Transaction costs encompass fees and expenses incurred during buying or selling assets, such as brokerage fees, taxes, and time delays. Minimizing these costs can significantly enhance your overall investment returns by maximizing net gains. Discover more strategies to reduce transaction costs and improve your financial efficiency in the rest of the article.

Table of Comparison

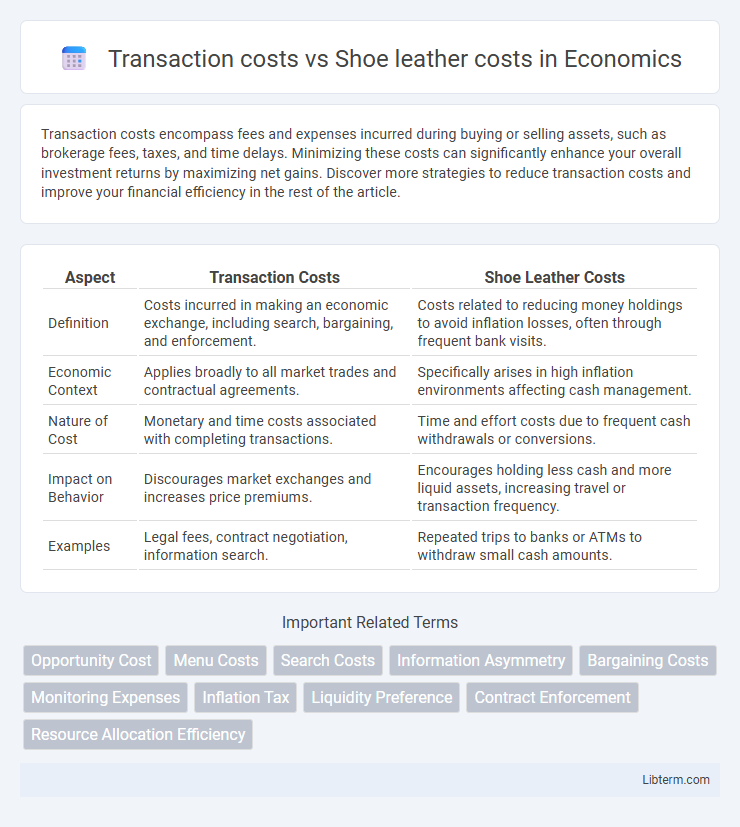

| Aspect | Transaction Costs | Shoe Leather Costs |

|---|---|---|

| Definition | Costs incurred in making an economic exchange, including search, bargaining, and enforcement. | Costs related to reducing money holdings to avoid inflation losses, often through frequent bank visits. |

| Economic Context | Applies broadly to all market trades and contractual agreements. | Specifically arises in high inflation environments affecting cash management. |

| Nature of Cost | Monetary and time costs associated with completing transactions. | Time and effort costs due to frequent cash withdrawals or conversions. |

| Impact on Behavior | Discourages market exchanges and increases price premiums. | Encourages holding less cash and more liquid assets, increasing travel or transaction frequency. |

| Examples | Legal fees, contract negotiation, information search. | Repeated trips to banks or ATMs to withdraw small cash amounts. |

Introduction to Transaction Costs and Shoe Leather Costs

Transaction costs refer to expenses incurred during economic exchanges, such as search, bargaining, and enforcement costs that influence market efficiency. Shoe leather costs represent the inconvenience and resources used to reduce money holdings in response to inflation, typically characterized by increased trips to banks or ATMs. Both concepts highlight different frictions in managing financial resources and transactional behaviors within an economy.

Defining Transaction Costs

Transaction costs refer to the expenses incurred when buying or selling goods and services, including search and information costs, bargaining costs, and enforcement costs. These costs influence market efficiency by affecting how easily transactions are conducted. Shoe leather costs represent a specific type of transaction cost related to the time and effort spent minimizing cash holdings due to inflation.

Understanding Shoe Leather Costs

Shoe leather costs refer to the increased time and effort individuals expend to reduce cash holdings during periods of high inflation, which leads to more frequent trips to the bank or ATM. These costs represent the inconvenience and resource expenditure associated with managing lower cash balances to avoid inflation's erosion of purchasing power. Unlike transaction costs, which are explicit fees for financial services, shoe leather costs are implicit costs arising from the behavioral response to inflation, impacting economic efficiency.

Key Differences Between Transaction Costs and Shoe Leather Costs

Transaction costs refer to the expenses incurred when buying or selling goods and services, including fees, commissions, and time spent on processing transactions. Shoe leather costs arise from the increased effort and inconvenience of managing cash holdings, typically resulting from attempting to minimize cash to reduce inflation erosion. The key difference lies in transaction costs being direct monetary expenses associated with exchange, while shoe leather costs reflect the indirect, non-monetary burden related to holding less cash and making more frequent trips to the bank.

Economic Impact of Transaction Costs

Transaction costs represent the expenses incurred during market exchanges, including search, bargaining, and enforcement costs, which directly affect market efficiency and resource allocation. High transaction costs discourage trading and reduce overall economic activity by increasing the friction in market transactions. Shoe leather costs, a subset of transaction costs related to holding and frequently accessing cash, reflect the effort and opportunity loss consumers face, amplifying the economic impact especially during periods of high inflation.

Economic Implications of Shoe Leather Costs

Shoe leather costs represent the economic expense of reducing money holdings to minimize inflation losses, leading to increased frequency of cash withdrawals and time spent managing cash. These costs signal inefficient resource allocation as individuals divert effort from productive activities to cash management, impacting overall economic productivity. High shoe leather costs typically indicate heightened inflation expectations, which can distort spending and saving behaviors, thereby influencing economic stability and growth.

Real-World Examples: Transaction Costs

Transaction costs encompass expenses such as broker fees, bid-ask spreads, and time spent negotiating deals, which directly impact the efficiency of financial markets in real-world scenarios. For instance, high-frequency trading firms face substantial transaction costs due to frequent trades despite low individual fees, affecting overall profitability. Retail investors also encounter significant transaction costs when purchasing stocks through traditional brokers, highlighting the need for cost-effective platforms.

Real-World Examples: Shoe Leather Costs

Shoe leather costs refer to the time and effort people spend reducing cash holdings during high inflation, such as frequently visiting banks or ATMs to withdraw smaller amounts. For example, in Venezuela's hyperinflation crisis, consumers made multiple trips daily to secure cash before it lost value, increasing commuting expenses and inconvenience. This phenomenon highlights how inflation not only erodes purchasing power but also imposes tangible transaction costs on everyday financial behavior.

Strategies to Minimize Both Costs

Transaction costs can be minimized by using digital payment systems and automated financial platforms that reduce processing time and fees, while shoe leather costs decrease through efficient cash management strategies, like optimizing withdrawal frequency to balance liquidity and effort. Utilizing mobile banking apps allows individuals to monitor account balances in real-time, lowering the need for frequent physical trips to the bank and further reducing shoe leather costs. Combining technology-driven solutions with strategic cash flow planning ensures both transaction and shoe leather costs are effectively controlled.

Conclusion: Weighing Transaction vs Shoe Leather Costs

Weighing transaction costs against shoe leather costs requires analyzing the trade-off between efficient money management and minimizing physical cash withdrawals. Higher transaction costs encourage holding larger cash balances despite increased shoe leather costs from frequent trips to banks or ATMs. Optimal portfolio theory balances these costs by determining the ideal cash holding that minimizes total expenditure and maximizes liquidity efficiency.

Transaction costs Infographic

libterm.com

libterm.com