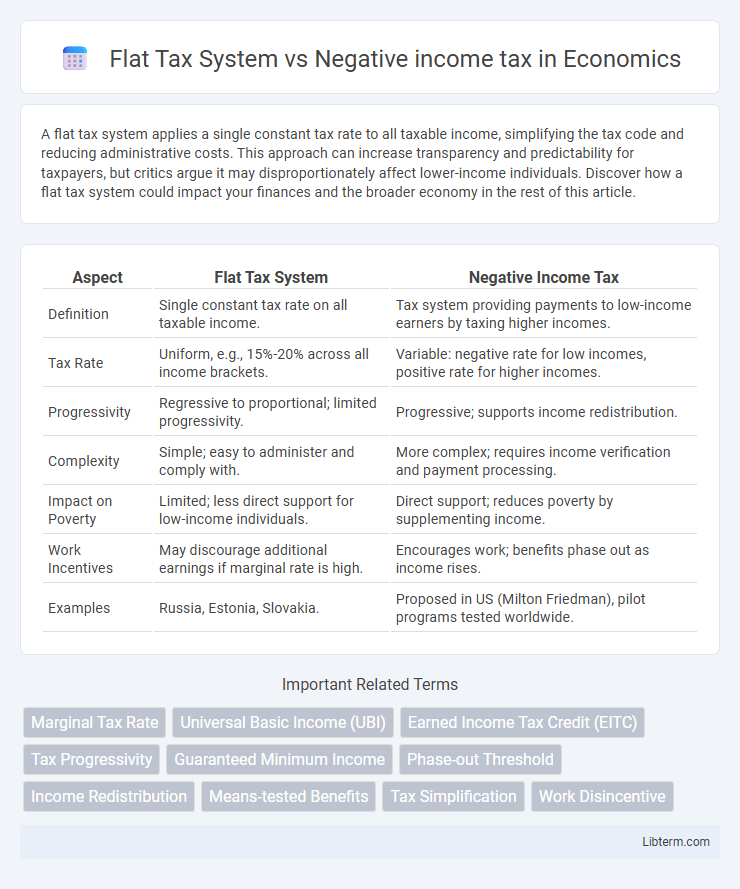

| Aspect | Flat Tax System | Negative Income Tax |

|---|---|---|

| Definition | Single constant tax rate on all taxable income. | Tax system providing payments to low-income earners by taxing higher incomes. |

| Tax Rate | Uniform, e.g., 15%-20% across all income brackets. | Variable: negative rate for low incomes, positive rate for higher incomes. |

| Progressivity | Regressive to proportional; limited progressivity. | Progressive; supports income redistribution. |

| Complexity | Simple; easy to administer and comply with. | More complex; requires income verification and payment processing. |

| Impact on Poverty | Limited; less direct support for low-income individuals. | Direct support; reduces poverty by supplementing income. |

| Work Incentives | May discourage additional earnings if marginal rate is high. | Encourages work; benefits phase out as income rises. |

| Examples | Russia, Estonia, Slovakia. | Proposed in US (Milton Friedman), pilot programs tested worldwide. |

Introduction to Flat Tax System and Negative Income Tax

The flat tax system imposes a uniform tax rate on all levels of income, simplifying tax compliance and aiming to enhance economic efficiency by removing tax brackets and deductions. Negative income tax provides a method for income redistribution by supplementing earnings for low-income individuals rather than taxing them, effectively acting as a social safety net that guarantees a minimum income. Both systems seek to address taxation fairness, but while the flat tax emphasizes simplicity and neutrality, the negative income tax targets poverty reduction through direct financial support.

Key Principles of Flat Tax Systems

Flat tax systems apply a single, uniform tax rate to all levels of income, simplifying tax compliance and reducing administrative costs. This approach eliminates deductions and loopholes, creating a transparent tax framework that aims to promote economic efficiency and fairness. By taxing all income equally, flat tax systems encourage higher earnings and investment without penalizing increased productivity.

Core Concepts of Negative Income Tax

The Negative Income Tax (NIT) system guarantees a minimum income by providing financial support to individuals or households earning below a certain threshold, effectively acting as a social safety net. Unlike the Flat Tax System, which applies a uniform tax rate to all income levels, the NIT targets income inequality by supplementing low earnings through direct payments rather than tax deductions. This model simplifies welfare programs by integrating tax collection and income support, promoting work incentives while reducing poverty.

Historical Background and Global Adoption

The flat tax system, first proposed by economist Robert Hall and Alvin Rabushka in the 1980s, gained traction with Eastern European countries like Estonia and Slovakia adopting it in the 1990s to simplify tax codes and boost growth. Negative income tax, conceptualized by economist Milton Friedman in the 1960s, aimed to provide guaranteed minimum income through tax credits, influencing pilot programs in the United States and the United Kingdom. Globally, flat tax has seen broader adoption across Central and Eastern Europe, while negative income tax concepts primarily inform social welfare policies and universal basic income debates rather than direct tax implementation.

Economic Efficiency: Comparing the Models

The flat tax system simplifies taxation by applying a single rate to all income levels, promoting economic efficiency through reduced compliance costs and minimized distortion of labor supply. In contrast, the negative income tax targets low-income earners by providing direct subsidies, potentially improving work incentives while maintaining social safety nets. Comparative studies show the flat tax system can enhance growth by broadening the tax base, whereas the negative income tax may better address poverty without significantly discouraging employment.

Impact on Income Inequality

The flat tax system imposes a uniform tax rate on all income levels, which can simplify tax administration but may disproportionately burden lower-income earners, potentially exacerbating income inequality. Negative income tax (NIT) provides direct cash transfers to low-income individuals, effectively reducing poverty and narrowing income gaps by ensuring a minimum income floor. Empirical studies indicate that NIT schemes more effectively mitigate income inequality compared to flat tax systems, due to their progressive redistribution mechanisms.

Administrative Complexity and Practicality

The Flat Tax System offers simplicity with a single tax rate and minimal deductions, reducing administrative burdens and improving compliance efficiency. In contrast, the Negative Income Tax requires precise income verification and calculations for subsidies, increasing complexity and enforcement costs. Practical implementation favors the Flat Tax due to easier taxpayer understanding and streamlined administration.

Effects on Work Incentives and Labor Participation

The Flat Tax System, by applying a uniform tax rate regardless of income, tends to maintain consistent work incentives but may disproportionately benefit higher earners, potentially discouraging low-income labor participation. Negative Income Tax (NIT) provides direct financial support to low earners, which can enhance labor participation by reducing poverty traps but also risks diminishing work incentives if benefits decrease too sharply with additional income. Studies show that carefully calibrated NIT programs can strike a balance, boosting employment among low-income groups without significantly deterring work effort.

Political and Public Perceptions

The flat tax system is often perceived politically as promoting simplicity and fairness by taxing all income at a single rate, appealing to conservative and libertarian groups advocating for reduced government intervention. Public opinion varies, with supporters appreciating its transparency and potential to stimulate economic growth, while critics argue it disproportionately benefits higher earners and undermines social equity. Negative income tax garners support among progressives and social justice advocates who view it as an efficient welfare mechanism to alleviate poverty, though opposition arises from concerns about cost and disincentivizing work.

Conclusion: Weighing Strengths and Weaknesses

The flat tax system offers simplicity and predictability by applying a uniform rate, fostering economic growth through reduced compliance costs and incentives for higher earnings. In contrast, the negative income tax provides targeted assistance to lower-income individuals, reducing poverty and income inequality but requires complex administration and potential disincentives to work. Policymakers must balance the flat tax's efficiency and fairness with the negative income tax's social welfare benefits when designing equitable tax policies.

Flat Tax System Infographic

libterm.com

libterm.com