Pay-as-you-go plans offer flexible payment options without long-term commitments, allowing you to control your expenses and avoid unexpected bills. These plans are ideal for users who want to pay only for the services they use, making budgeting simpler and more transparent. Explore the rest of the article to discover how pay-as-you-go can benefit your financial planning.

Table of Comparison

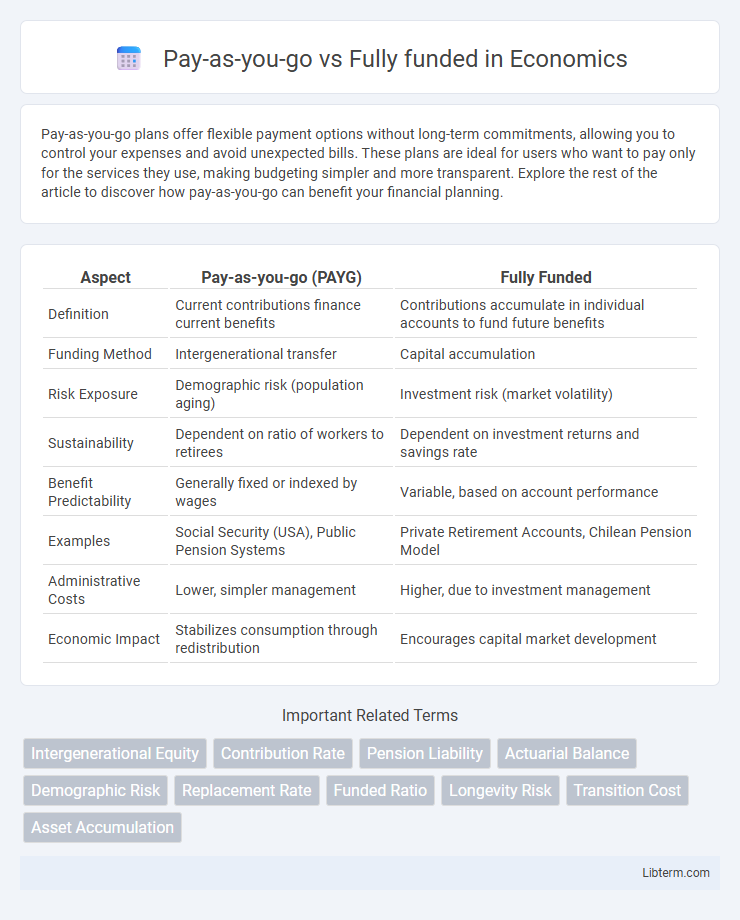

| Aspect | Pay-as-you-go (PAYG) | Fully Funded |

|---|---|---|

| Definition | Current contributions finance current benefits | Contributions accumulate in individual accounts to fund future benefits |

| Funding Method | Intergenerational transfer | Capital accumulation |

| Risk Exposure | Demographic risk (population aging) | Investment risk (market volatility) |

| Sustainability | Dependent on ratio of workers to retirees | Dependent on investment returns and savings rate |

| Benefit Predictability | Generally fixed or indexed by wages | Variable, based on account performance |

| Examples | Social Security (USA), Public Pension Systems | Private Retirement Accounts, Chilean Pension Model |

| Administrative Costs | Lower, simpler management | Higher, due to investment management |

| Economic Impact | Stabilizes consumption through redistribution | Encourages capital market development |

Introduction to Pension Financing Models

Pay-as-you-go pension financing relies on current workers' contributions to pay retirees, creating a direct intergenerational transfer system essential in many public pension programs. Fully funded pension schemes accumulate capital in investment funds over time, ensuring that each participant's benefits are pre-financed and supported by dedicated assets. The choice between these models hinges on sustainability, demographic factors, and fiscal capacity influencing long-term pension security.

Defining Pay-as-You-Go (PAYG) Systems

Pay-as-You-Go (PAYG) systems operate by financing current expenses through incoming revenues rather than pre-collected funds, ensuring liquidity and real-time budget alignment. Unlike fully funded models that accumulate reserves for future obligations, PAYG relies on continuous inflows, making it common in social security and public pension schemes. This system's sustainability depends on demographic and economic factors influencing contribution flows relative to benefit payouts.

Understanding Fully Funded Pension Schemes

Fully funded pension schemes accumulate sufficient assets to cover all future liabilities, ensuring retirees receive guaranteed benefits regardless of market performance. These schemes rely on long-term investment strategies and actuarial assessments to maintain solvency and meet pension promises. Pay-as-you-go systems, in contrast, use current workers' contributions to pay retirees, lacking asset buffers and often facing demographic challenges.

Key Differences Between PAYG and Fully Funded Models

The key differences between Pay-as-you-go (PAYG) and Fully Funded pension models lie in their funding mechanisms and risk management. PAYG systems finance current retirees' benefits through current workers' contributions, relying on demographic stability and workforce size, whereas Fully Funded models accumulate assets in individual accounts to cover future liabilities, reducing intergenerational risk but exposing individuals to market fluctuations. PAYG systems depend heavily on a continuous inflow of contributions, while Fully Funded schemes emphasize investment performance and long-term asset growth.

Advantages of Pay-as-You-Go Pension Systems

Pay-as-you-go (PAYG) pension systems offer the advantage of immediate funding through current workers' contributions, ensuring continuous cash flow without the need for large capital reserves. PAYG systems dynamically adjust to demographic changes, promoting sustainability by linking benefits to the current workforce size and wage levels. This structure minimizes investment risk compared to fully funded systems, which rely on market performance for accumulated assets.

Benefits of Fully Funded Retirement Plans

Fully funded retirement plans guarantee that sufficient assets are set aside to cover future pension obligations, providing retirees with financial security and predictable income streams. These plans reduce the risk of funding shortfalls and reliance on future contributions, ensuring stability regardless of economic fluctuations. Employers benefit from improved balance sheet transparency and long-term cost control by managing liabilities proactively.

Financial Sustainability and Long-Term Stability

Pay-as-you-go pension systems rely on current contributions to pay existing benefits, which can strain financial sustainability as demographic shifts lead to fewer workers supporting more retirees. Fully funded pension plans accumulate assets over time, offering greater long-term stability by investing contributions to meet future obligations. A balanced approach to funding ensures resilience to economic fluctuations and demographic changes, securing reliable benefits for retirees.

Impact on Intergenerational Equity

Pay-as-you-go pension systems finance current retirees through contributions from the current workforce, potentially shifting financial burdens to younger generations and affecting intergenerational equity. Fully funded pension plans accumulate assets invested to cover future benefits, promoting fairer distribution of resources across generations. The choice between these systems influences the economic balance between current and future beneficiaries, impacting long-term social and fiscal sustainability.

Global Examples and Case Studies

Pay-as-you-go (PAYG) pension systems, prevalent in countries like Germany and Japan, rely on current workforce contributions to fund retirees, demonstrating sustainability challenges amid aging populations. Fully funded pension schemes, exemplified by Chile and Australia, accumulate individual savings invested over time, offering more stable benefits but with market risk exposure. Comparative case studies reveal that hybrid models integrating PAYG foundations with fully funded pillars, as seen in Sweden, balance demographic pressures and financial market volatility effectively.

Choosing the Right Pension Model: Key Considerations

Pay-as-you-go pension models rely on current workers' contributions to fund retirees' benefits, making them sensitive to demographic changes and economic fluctuations. Fully funded models accumulate assets over time, investing contributions to finance future payouts, enhancing long-term sustainability but requiring robust investment management. Choosing the right pension model depends on factors like population age distribution, fiscal capacity, economic stability, and the ability to manage investment risks effectively.

Pay-as-you-go Infographic

libterm.com

libterm.com