Default premium refers to the additional yield investors demand to compensate for the risk that a borrower may fail to meet debt obligations. This premium varies based on creditworthiness, economic conditions, and market sentiment, directly impacting loan interest rates and bond prices. Explore the rest of the article to understand how default premium influences your investment decisions and risk assessment.

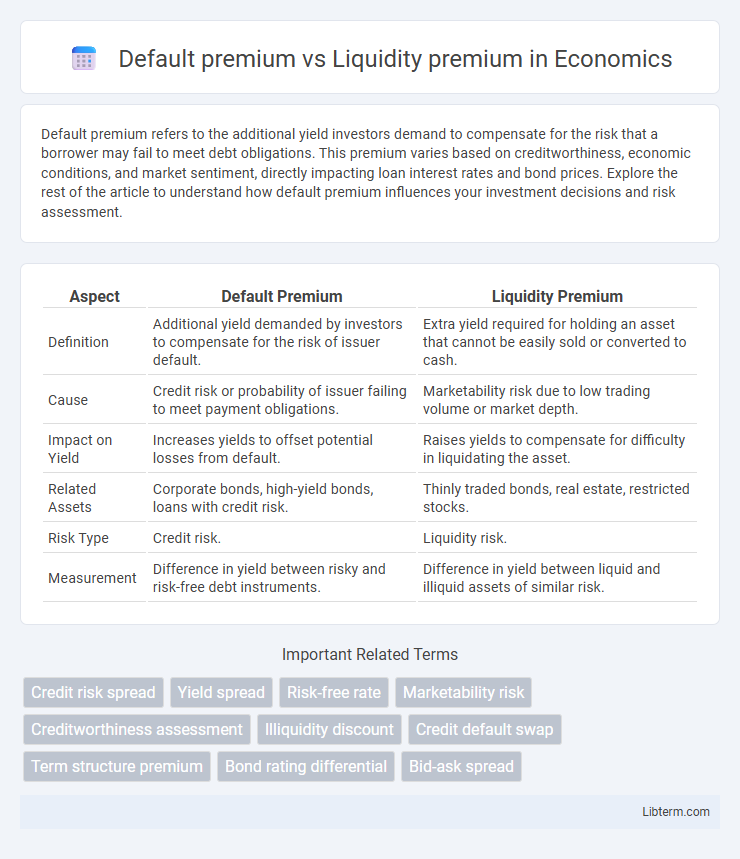

Table of Comparison

| Aspect | Default Premium | Liquidity Premium |

|---|---|---|

| Definition | Additional yield demanded by investors to compensate for the risk of issuer default. | Extra yield required for holding an asset that cannot be easily sold or converted to cash. |

| Cause | Credit risk or probability of issuer failing to meet payment obligations. | Marketability risk due to low trading volume or market depth. |

| Impact on Yield | Increases yields to offset potential losses from default. | Raises yields to compensate for difficulty in liquidating the asset. |

| Related Assets | Corporate bonds, high-yield bonds, loans with credit risk. | Thinly traded bonds, real estate, restricted stocks. |

| Risk Type | Credit risk. | Liquidity risk. |

| Measurement | Difference in yield between risky and risk-free debt instruments. | Difference in yield between liquid and illiquid assets of similar risk. |

Understanding Default Premium: Definition and Importance

Default premium refers to the extra yield investors demand for bearing the risk that a bond issuer may fail to make timely interest or principal payments. This premium reflects the credit risk associated with the issuer's financial health, impacting bond pricing and investor returns. Understanding default premium is crucial for assessing investment risk and making informed decisions in fixed-income markets.

Defining Liquidity Premium in Financial Markets

Liquidity premium in financial markets refers to the additional yield investors require for holding assets that are not easily convertible to cash without significant price concessions. This premium compensates for the higher risk and potential cost associated with selling less liquid securities compared to more liquid ones. Unlike the default premium, which accounts for credit risk, the liquidity premium specifically addresses the marketability and immediacy of converting an asset into cash.

Key Differences: Default Premium vs Liquidity Premium

Default premium compensates investors for the risk of issuer default, reflecting the likelihood that bondholders may not receive scheduled payments. Liquidity premium accounts for the ease with which an asset can be bought or sold in the market without affecting its price, rewarding securities that are harder to trade. The key difference lies in risk type: default premium addresses credit risk, whereas liquidity premium pertains to marketability risk.

How Default Risk Influences Bond Yields

Default risk directly impacts bond yields by increasing the default premium investors demand for bearing the risk of issuer non-payment, which raises the overall yield on bonds with higher default probabilities. Liquidity premium affects yields by compensating investors for potential difficulties in selling the bond quickly without price concessions, but default risk generally has a more significant effect on yield spreads. Bonds with elevated default risk exhibit wider yield spreads over risk-free securities as investors require additional compensation for potential credit losses.

The Role of Liquidity Risk in Asset Pricing

Liquidity premium compensates investors for the risk of not being able to quickly sell an asset without significant price discounts, directly influencing asset pricing through expected returns. Default premium reflects the additional yield demanded for bearing credit risk due to potential borrower default, separate from liquidity considerations. Liquidity risk affects asset pricing by increasing the required yield, especially in less liquid markets, making liquidity premium a critical component alongside default risk in determining asset valuation.

Real-World Examples of Default Premiums

Default premium represents the additional yield investors demand for bearing the risk of borrower default, as seen in corporate bonds issued by companies with lower credit ratings like Tesla during periods of financial uncertainty. Liquidity premium compensates investors for the difficulty of selling an asset quickly without price discounts, evident in markets for municipal bonds compared to U.S. Treasuries. Real-world default premiums fluctuate based on macroeconomic conditions and credit events, exemplified by heightened spreads during the 2008 financial crisis when investors demanded significantly higher returns from subprime mortgage-backed securities.

Measuring and Assessing Liquidity Premiums

Measuring liquidity premiums involves comparing yields on securities with similar credit risk and maturity but differing liquidity levels, such as Treasury bonds versus corporate bonds, to isolate the extra yield investors demand for liquidity risk. Techniques like bid-ask spread analysis, trading volume metrics, and price impact models help quantify liquidity premiums by assessing market depth and transaction costs. Accurate assessment requires adjusting for default risk premiums to ensure the liquidity component reflects true compensation for potential difficulties in quickly converting assets to cash without significant price concessions.

Impact on Investors: Choosing Between Risk and Return

Default premium compensates investors for the credit risk of potential borrower default, often leading to higher yields on riskier bonds but increased chance of loss. Liquidity premium reflects the additional return demanded for holding assets that are harder to quickly sell without significant price concessions. Investors must balance these premiums to optimize portfolios, weighing higher returns from default risk against potential difficulties in asset liquidation and price stability.

Market Conditions Affecting Premium Trends

Default premiums tend to rise during periods of economic uncertainty or recession as investors demand higher compensation for increased credit risk, while liquidity premiums expand in stressed market conditions when asset sales become more difficult and costly. In stable or booming markets, lower default risk and ample market liquidity compress both premiums, reflecting investor confidence and ease of trading. Fluctuations in interest rates and central bank policies also influence these premiums by altering credit spreads and market liquidity dynamics.

Strategies to Manage Default and Liquidity Risks

Strategies to manage default risk include thorough credit analysis, diversification of bond portfolios, and the use of credit derivatives such as credit default swaps. Liquidity risk is addressed by maintaining cash reserves, investing in highly liquid assets, and implementing dynamic asset allocation to quickly adjust to market conditions. Combining both approaches enhances overall investment resilience by balancing yield with risk exposure.

Default premium Infographic

libterm.com

libterm.com