Interest rate effect plays a crucial role in influencing consumer spending and business investments by altering borrowing costs and savings incentives. Changes in interest rates can either stimulate economic growth or slow it down, impacting inflation and overall financial stability. Explore the rest of this article to understand how the interest rate effect shapes your financial decisions and the broader economy.

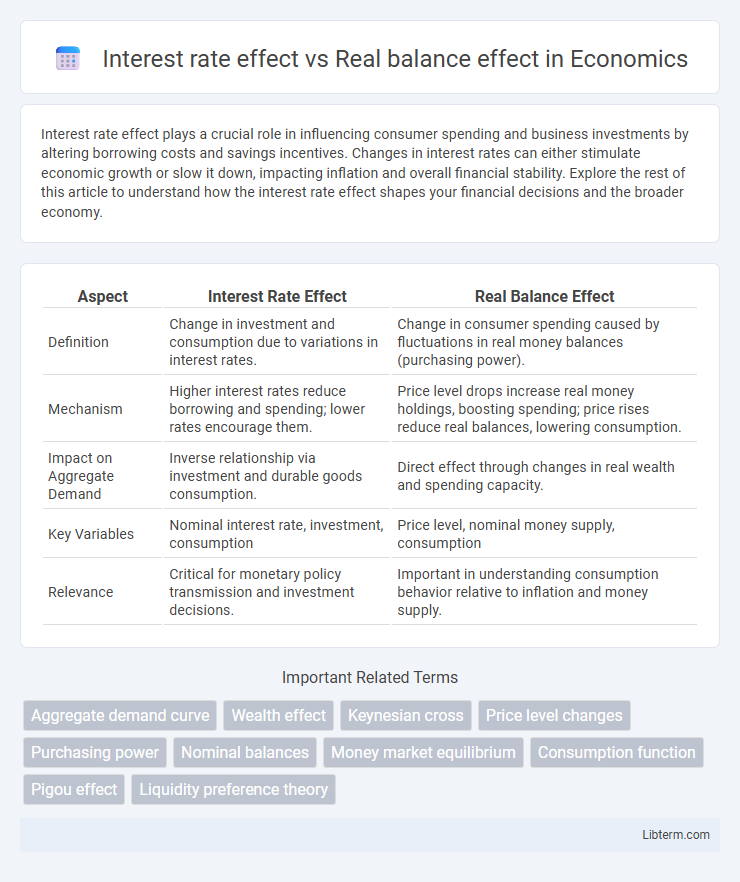

Table of Comparison

| Aspect | Interest Rate Effect | Real Balance Effect |

|---|---|---|

| Definition | Change in investment and consumption due to variations in interest rates. | Change in consumer spending caused by fluctuations in real money balances (purchasing power). |

| Mechanism | Higher interest rates reduce borrowing and spending; lower rates encourage them. | Price level drops increase real money holdings, boosting spending; price rises reduce real balances, lowering consumption. |

| Impact on Aggregate Demand | Inverse relationship via investment and durable goods consumption. | Direct effect through changes in real wealth and spending capacity. |

| Key Variables | Nominal interest rate, investment, consumption | Price level, nominal money supply, consumption |

| Relevance | Critical for monetary policy transmission and investment decisions. | Important in understanding consumption behavior relative to inflation and money supply. |

Introduction to Interest Rate Effect and Real Balance Effect

Interest rate effect describes how changes in interest rates influence consumer spending and investment by affecting borrowing costs and saving incentives. Real balance effect explains the impact of price level changes on consumers' purchasing power, where a lower price level increases real wealth and boosts demand for goods. Both effects play crucial roles in aggregate demand fluctuations within macroeconomic models.

Defining the Interest Rate Effect

The interest rate effect describes how changes in the price level influence consumer spending by altering real money balances and subsequently affecting interest rates; when the price level falls, real money balances increase, leading to lower interest rates and higher investment spending. This mechanism contrasts with the real balance effect, which emphasizes the direct impact of price level changes on the purchasing power of wealth and consumer demand without involving interest rates. Understanding the interest rate effect is crucial for analyzing how monetary factors contribute to aggregate demand fluctuations.

Understanding the Real Balance Effect

The Real Balance Effect explains how a change in the price level influences consumer spending by altering the purchasing power of money balances; when prices fall, the real value of money holdings increases, leading to higher consumption. Unlike the Interest Rate Effect, which affects investment through changes in interest rates caused by shifts in money demand, the Real Balance Effect directly impacts consumption by changing consumers' real wealth. This mechanism is crucial for understanding aggregate demand shifts in response to inflation or deflation without relying on interest rate fluctuations.

Key Differences Between Interest Rate and Real Balance Effects

The interest rate effect describes how changes in interest rates influence consumer spending and investment demand, where a higher interest rate typically reduces these expenditures by increasing the cost of borrowing. The real balance effect emphasizes the impact of price level changes on the purchasing power of money holdings, with a lower price level increasing real balances and thereby boosting consumption. Key differences include the interest rate effect's direct link to financial market conditions and borrowing costs, while the real balance effect centers on wealth effects stemming from variations in the real value of money.

Interest Rate Effect in Aggregate Demand

The interest rate effect in aggregate demand explains how changes in the price level influence interest rates, subsequently affecting investment and consumption spending. When the price level rises, households and firms require more money for transactions, increasing demand for money and driving up interest rates. Higher interest rates discourage borrowing and reduce investment and consumer expenditures, leading to a decrease in aggregate demand.

Real Balance Effect on Consumer Spending

The Real Balance Effect highlights how changes in the price level impact consumer spending by altering the purchasing power of money holdings. When prices fall, the real value of money increases, enabling consumers to buy more goods and services, thereby boosting overall demand. This mechanism plays a crucial role in the aggregate demand curve, demonstrating a negative relationship between price level and consumption.

Factors Influencing Interest Rate and Real Balance Effects

Interest rate effects are primarily influenced by central bank policies, inflation expectations, and the demand for credit, which cause fluctuations in borrowing costs and investment levels. Real balance effects depend on changes in the purchasing power of money holdings, influenced by price levels and income, altering consumer spending through wealth perception. Both effects interact to shape aggregate demand, where interest rate changes affect investment and consumption, while real balance changes impact consumption by adjusting real wealth.

Macroeconomic Implications of Both Effects

The interest rate effect influences aggregate demand by altering investment and consumption through changes in borrowing costs, thereby impacting economic growth and inflation rates. The real balance effect affects purchasing power and consumption behavior by changing the real value of money holdings, which in turn influences aggregate demand and overall economic stability. Together, these effects shape monetary policy outcomes, affecting inflation targeting and economic output fluctuations in macroeconomic models.

Real-World Examples of Interest Rate and Real Balance Effects

The interest rate effect is evident when higher interest rates lead to reduced consumer spending and investment, as seen during the Federal Reserve's rate hikes to combat inflation in 2022, which slowed home purchases and business expansions. The real balance effect occurs when changes in the price level affect consumers' real wealth and purchasing power, demonstrated by the 2008 financial crisis where falling prices increased real cash balances, altering consumption patterns despite economic downturns. Both effects illustrate how monetary policy impacts aggregate demand through shifts in borrowing costs and real wealth in the economy.

Conclusion: Comparing Impact on Economic Policy

The interest rate effect influences aggregate demand by altering borrowing costs, directly affecting investment and consumption levels, while the real balance effect changes purchasing power through price level variations, impacting consumer spending. Economic policy aimed at stabilizing output must consider the stronger responsiveness of investment to interest rate changes compared to consumer spending's sensitivity to real balances. In conclusion, policies targeting interest rates tend to have more immediate and pronounced effects on aggregate demand than those relying solely on real balance adjustments.

Interest rate effect Infographic

libterm.com

libterm.com