A multiplier amplifies the effect of an initial input, commonly used in economics to describe how increased spending leads to a greater overall increase in national income. Understanding the multiplier effect is essential for grasping how fiscal policies impact economic growth and employment. Explore the rest of the article to discover how multipliers influence your financial decisions and the broader economy.

Table of Comparison

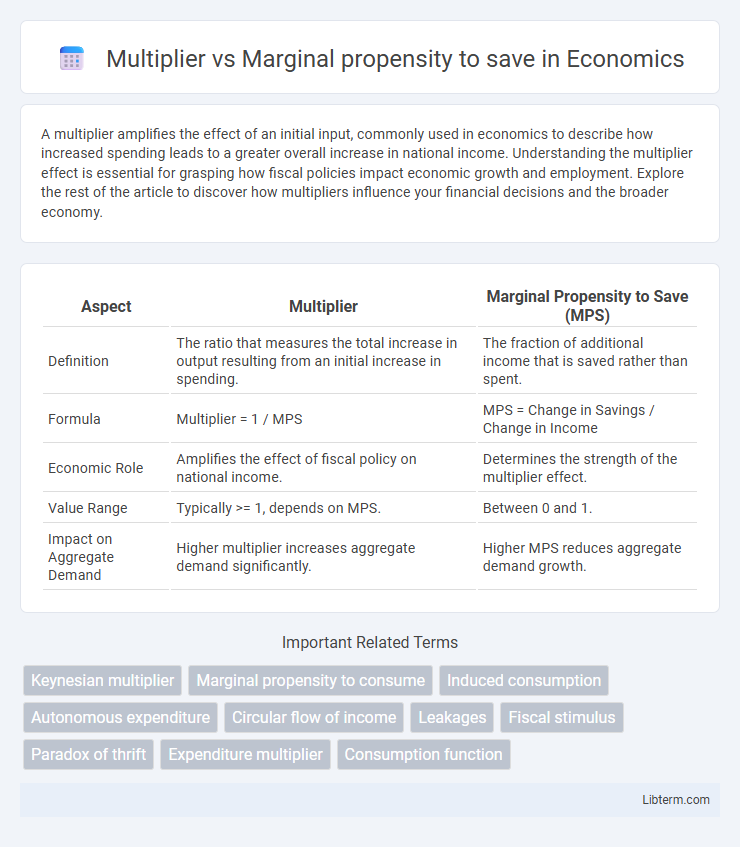

| Aspect | Multiplier | Marginal Propensity to Save (MPS) |

|---|---|---|

| Definition | The ratio that measures the total increase in output resulting from an initial increase in spending. | The fraction of additional income that is saved rather than spent. |

| Formula | Multiplier = 1 / MPS | MPS = Change in Savings / Change in Income |

| Economic Role | Amplifies the effect of fiscal policy on national income. | Determines the strength of the multiplier effect. |

| Value Range | Typically >= 1, depends on MPS. | Between 0 and 1. |

| Impact on Aggregate Demand | Higher multiplier increases aggregate demand significantly. | Higher MPS reduces aggregate demand growth. |

Understanding the Multiplier Effect

The multiplier effect measures how initial changes in spending lead to a larger overall increase in national income, influenced directly by the marginal propensity to save (MPS), which is the fraction of additional income that households save rather than spend. A lower MPS results in a higher multiplier, amplifying the initial expenditure impact on the economy, while a higher MPS diminishes the multiplier effect. Understanding the precise relationship between the multiplier and MPS is essential for effective fiscal policy design aimed at stimulating economic growth.

Defining Marginal Propensity to Save (MPS)

Marginal Propensity to Save (MPS) measures the fraction of additional income that households save rather than spend on consumption. It plays a crucial role in economic models by determining the impact of changes in income on overall saving behavior. The MPS directly influences the multiplier effect, as a higher MPS reduces the multiplier by increasing savings and decreasing consumption expenditure.

The Mathematical Relationship: Multiplier and MPS

The multiplier is mathematically expressed as 1 divided by the Marginal Propensity to Save (MPS), indicating a direct inverse relationship between the two. A lower MPS results in a higher multiplier, amplifying the impact of initial spending on total economic output. This equation, Multiplier = 1/MPS, quantifies how savings behavior influences aggregate demand and economic growth.

How MPS Influences the Multiplier

The Marginal Propensity to Save (MPS) directly influences the size of the multiplier effect in economics, as the multiplier is calculated as 1 divided by MPS. A lower MPS indicates that consumers save less and spend more, leading to a higher multiplier and greater overall economic output from initial spending. Conversely, a higher MPS results in a smaller multiplier, reducing the impact of fiscal stimulus on aggregate demand and economic growth.

Economic Significance of the Multiplier

The multiplier illustrates how initial changes in autonomous spending can lead to amplified effects on national income, highlighting its critical role in fiscal policy and economic stimulus. Its significance lies in demonstrating the extent to which investment or government spending can stimulate overall economic activity, directly influenced by the marginal propensity to save (MPS). A lower MPS indicates a higher multiplier effect, emphasizing the importance of consumer savings behavior in determining the efficiency of fiscal interventions.

Factors Affecting Marginal Propensity to Save

Factors affecting marginal propensity to save (MPS) include income level, as higher incomes typically increase the ability to save, while lower incomes reduce it due to essential consumption needs. Economic expectations also influence MPS; during economic uncertainty, households tend to save more as a precautionary measure. Cultural attitudes towards saving and access to financial institutions further shape saving behavior, impacting the overall marginal propensity to save in an economy.

Policy Implications: Multiplier vs MPS

Policymakers must consider the multiplier effect, which measures the total economic impact of initial government spending, in relation to the marginal propensity to save (MPS), representing the proportion of additional income saved rather than spent. A lower MPS leads to a higher multiplier, indicating that fiscal stimulus results in a more significant increase in aggregate demand and economic output. Understanding this relationship helps design effective fiscal policies that maximize economic growth by targeting spending and saving behaviors in the economy.

Real-World Examples: Multiplier and MPS in Action

The multiplier effect quantifies how an initial change in spending leads to a larger overall increase in national income, closely tied to the marginal propensity to save (MPS), which measures the portion of additional income saved rather than spent. For instance, during a government stimulus in the United States, a low MPS means consumers spend most of their additional income, resulting in a high multiplier effect that boosts economic growth. Contrastingly, in economies with higher MPS, such as Japan, a significant portion of incremental income is saved, dampening the multiplier and slowing the pace of economic expansion.

Limitations of the Multiplier and MPS Concepts

The multiplier effect measures the total impact of an initial change in spending on aggregate output but assumes a constant marginal propensity to save (MPS), which can oversimplify real economic behavior. Limitations of the multiplier include its sensitivity to changes in MPS, as higher MPS reduces the multiplier size and dampens economic stimulus effects. Furthermore, both concepts often ignore factors like taxation, inflation, and external constraints, limiting their accuracy in predicting complex economic outcomes.

Key Differences and Takeaways: Multiplier vs Marginal Propensity to Save

The multiplier measures the total increase in output resulting from an initial change in spending, highlighting the amplified effect on the economy, whereas the marginal propensity to save (MPS) represents the fraction of additional income that households save rather than spend. A higher MPS leads to a lower multiplier effect because more income is saved and less is spent, reducing the chain of consumption-driven economic expansion. Understanding these key differences helps analyze fiscal policy impacts and predict the magnitude of economic responses to changes in government spending or taxation.

Multiplier Infographic

libterm.com

libterm.com