Climate bonds are financial instruments designed to fund projects that have a positive environmental impact, such as renewable energy, sustainable agriculture, and pollution reduction initiatives. Investing in these bonds supports the transition to a low-carbon economy while offering potential returns aligned with your sustainability goals. Explore the rest of this article to understand how climate bonds can benefit your portfolio and the planet.

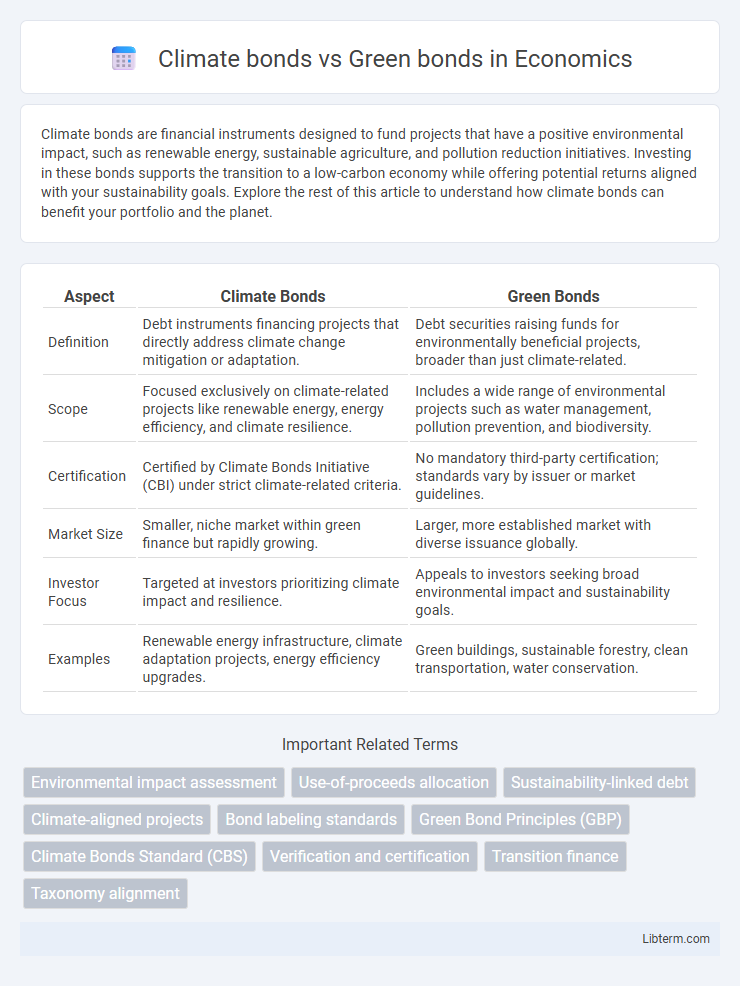

Table of Comparison

| Aspect | Climate Bonds | Green Bonds |

|---|---|---|

| Definition | Debt instruments financing projects that directly address climate change mitigation or adaptation. | Debt securities raising funds for environmentally beneficial projects, broader than just climate-related. |

| Scope | Focused exclusively on climate-related projects like renewable energy, energy efficiency, and climate resilience. | Includes a wide range of environmental projects such as water management, pollution prevention, and biodiversity. |

| Certification | Certified by Climate Bonds Initiative (CBI) under strict climate-related criteria. | No mandatory third-party certification; standards vary by issuer or market guidelines. |

| Market Size | Smaller, niche market within green finance but rapidly growing. | Larger, more established market with diverse issuance globally. |

| Investor Focus | Targeted at investors prioritizing climate impact and resilience. | Appeals to investors seeking broad environmental impact and sustainability goals. |

| Examples | Renewable energy infrastructure, climate adaptation projects, energy efficiency upgrades. | Green buildings, sustainable forestry, clean transportation, water conservation. |

Understanding Climate Bonds and Green Bonds

Climate bonds and green bonds are fixed-income financial instruments designed to fund projects that address environmental challenges and promote sustainability. Climate bonds specifically target initiatives that mitigate or adapt to climate change impacts, such as renewable energy, energy efficiency, and carbon reduction projects. Green bonds have a broader scope, covering a wide range of environmentally friendly activities, including water management, biodiversity conservation, and pollution prevention, in addition to climate-related efforts.

Key Differences Between Climate Bonds and Green Bonds

Climate bonds specifically finance projects that mitigate climate change by targeting carbon emissions reduction, renewable energy, and climate adaptation. Green bonds encompass a broader category funding environmental initiatives, including sustainable water management, pollution prevention, and biodiversity conservation alongside climate-related projects. The key difference lies in climate bonds' exclusive focus on climate impact, while green bonds support a wider range of environmental benefits.

Objectives and Impact of Climate Bonds

Climate bonds specifically target projects that reduce greenhouse gas emissions and support climate resilience, such as renewable energy, energy efficiency, and sustainable agriculture, aiming to combat climate change directly. Their primary objective is to finance initiatives that contribute to global carbon reduction targets and adaptation to climate impacts, ensuring measurable environmental benefits. The impact of climate bonds is assessed by rigorous standards and verification processes that track the reduction in carbon footprint and enhancement of climate resilience in targeted sectors.

Environmental Focus of Green Bonds

Green bonds specifically target environmental projects such as renewable energy, pollution prevention, and conservation initiatives, ensuring funds directly support sustainable development. Climate bonds are a subset of green bonds with a narrower focus on climate change mitigation and adaptation efforts. The environmental focus of green bonds makes them crucial for financing projects that reduce carbon emissions and promote ecological resilience.

Qualification Criteria and Certification Standards

Climate bonds require adherence to the Climate Bonds Standard, which specifies sector-specific eligibility criteria ensuring projects contribute to low carbon and climate-resilient development. Green bonds follow broader Green Bond Principles (GBP) set by the International Capital Market Association, emphasizing transparency, use of proceeds, and impact reporting without strict sectoral thresholds. Certification for climate bonds involves third-party verification by the Climate Bonds Initiative, while green bonds rely on external reviews or second-party opinions for voluntary compliance.

Project Types Funded by Climate Bonds vs. Green Bonds

Climate bonds primarily fund large-scale infrastructure projects focused on renewable energy, energy efficiency, and sustainable transport, aiming to reduce greenhouse gas emissions globally. Green bonds finance a broader range of environmentally sustainable projects including water management, waste treatment, and biodiversity conservation alongside renewable energy initiatives. The distinction lies in climate bonds' targeted approach to climate mitigation and adaptation, whereas green bonds encompass a wider array of ecological benefits.

Market Trends and Growth Statistics

Climate bonds and green bonds are rapidly expanding segments within sustainable finance, with global green bond issuance reaching over $500 billion by 2023, driven primarily by energy, transportation, and building projects. Climate bonds, a subset of green bonds focused on climate change mitigation and adaptation, have seen an annual growth rate exceeding 20% since 2020, reflecting increased regulatory support and investor demand. Market trends highlight Asia and Europe as leading regions, while innovation in verification standards and digital platforms further accelerates market liquidity and transparency.

Regulatory Framework and Governance

Climate bonds and green bonds both operate under evolving regulatory frameworks aimed at ensuring transparency and environmental impact credibility, with climate bonds often subject to broader international standards such as the Climate Bonds Initiative certification. Green bonds typically adhere to guidelines set by frameworks like the Green Bond Principles issued by the International Capital Market Association (ICMA), emphasizing project eligibility and reporting requirements. Governance structures in both instruments require issuers to maintain rigorous auditing and impact reporting mechanisms, but climate bonds generally demand stricter compliance with climate-related performance metrics to meet certification criteria.

Investor Perspectives and Opportunities

Climate bonds specifically finance projects targeting climate change mitigation and adaptation, offering investors a clear alignment with environmental goals and risk reduction related to climate impacts. Green bonds encompass a broader range of environmental initiatives, providing diversified investment opportunities that extend beyond climate-specific projects to include biodiversity and pollution control. Investors benefit from both bond types through enhanced portfolio resilience, regulatory incentives, and growing market demand for sustainable assets, driving long-term value and positive environmental impact.

Challenges and Future Outlook

Climate bonds and green bonds both face challenges in standardization, with varying definitions and criteria causing market fragmentation and investor uncertainty. Regulatory frameworks and transparent reporting mechanisms are critical to overcoming these hurdles and ensuring credibility in environmental impact. Future outlooks emphasize increased alignment of taxonomy standards, technological advances in impact measurement, and growing investor demand driving market expansion and innovation.

Climate bonds Infographic

libterm.com

libterm.com